Litigation funding provides capital to plaintiffs involved in lawsuits, enabling them to pursue legal claims without financial strain, while private equity invests directly in companies to support growth and operational improvements. Litigation funding focuses on risk-sharing for legal cases, whereas private equity targets long-term business value creation across sectors. Explore the distinct advantages and strategic roles of litigation funding versus private equity in modern investment portfolios.

Why it is important

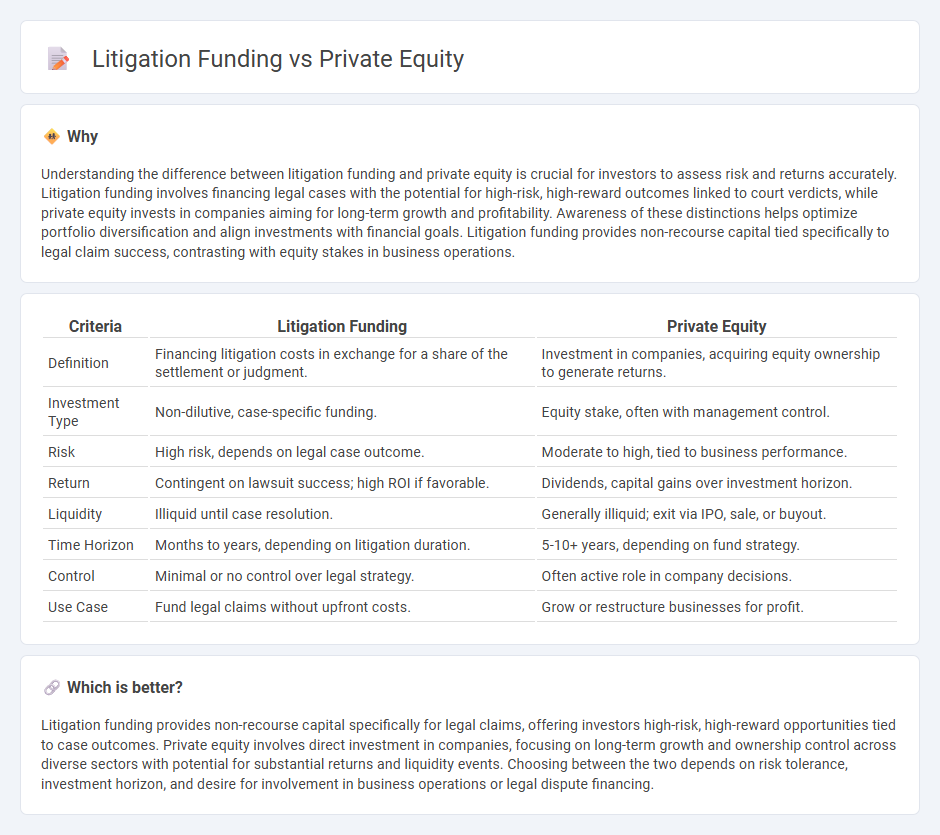

Understanding the difference between litigation funding and private equity is crucial for investors to assess risk and returns accurately. Litigation funding involves financing legal cases with the potential for high-risk, high-reward outcomes linked to court verdicts, while private equity invests in companies aiming for long-term growth and profitability. Awareness of these distinctions helps optimize portfolio diversification and align investments with financial goals. Litigation funding provides non-recourse capital tied specifically to legal claim success, contrasting with equity stakes in business operations.

Comparison Table

| Criteria | Litigation Funding | Private Equity |

|---|---|---|

| Definition | Financing litigation costs in exchange for a share of the settlement or judgment. | Investment in companies, acquiring equity ownership to generate returns. |

| Investment Type | Non-dilutive, case-specific funding. | Equity stake, often with management control. |

| Risk | High risk, depends on legal case outcome. | Moderate to high, tied to business performance. |

| Return | Contingent on lawsuit success; high ROI if favorable. | Dividends, capital gains over investment horizon. |

| Liquidity | Illiquid until case resolution. | Generally illiquid; exit via IPO, sale, or buyout. |

| Time Horizon | Months to years, depending on litigation duration. | 5-10+ years, depending on fund strategy. |

| Control | Minimal or no control over legal strategy. | Often active role in company decisions. |

| Use Case | Fund legal claims without upfront costs. | Grow or restructure businesses for profit. |

Which is better?

Litigation funding provides non-recourse capital specifically for legal claims, offering investors high-risk, high-reward opportunities tied to case outcomes. Private equity involves direct investment in companies, focusing on long-term growth and ownership control across diverse sectors with potential for substantial returns and liquidity events. Choosing between the two depends on risk tolerance, investment horizon, and desire for involvement in business operations or legal dispute financing.

Connection

Litigation funding and private equity intersect as both provide alternative capital sources that support high-risk, high-reward opportunities outside traditional financing. Private equity firms often invest in litigation funding companies to leverage potential substantial returns from successful legal claims. This synergy enhances liquidity for plaintiffs and diversifies portfolio assets for private equity investors, aligning financial incentives across the legal and investment sectors.

Key Terms

Capital commitment

Private equity involves long-term capital commitments typically ranging from 7 to 10 years, as investors allocate funds into managed portfolios aimed at maximizing returns through company growth or restructuring. Litigation funding requires shorter, case-specific capital deployment with risk exposure tied to the outcome of legal disputes, providing liquidity without ownership dilution. Explore the nuances of capital commitment in both funding strategies to optimize your investment approach.

Portfolio diversification

Private equity offers portfolio diversification by investing directly in private companies across various sectors, enabling exposure to potentially high-growth assets not correlated with public markets. Litigation funding diversifies portfolios by financing legal claims, which often have low correlation with economic cycles, providing alternative risk-adjusted returns. Explore how each approach can strategically enhance your investment portfolio diversification.

Return structure

Private equity typically involves equity ownership with returns derived from capital appreciation and dividends, aligning investor interests with the company's growth. Litigation funding offers a different return structure based on a predefined percentage of the settlement or judgment, often involving no ownership stake but a higher risk-return profile due to case outcomes. Explore the detailed differences to understand which investment aligns best with your financial goals.

Source and External Links

Private equity - Wikipedia - Private equity (PE) involves investment in private companies not publicly traded, where investment managers raise funds from institutional investors to acquire equity stakes using equity and debt financing, aiming for returns through revenue growth, margin expansion, cash flow generation, and valuation multiple expansion within typically 4-7 years.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance in exchange for equity in mature, unquoted companies, working closely with management through active ownership to drive sustainable growth, operational improvements, and value enhancement, usually over a 4-7 year holding period before exit.

Private Equity: What You Need to Know - KKR - Private equity funds invest in non-public companies and create value by strengthening management, expanding operations, shaping strategy, optimizing capital structure, and delivering returns through enhanced company performance and growth over their investment horizon.

dowidth.com

dowidth.com