Litigation funding involves financing legal cases in exchange for a portion of the settlement or judgment, offering investors alternative asset exposure with potentially high returns uncorrelated to traditional markets. Real estate investment focuses on acquiring property assets for rental income, capital appreciation, or both, providing tangible collateral and diverse risk profiles. Explore the distinct advantages and risks of litigation funding versus real estate investment to make informed financial decisions.

Why it is important

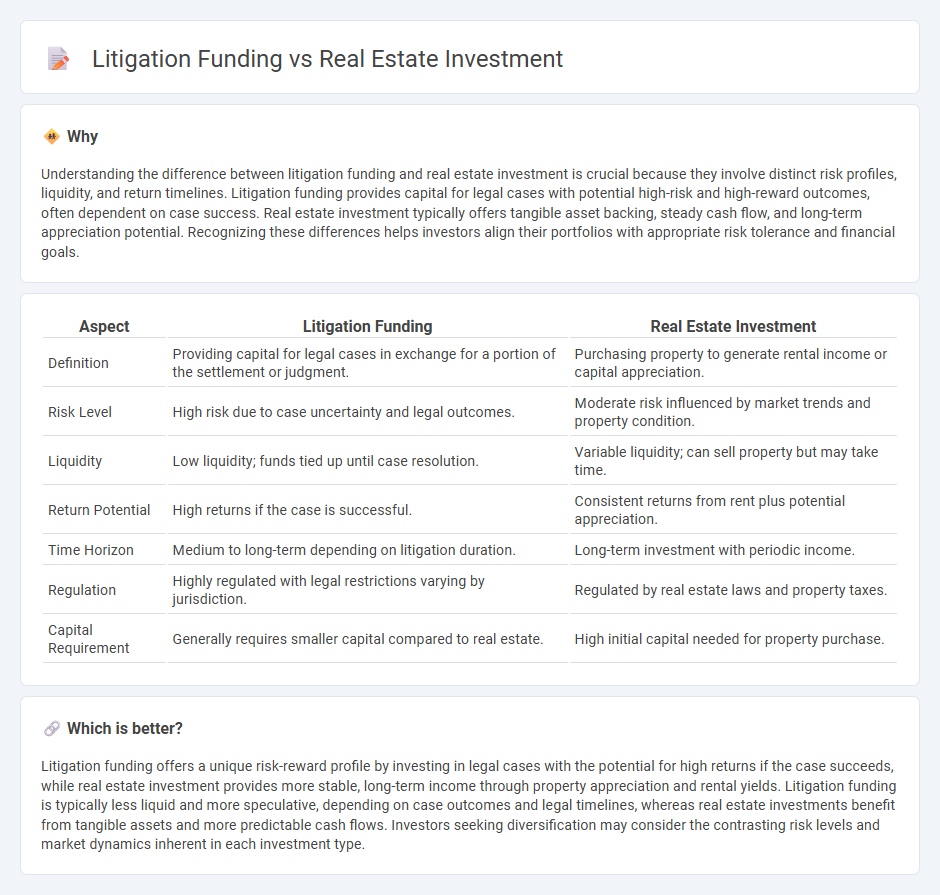

Understanding the difference between litigation funding and real estate investment is crucial because they involve distinct risk profiles, liquidity, and return timelines. Litigation funding provides capital for legal cases with potential high-risk and high-reward outcomes, often dependent on case success. Real estate investment typically offers tangible asset backing, steady cash flow, and long-term appreciation potential. Recognizing these differences helps investors align their portfolios with appropriate risk tolerance and financial goals.

Comparison Table

| Aspect | Litigation Funding | Real Estate Investment |

|---|---|---|

| Definition | Providing capital for legal cases in exchange for a portion of the settlement or judgment. | Purchasing property to generate rental income or capital appreciation. |

| Risk Level | High risk due to case uncertainty and legal outcomes. | Moderate risk influenced by market trends and property condition. |

| Liquidity | Low liquidity; funds tied up until case resolution. | Variable liquidity; can sell property but may take time. |

| Return Potential | High returns if the case is successful. | Consistent returns from rent plus potential appreciation. |

| Time Horizon | Medium to long-term depending on litigation duration. | Long-term investment with periodic income. |

| Regulation | Highly regulated with legal restrictions varying by jurisdiction. | Regulated by real estate laws and property taxes. |

| Capital Requirement | Generally requires smaller capital compared to real estate. | High initial capital needed for property purchase. |

Which is better?

Litigation funding offers a unique risk-reward profile by investing in legal cases with the potential for high returns if the case succeeds, while real estate investment provides more stable, long-term income through property appreciation and rental yields. Litigation funding is typically less liquid and more speculative, depending on case outcomes and legal timelines, whereas real estate investments benefit from tangible assets and more predictable cash flows. Investors seeking diversification may consider the contrasting risk levels and market dynamics inherent in each investment type.

Connection

Litigation funding and real estate investment intersect through the strategic allocation of capital to high-potential legal claims involving property disputes, enabling investors to diversify portfolios while benefiting from anticipated legal settlements. Real estate litigation cases such as eminent domain, zoning challenges, and construction defects create opportunities for litigation funders to finance these claims in exchange for a portion of the recovered damages. This synergy leverages the inherent value in contested real estate assets, driving returns that align with risk-managed investment strategies.

Key Terms

**Real Estate Investment:**

Real estate investment offers tangible asset ownership with potential for long-term capital appreciation and steady rental income, often providing tax benefits such as depreciation deductions and 1031 exchanges. Investors gain portfolio diversification through residential, commercial, or industrial properties, while leveraging market trends and location advantages to maximize returns. Explore comprehensive strategies to optimize real estate investments and enhance financial growth.

Property Valuation

Property valuation plays a crucial role in real estate investment, determining asset worth and potential return on investment based on market trends and location. In litigation funding, valuation assesses the financial viability of legal claims, estimating expected settlement value to manage risk and investor returns. Explore the nuances of property valuation in both sectors to optimize your investment strategy.

Rental Yield

Real estate investment typically offers rental yields ranging from 4% to 8%, providing steady income through property leasing, while litigation funding returns are less predictable but can exceed 20% upon case resolution. Rental yield is a key metric calculating annual rental income relative to property value, making it a tangible measure of real estate profitability. Explore detailed comparisons and risk factors to determine which investment aligns better with your financial goals.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Real estate investment can be lucrative and offers diversified methods including REITs, rental properties, and flipping investment properties with varying levels of involvement and risk.

4 ways to invest in real estate - Fidelity - Common strategies include purchasing a home to build equity, investing in REITs or mutual funds, and becoming a landlord, each having benefits like potential tax advantages and inflation hedging.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in income-producing commercial real estate without direct property ownership, with options including publicly traded and non-traded REITs differing in liquidity and risk profiles.

dowidth.com

dowidth.com