Fractional real estate allows investors to buy shares of physical properties, providing direct exposure to real estate markets with lower capital requirements and potential rental income. Mutual funds pool capital from multiple investors to invest in diversified portfolios of stocks, bonds, or other assets, offering liquidity and professional management. Explore the benefits and risks of each investment vehicle to make informed decisions.

Why it is important

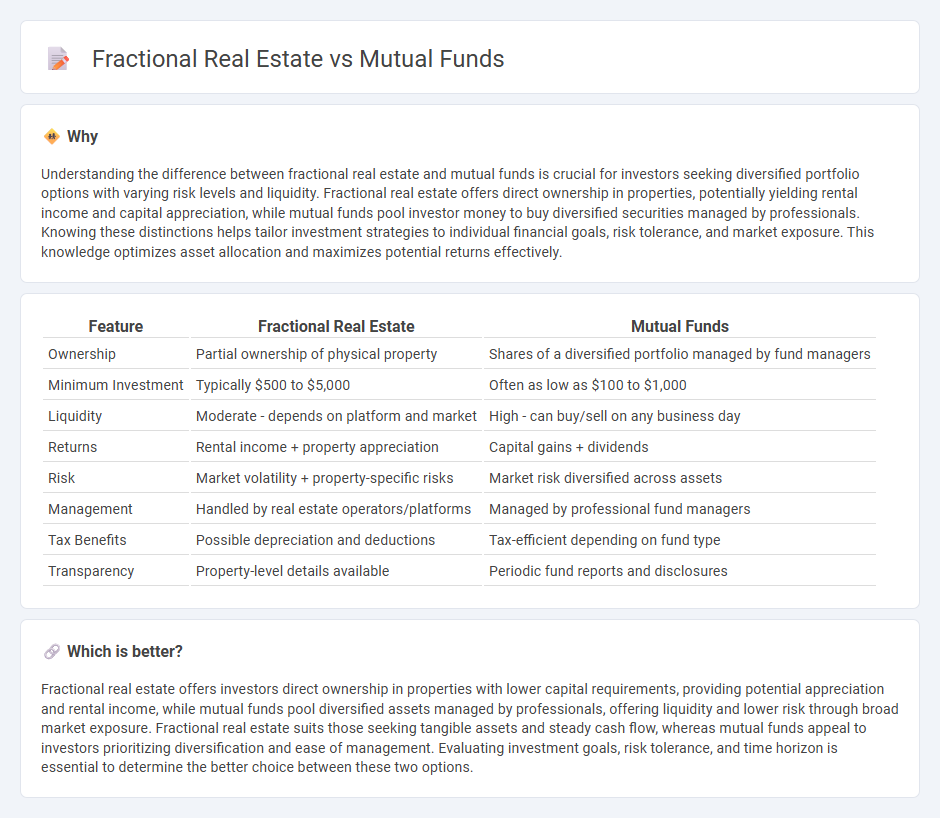

Understanding the difference between fractional real estate and mutual funds is crucial for investors seeking diversified portfolio options with varying risk levels and liquidity. Fractional real estate offers direct ownership in properties, potentially yielding rental income and capital appreciation, while mutual funds pool investor money to buy diversified securities managed by professionals. Knowing these distinctions helps tailor investment strategies to individual financial goals, risk tolerance, and market exposure. This knowledge optimizes asset allocation and maximizes potential returns effectively.

Comparison Table

| Feature | Fractional Real Estate | Mutual Funds |

|---|---|---|

| Ownership | Partial ownership of physical property | Shares of a diversified portfolio managed by fund managers |

| Minimum Investment | Typically $500 to $5,000 | Often as low as $100 to $1,000 |

| Liquidity | Moderate - depends on platform and market | High - can buy/sell on any business day |

| Returns | Rental income + property appreciation | Capital gains + dividends |

| Risk | Market volatility + property-specific risks | Market risk diversified across assets |

| Management | Handled by real estate operators/platforms | Managed by professional fund managers |

| Tax Benefits | Possible depreciation and deductions | Tax-efficient depending on fund type |

| Transparency | Property-level details available | Periodic fund reports and disclosures |

Which is better?

Fractional real estate offers investors direct ownership in properties with lower capital requirements, providing potential appreciation and rental income, while mutual funds pool diversified assets managed by professionals, offering liquidity and lower risk through broad market exposure. Fractional real estate suits those seeking tangible assets and steady cash flow, whereas mutual funds appeal to investors prioritizing diversification and ease of management. Evaluating investment goals, risk tolerance, and time horizon is essential to determine the better choice between these two options.

Connection

Fractional real estate and mutual funds both provide accessible pathways for investors to diversify portfolios without requiring large capital commitments. Fractional real estate allows individuals to buy shares in property assets, similar to how mutual funds pool money to invest in a diversified range of securities. This fractional ownership model reduces risk exposure and increases liquidity compared to direct real estate investments or single-stock purchases.

Key Terms

Diversification

Mutual funds offer diversification by pooling investments across various asset classes such as stocks, bonds, and money market instruments, reducing risk exposure. Fractional real estate allows investors to own a portion of properties, diversifying across residential, commercial, and industrial sectors without the need for full property acquisition. Explore how each option enhances portfolio diversification to make informed investment decisions.

Liquidity

Mutual funds offer high liquidity with the ability to buy or sell shares on any trading day, providing investors quick access to cash. Fractional real estate, while more accessible than traditional property investments, generally involves longer liquidity horizons due to property market cycles and resale complexities. Explore the advantages and limitations of each investment type to determine the best fit for your liquidity needs.

Ownership structure

Mutual funds pool investor capital to acquire diversified portfolios managed by professionals, offering shareholders proportional units without direct ownership of specific assets. Fractional real estate involves investors holding direct title to a portion of a tangible property, allowing individual claims on the asset and its income streams. Explore the key differences in ownership structures to determine which investment aligns best with your financial goals.

Source and External Links

Mutual Funds (SEC Investor.gov) - Mutual funds pool money from many investors to buy stocks, bonds, or other assets, with each share representing part ownership in the fund's portfolio managed by professional advisers, offering diversification, liquidity, and relatively low minimum investments.

Mutual fund (Wikipedia) - Mutual funds are investment vehicles that combine money from many investors to purchase securities, categorized by asset type (stocks, bonds, etc.) and management style (active or passive), and provide advantages like professional management, diversification, and liquidity, though they charge various fees.

Understanding Mutual Funds (Schwab) - Mutual funds allow individual investors to pool funds with others for professional management of a diversified portfolio of stocks, bonds, or other assets, offering convenience, lower costs, and access to various investment strategies.

dowidth.com

dowidth.com