Sports memorabilia investment involves acquiring valuable collectibles like autographed items, rare cards, and limited-edition merchandise with potential appreciation based on athlete popularity and market demand. Angel investing focuses on providing capital to early-stage startups in exchange for equity, offering high risk and high reward through business growth and innovation. Explore the distinct advantages and risks of sports memorabilia and angel investing to determine which aligns best with your financial goals.

Why it is important

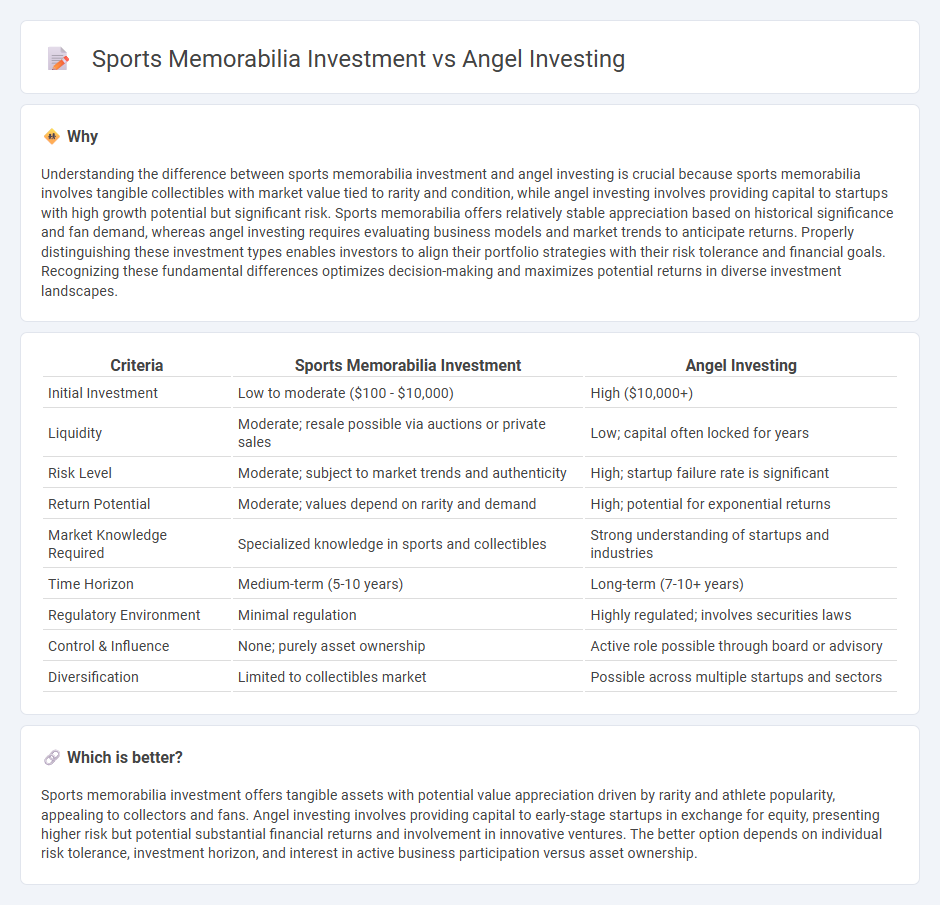

Understanding the difference between sports memorabilia investment and angel investing is crucial because sports memorabilia involves tangible collectibles with market value tied to rarity and condition, while angel investing involves providing capital to startups with high growth potential but significant risk. Sports memorabilia offers relatively stable appreciation based on historical significance and fan demand, whereas angel investing requires evaluating business models and market trends to anticipate returns. Properly distinguishing these investment types enables investors to align their portfolio strategies with their risk tolerance and financial goals. Recognizing these fundamental differences optimizes decision-making and maximizes potential returns in diverse investment landscapes.

Comparison Table

| Criteria | Sports Memorabilia Investment | Angel Investing |

|---|---|---|

| Initial Investment | Low to moderate ($100 - $10,000) | High ($10,000+) |

| Liquidity | Moderate; resale possible via auctions or private sales | Low; capital often locked for years |

| Risk Level | Moderate; subject to market trends and authenticity | High; startup failure rate is significant |

| Return Potential | Moderate; values depend on rarity and demand | High; potential for exponential returns |

| Market Knowledge Required | Specialized knowledge in sports and collectibles | Strong understanding of startups and industries |

| Time Horizon | Medium-term (5-10 years) | Long-term (7-10+ years) |

| Regulatory Environment | Minimal regulation | Highly regulated; involves securities laws |

| Control & Influence | None; purely asset ownership | Active role possible through board or advisory |

| Diversification | Limited to collectibles market | Possible across multiple startups and sectors |

Which is better?

Sports memorabilia investment offers tangible assets with potential value appreciation driven by rarity and athlete popularity, appealing to collectors and fans. Angel investing involves providing capital to early-stage startups in exchange for equity, presenting higher risk but potential substantial financial returns and involvement in innovative ventures. The better option depends on individual risk tolerance, investment horizon, and interest in active business participation versus asset ownership.

Connection

Sports memorabilia investment and angel investing intersect through the shared principle of asset appreciation and risk management, as both involve allocating capital to high-potential opportunities for long-term financial gains. Investors analyze market trends, rarity, and provenance in memorabilia, similar to how angel investors evaluate startup potential, scalability, and innovation. Strategic diversification across unique assets like collectibles and startup equity enhances portfolio resilience and growth prospects.

Key Terms

Angel Investing:

Angel investing involves providing early-stage capital to startups, often in exchange for equity, with the potential for high returns but significant risks due to market volatility and startup failure rates. Unlike sports memorabilia investment, which depends on the rarity and condition of physical items, angel investing leverages innovation-driven growth and strategic business models for wealth accumulation. Explore deeper insights into angel investing to understand its unique advantages and risk management strategies.

Equity

Angel investing involves providing capital to early-stage startups in exchange for equity, offering potential for high returns through company growth and eventual exit events like IPOs or acquisitions. Sports memorabilia investment is typically asset-based, focusing on the value appreciation of physical items such as jerseys or autographed gear, and does not provide equity or ownership in a business. Explore further to understand which investment aligns best with your financial goals and risk tolerance.

Valuation

Angel investing valuation often relies on projected startup growth, market potential, and equity percentages, making it highly speculative and future-oriented. In contrast, sports memorabilia valuation depends on rarity, provenance, player popularity, and condition, offering more tangible and historically grounded value metrics. Explore detailed comparisons to understand which investment aligns best with your financial goals and risk tolerance.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investing involves wealthy individuals providing capital to startups in exchange for equity or convertible debt, helping founders bridge the gap from early family and friends funding to professional rounds, often offering mentorship and network support to de-risk the business and prepare it for institutional investment.

Demystifying Angel Investing - Angel Capital Association - Angel investing allows individuals to invest capital in promising startups to generate returns, build financial legacies, and support regional economic growth, often benefiting from favorable tax incentives and access to a community of experienced investors and resources.

Angel Investors - The Hartford Insurance - Angel investors are wealthy individuals using their own funds to invest in startups for equity stakes, generally more patient than venture capitalists and often providing mentoring, with investments typically aimed at startups beyond initial phases seeking growth capital; they expect an exit strategy to realize profits.

dowidth.com

dowidth.com