Fractional farmland ownership offers direct equity in agricultural land, allowing investors to benefit from land appreciation and crop yields, while Agricultural ETFs provide diversified exposure to agribusiness companies and commodity prices without physical land management. Farmland ownership typically requires higher capital and involves operational responsibilities, whereas ETFs offer liquidity and ease of trading on stock exchanges. Explore detailed comparisons to determine the best fit for your investment portfolio.

Why it is important

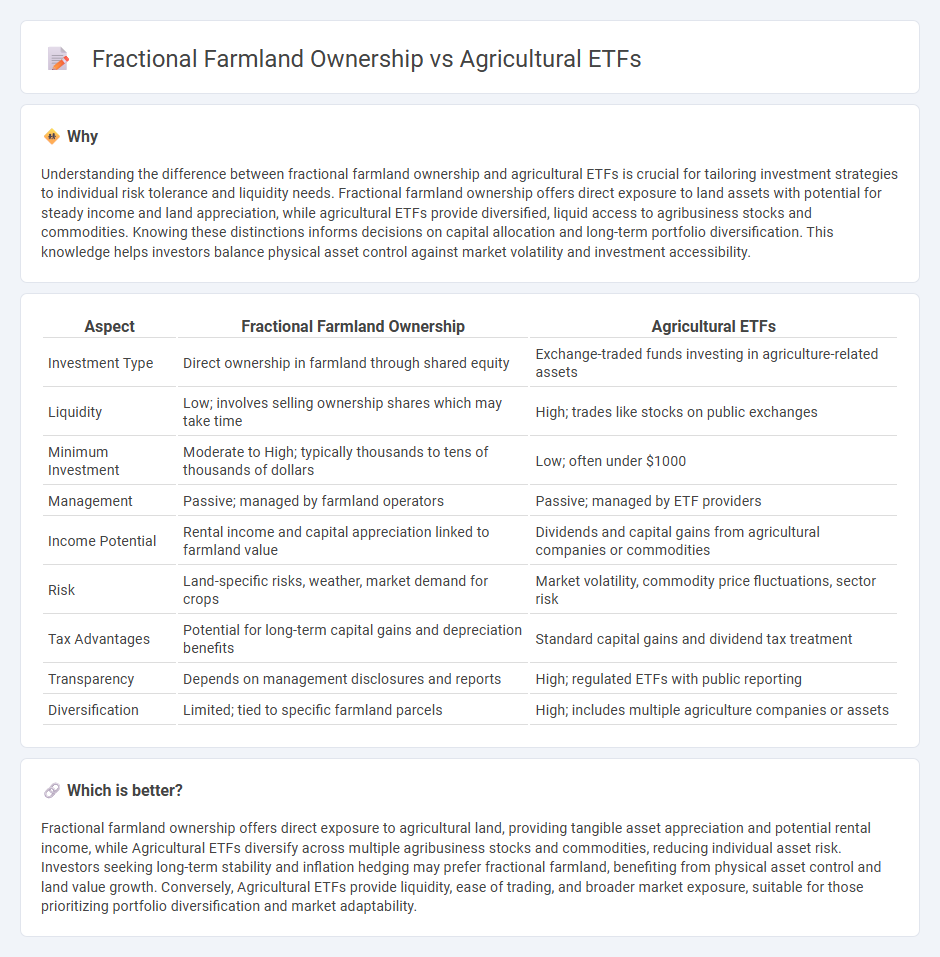

Understanding the difference between fractional farmland ownership and agricultural ETFs is crucial for tailoring investment strategies to individual risk tolerance and liquidity needs. Fractional farmland ownership offers direct exposure to land assets with potential for steady income and land appreciation, while agricultural ETFs provide diversified, liquid access to agribusiness stocks and commodities. Knowing these distinctions informs decisions on capital allocation and long-term portfolio diversification. This knowledge helps investors balance physical asset control against market volatility and investment accessibility.

