Patent monetization leverages intellectual property assets to generate revenue through licensing, sales, or litigation, offering potentially high returns but with complex legal and market risks. Mutual funds pool investor capital to invest in diversified portfolios managed by professionals, providing liquidity and risk mitigation with more predictable performance. Explore the advantages and challenges of each investment strategy to determine the best fit for your financial goals.

Why it is important

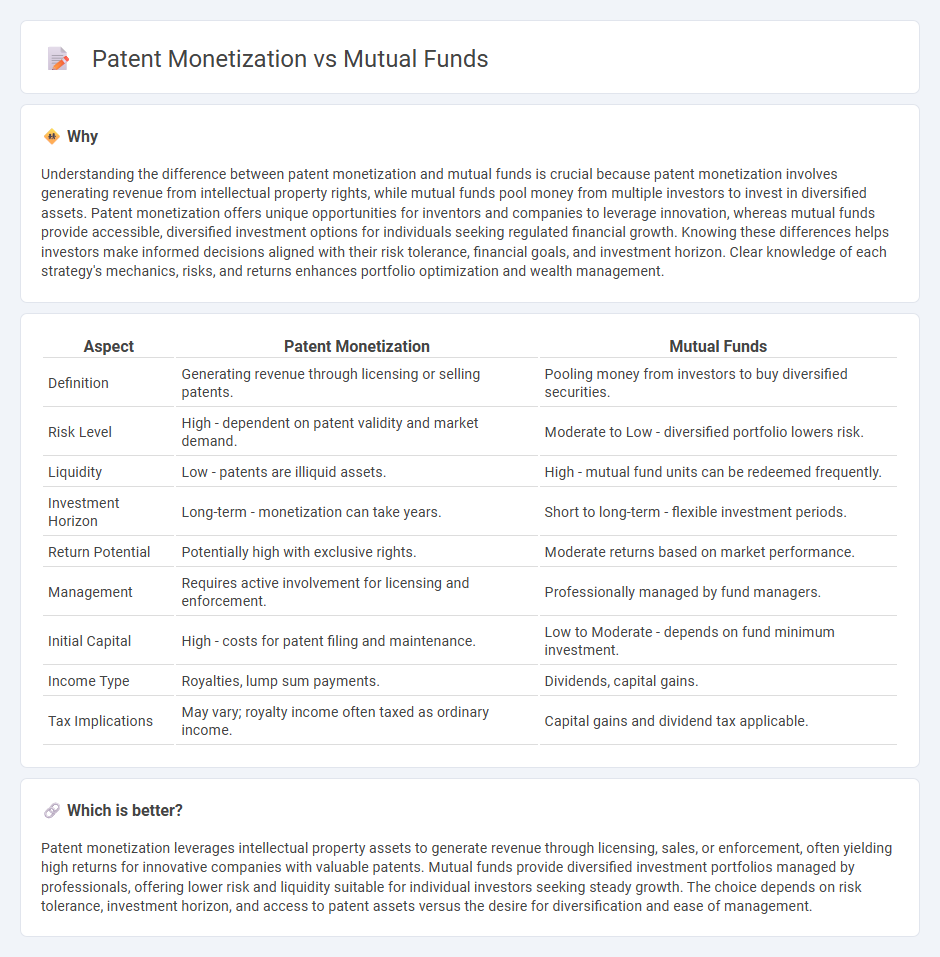

Understanding the difference between patent monetization and mutual funds is crucial because patent monetization involves generating revenue from intellectual property rights, while mutual funds pool money from multiple investors to invest in diversified assets. Patent monetization offers unique opportunities for inventors and companies to leverage innovation, whereas mutual funds provide accessible, diversified investment options for individuals seeking regulated financial growth. Knowing these differences helps investors make informed decisions aligned with their risk tolerance, financial goals, and investment horizon. Clear knowledge of each strategy's mechanics, risks, and returns enhances portfolio optimization and wealth management.

Comparison Table

| Aspect | Patent Monetization | Mutual Funds |

|---|---|---|

| Definition | Generating revenue through licensing or selling patents. | Pooling money from investors to buy diversified securities. |

| Risk Level | High - dependent on patent validity and market demand. | Moderate to Low - diversified portfolio lowers risk. |

| Liquidity | Low - patents are illiquid assets. | High - mutual fund units can be redeemed frequently. |

| Investment Horizon | Long-term - monetization can take years. | Short to long-term - flexible investment periods. |

| Return Potential | Potentially high with exclusive rights. | Moderate returns based on market performance. |

| Management | Requires active involvement for licensing and enforcement. | Professionally managed by fund managers. |

| Initial Capital | High - costs for patent filing and maintenance. | Low to Moderate - depends on fund minimum investment. |

| Income Type | Royalties, lump sum payments. | Dividends, capital gains. |

| Tax Implications | May vary; royalty income often taxed as ordinary income. | Capital gains and dividend tax applicable. |

Which is better?

Patent monetization leverages intellectual property assets to generate revenue through licensing, sales, or enforcement, often yielding high returns for innovative companies with valuable patents. Mutual funds provide diversified investment portfolios managed by professionals, offering lower risk and liquidity suitable for individual investors seeking steady growth. The choice depends on risk tolerance, investment horizon, and access to patent assets versus the desire for diversification and ease of management.

Connection

Patent monetization generates revenue from intellectual property assets, providing investors with diversified income streams that can be integrated into mutual fund portfolios. Mutual funds that include companies with valuable patent portfolios may experience enhanced asset growth due to licensing fees and royalties. This connection allows investors to benefit indirectly from patent monetization through professionally managed mutual fund investments.

Key Terms

Diversification

Mutual funds offer diversification by pooling investments across various asset classes such as stocks, bonds, and commodities, reducing risk through a broad portfolio spread. Patent monetization is less diversified, focusing on generating income from intellectual property assets, which involves specific market and legal risks tied to innovation performance. Explore more about how diversification impacts investment strategies between mutual funds and patent monetization.

Intellectual Property

Mutual funds pool capital from multiple investors to invest in diversified assets, yielding financial returns without direct involvement in intellectual property (IP) management. Patent monetization involves leveraging IP assets through licensing, sales, or enforcement to generate revenue by capitalizing on innovative technologies and inventions. Explore how strategic patent monetization can enhance portfolio value beyond traditional mutual fund investments.

Returns

Mutual funds typically offer diversified investment options with average annual returns ranging between 7% to 12%, depending on market conditions and fund type. Patent monetization can yield significantly higher returns, sometimes exceeding 20%, but involves higher risks due to the complexities of intellectual property valuation, licensing, and enforcement. Explore detailed strategies and risk assessments to maximize returns in both areas.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered open-end investment companies that pool money from many investors to buy diversified portfolios of stocks, bonds, or other securities, managed professionally, offering liquidity and low minimum investments.

Mutual fund - Wikipedia - Mutual funds pool money from investors to purchase securities, are often classified by investment type or management style (active or passive), and provide advantages such as liquidity, diversification, and professional management while incurring fees.

Understanding mutual funds - Charles Schwab - Mutual funds let investors pool money to buy diversified securities managed by professionals, providing benefits like diversification, low transaction costs, convenience, and professional management.

dowidth.com

dowidth.com