Rare whisky bottle trading offers a unique investment opportunity characterized by high liquidity and exceptional appreciation potential, often outperforming traditional assets like real estate in shorter timeframes. Unlike real estate, which requires significant capital and entails lengthy transaction processes, rare whisky investments can be more accessible and flexible, appealing to collectors and investors seeking diversification. Explore the advantages and risks of both markets to determine the optimal strategy for your investment portfolio.

Why it is important

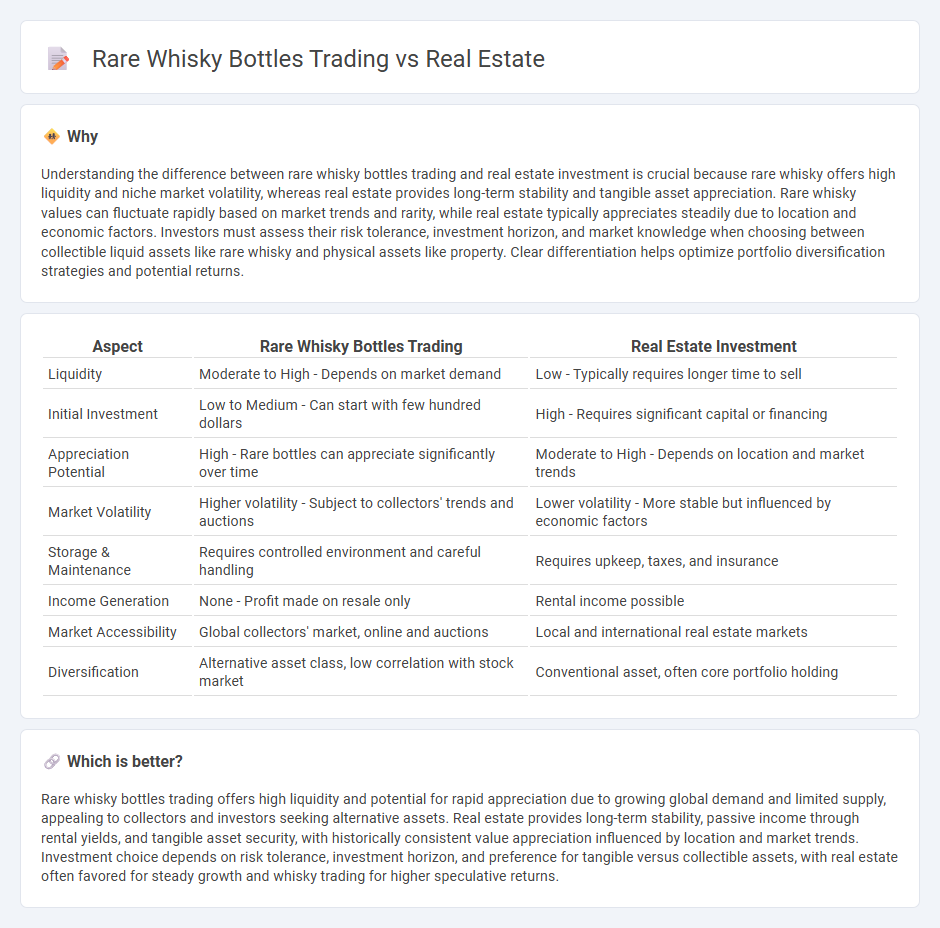

Understanding the difference between rare whisky bottles trading and real estate investment is crucial because rare whisky offers high liquidity and niche market volatility, whereas real estate provides long-term stability and tangible asset appreciation. Rare whisky values can fluctuate rapidly based on market trends and rarity, while real estate typically appreciates steadily due to location and economic factors. Investors must assess their risk tolerance, investment horizon, and market knowledge when choosing between collectible liquid assets like rare whisky and physical assets like property. Clear differentiation helps optimize portfolio diversification strategies and potential returns.

Comparison Table

| Aspect | Rare Whisky Bottles Trading | Real Estate Investment |

|---|---|---|

| Liquidity | Moderate to High - Depends on market demand | Low - Typically requires longer time to sell |

| Initial Investment | Low to Medium - Can start with few hundred dollars | High - Requires significant capital or financing |

| Appreciation Potential | High - Rare bottles can appreciate significantly over time | Moderate to High - Depends on location and market trends |

| Market Volatility | Higher volatility - Subject to collectors' trends and auctions | Lower volatility - More stable but influenced by economic factors |

| Storage & Maintenance | Requires controlled environment and careful handling | Requires upkeep, taxes, and insurance |

| Income Generation | None - Profit made on resale only | Rental income possible |

| Market Accessibility | Global collectors' market, online and auctions | Local and international real estate markets |

| Diversification | Alternative asset class, low correlation with stock market | Conventional asset, often core portfolio holding |

Which is better?

Rare whisky bottles trading offers high liquidity and potential for rapid appreciation due to growing global demand and limited supply, appealing to collectors and investors seeking alternative assets. Real estate provides long-term stability, passive income through rental yields, and tangible asset security, with historically consistent value appreciation influenced by location and market trends. Investment choice depends on risk tolerance, investment horizon, and preference for tangible versus collectible assets, with real estate often favored for steady growth and whisky trading for higher speculative returns.

Connection

Rare whisky bottles trading and real estate investment both serve as alternative asset classes that diversify traditional portfolios and hedge against market volatility. Both markets rely heavily on scarcity, provenance, and market demand, with rare whisky bottles appreciating in value similarly to prime real estate locations over time. Investors leverage tangible assets in each sector to preserve wealth and achieve long-term capital gains in a low-interest-rate environment.

Key Terms

**Real Estate:**

Real estate investment offers tangible asset stability, long-term appreciation, and rental income potential, making it a preferred choice for many investors seeking consistent returns and portfolio diversification. Properties in prime locations, such as major metropolitan areas and developing regions, tend to exhibit higher liquidity and resilience against market volatility compared to niche markets like rare whisky bottles. Explore detailed insights on optimizing real estate investments and maximizing profitability.

Equity

Equity in real estate typically involves ownership shares in tangible properties that can appreciate over time and generate rental income, whereas rare whisky bottles represent equity in collectible assets with value driven by rarity, provenance, and market demand. Real estate equity offers more stability and potential for long-term growth through property appreciation and leverage, while rare whisky equity is more speculative and influenced by trends in the luxury collectibles market. Explore the key factors affecting equity performance in both markets to make informed investment decisions.

Mortgage

Real estate investments often rely on mortgage financing, allowing buyers to leverage property value and access substantial capital with favorable interest rates. In contrast, rare whisky bottle trading typically involves direct purchase without financing options, focusing on liquidity and asset appreciation rather than leveraging debt. Explore the unique financial mechanisms and benefits of each asset class to determine the best strategy for your investment portfolio.

Source and External Links

Real Estate - Wikipedia - Provides information on real estate, including its definition, types, and environmental impacts.

Trulia: Real Estate Listings, Homes For Sale - Offers listings for homes for sale, neighborhood insights, and tools for finding rentals.

Real Estate - realestate.com.au - Provides real estate listings, property valuations, and market data in Australia.

dowidth.com

dowidth.com