Comparison Table

| Aspect | Fractional Farmland Ownership | Agricultural ETFs |

|---|---|---|

| Investment Type | Direct ownership in farmland through shared equity | Exchange-traded funds investing in agriculture-related assets |

| Liquidity | Low; involves selling ownership shares which may take time | High; trades like stocks on public exchanges |

| Minimum Investment | Moderate to High; typically thousands to tens of thousands of dollars | Low; often under $1000 |

| Management | Passive; managed by farmland operators | Passive; managed by ETF providers |

| Income Potential | Rental income and capital appreciation linked to farmland value | Dividends and capital gains from agricultural companies or commodities |

| Risk | Land-specific risks, weather, market demand for crops | Market volatility, commodity price fluctuations, sector risk |

| Tax Advantages | Potential for long-term capital gains and depreciation benefits | Standard capital gains and dividend tax treatment |

| Transparency | Depends on management disclosures and reports | High; regulated ETFs with public reporting |

| Diversification | Limited; tied to specific farmland parcels | High; includes multiple agriculture companies or assets |

Which is better?

Fractional farmland ownership offers direct exposure to agricultural land, providing tangible asset appreciation and potential rental income, while Agricultural ETFs diversify across multiple agribusiness stocks and commodities, reducing individual asset risk. Investors seeking long-term stability and inflation hedging may prefer fractional farmland, benefiting from physical asset control and land value growth. Conversely, Agricultural ETFs provide liquidity, ease of trading, and broader market exposure, suitable for those prioritizing portfolio diversification and market adaptability.

Connection

Fractional farmland ownership allows investors to purchase small shares of agricultural land, providing direct asset exposure without full land management responsibilities. Agricultural ETFs aggregate these investments by pooling fractional farmland shares or related agribusiness assets, enabling diversified access to the agriculture sector. This connection enhances liquidity and accessibility for investors seeking to benefit from farmland appreciation and commodity production growth.

Key Terms

Diversification

Agricultural ETFs offer diversified exposure across multiple agribusiness sectors, reducing risks tied to individual crops or regions, whereas fractional farmland ownership concentrates investment in specific plots, trading off diversification for direct asset control. ETFs provide liquidity and simplified portfolio management, while fractional ownership allows investors to benefit from land appreciation and agricultural income streams. Explore the key differences and benefits of each option to optimize your agricultural investment strategy.

Liquidity

Agricultural ETFs offer high liquidity by allowing investors to buy or sell shares easily on stock exchanges, providing immediate access to funds. Fractional farmland ownership involves direct investment in physical land, which tends to have lower liquidity due to longer transaction times and fewer buyers. Explore how liquidity impacts your investment strategy to determine the best fit for your portfolio needs.

Asset Management

Agricultural ETFs offer diversified exposure to farming-related assets with the advantage of liquidity and professional asset management, whereas fractional farmland ownership provides direct investment in physical farmland, allowing for tangible asset control and potential income through crop production. ETFs are managed by financial professionals who adjust holdings based on market conditions, while fractional ownership requires active management or reliance on property managers for operational efficiency. Explore detailed comparisons to understand which asset management approach aligns better with your investment goals.

Source and External Links

TILL - Teucrium Agricultural Strategy No K-1 ETF - TILL offers investors long-only exposure to corn, wheat, soybeans, and sugar futures, designed for portfolio diversification and long-term capital appreciation through active management of agricultural commodity futures contracts.

Global Agriculture ETF - FOOD ASX - This ETF tracks the largest global agriculture companies (outside Australia), providing diversified, cost-effective, passive exposure to the agricultural sector with currency hedging to AUD.

Invesco Agriculture Commodity Strategy No K-1 ETF (PDBA) - PDBA offers exposure to 11 agricultural commodities including grains, livestock, and soft commodities using an enhanced Optimum Yield methodology aimed at maximizing roll yield and minimizing losses in futures markets.

dowidth.com

dowidth.com