Spice trading has historically driven global commerce, offering high returns through the demand for rare and exotic commodities valued for their flavors and medicinal properties. Wine investing, on the other hand, capitalizes on the appreciation of fine vintages and collectible bottles, blending passion with portfolio diversification and potential long-term gains. Discover the unique benefits and risks of these contrasting investment avenues to enhance your financial strategy.

Why it is important

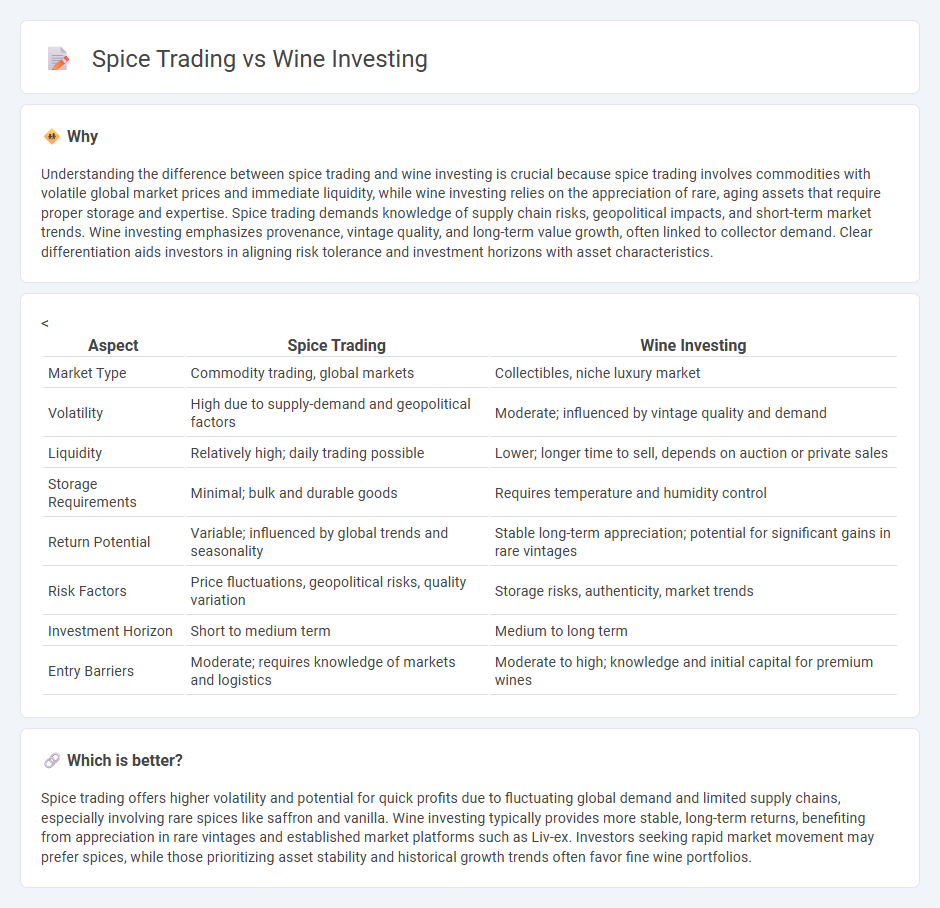

Understanding the difference between spice trading and wine investing is crucial because spice trading involves commodities with volatile global market prices and immediate liquidity, while wine investing relies on the appreciation of rare, aging assets that require proper storage and expertise. Spice trading demands knowledge of supply chain risks, geopolitical impacts, and short-term market trends. Wine investing emphasizes provenance, vintage quality, and long-term value growth, often linked to collector demand. Clear differentiation aids investors in aligning risk tolerance and investment horizons with asset characteristics.

Comparison Table

| Aspect | Spice Trading | Wine Investing |

|---|---|---|

| Market Type | Commodity trading, global markets | Collectibles, niche luxury market |

| Volatility | High due to supply-demand and geopolitical factors | Moderate; influenced by vintage quality and demand |

| Liquidity | Relatively high; daily trading possible | Lower; longer time to sell, depends on auction or private sales |

| Storage Requirements | Minimal; bulk and durable goods | Requires temperature and humidity control |

| Return Potential | Variable; influenced by global trends and seasonality | Stable long-term appreciation; potential for significant gains in rare vintages |

| Risk Factors | Price fluctuations, geopolitical risks, quality variation | Storage risks, authenticity, market trends |

| Investment Horizon | Short to medium term | Medium to long term |

| Entry Barriers | Moderate; requires knowledge of markets and logistics | Moderate to high; knowledge and initial capital for premium wines |

Which is better?

Spice trading offers higher volatility and potential for quick profits due to fluctuating global demand and limited supply chains, especially involving rare spices like saffron and vanilla. Wine investing typically provides more stable, long-term returns, benefiting from appreciation in rare vintages and established market platforms such as Liv-ex. Investors seeking rapid market movement may prefer spices, while those prioritizing asset stability and historical growth trends often favor fine wine portfolios.

Connection

Spice trading and wine investing share a historical connection as both involve commodities with fluctuating values influenced by supply, demand, and scarcity. The ancient spice markets laid the foundation for modern commodity trading, much like the fine wine market, where rarity and provenance drive investment potential. Investors in both sectors focus on provenance, quality, and market trends to optimize returns, leveraging knowledge of global trade dynamics and consumer preferences.

Key Terms

Provenance

Provenance plays a critical role in wine investing, as documented history ensures authenticity and enhances value through verified vineyard origins and vintage details. In spice trading, provenance guarantees the traceability of source regions and cultivation practices, impacting quality and market demand. Explore deeper insights into how provenance shapes investment strategies and market trust in both industries.

Market Liquidity

Wine investing and spice trading differ significantly in market liquidity, with wine markets often exhibiting higher liquidity due to established auction houses and online platforms facilitating frequent transactions. Spice trading generally faces lower liquidity caused by limited market participants and less standardized products, leading to slower trade execution and price discovery. Explore further to understand how these liquidity dynamics impact investment strategies and risk management.

Storage Conditions

Proper storage conditions are critical for both wine investing and spice trading, influencing product quality and market value. Wine requires a stable environment with controlled temperature (55degF), humidity (70%), and minimal light exposure to preserve aging potential, while spices demand dry, dark, and airtight conditions to maintain flavor and potency. Explore expert storage strategies to maximize returns in wine and spice markets.

Source and External Links

Understanding Online Wine Investments And Investing Platforms - Online wine investing allows investors to diversify across regions and varietals, blending tradition with modern technology, but requires thorough research and a strategic approach for success.

Getting Started with Wine Investments | Wine Folly - Investment wines are typically age-worthy, in-demand bottles like fine Bordeaux and Grand Cru Burgundy, with provenance and proper storage being key factors in preserving value.

Historic Wine Investment Performance | Wine Reports - Vin-X - Fine wine has historically delivered over 10% average annual growth with low risk, acting as a stable asset even during global financial crises.

dowidth.com

dowidth.com