Fractional farmland ownership offers investors direct equity in agricultural land, providing tangible assets with potential for land appreciation and consistent rental income. Agri-business stocks enable investment in companies involved in the agricultural sector, offering liquidity and exposure to broader market trends but with higher volatility. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

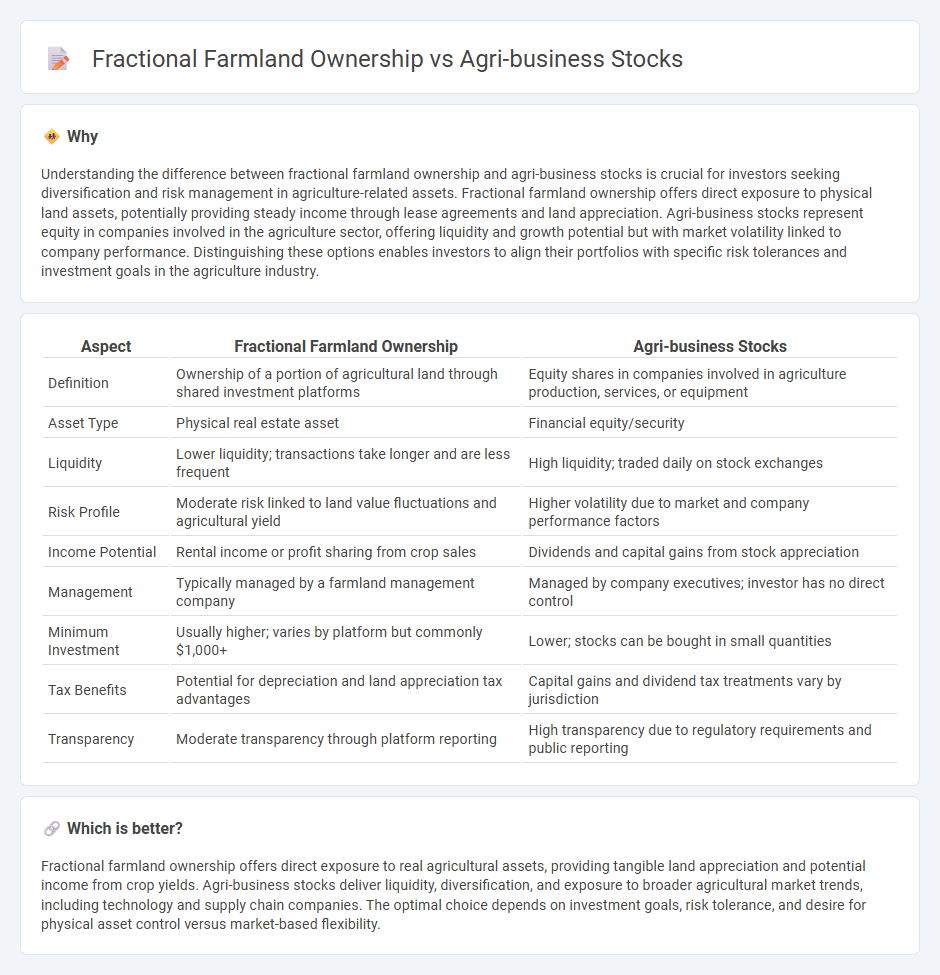

Understanding the difference between fractional farmland ownership and agri-business stocks is crucial for investors seeking diversification and risk management in agriculture-related assets. Fractional farmland ownership offers direct exposure to physical land assets, potentially providing steady income through lease agreements and land appreciation. Agri-business stocks represent equity in companies involved in the agriculture sector, offering liquidity and growth potential but with market volatility linked to company performance. Distinguishing these options enables investors to align their portfolios with specific risk tolerances and investment goals in the agriculture industry.

Comparison Table

| Aspect | Fractional Farmland Ownership | Agri-business Stocks |

|---|---|---|

| Definition | Ownership of a portion of agricultural land through shared investment platforms | Equity shares in companies involved in agriculture production, services, or equipment |

| Asset Type | Physical real estate asset | Financial equity/security |

| Liquidity | Lower liquidity; transactions take longer and are less frequent | High liquidity; traded daily on stock exchanges |

| Risk Profile | Moderate risk linked to land value fluctuations and agricultural yield | Higher volatility due to market and company performance factors |

| Income Potential | Rental income or profit sharing from crop sales | Dividends and capital gains from stock appreciation |

| Management | Typically managed by a farmland management company | Managed by company executives; investor has no direct control |

| Minimum Investment | Usually higher; varies by platform but commonly $1,000+ | Lower; stocks can be bought in small quantities |

| Tax Benefits | Potential for depreciation and land appreciation tax advantages | Capital gains and dividend tax treatments vary by jurisdiction |

| Transparency | Moderate transparency through platform reporting | High transparency due to regulatory requirements and public reporting |

Which is better?

Fractional farmland ownership offers direct exposure to real agricultural assets, providing tangible land appreciation and potential income from crop yields. Agri-business stocks deliver liquidity, diversification, and exposure to broader agricultural market trends, including technology and supply chain companies. The optimal choice depends on investment goals, risk tolerance, and desire for physical asset control versus market-based flexibility.

Connection

Fractional farmland ownership allows investors to buy partial shares of agricultural land, increasing accessibility to this asset class. Agri-business stocks represent companies involved in farming operations, equipment, and agritech, complementing direct land investment by offering liquidity and diversification. Together, these investment options provide a balanced exposure to agriculture, blending tangible land assets with equity stakes in the agricultural supply chain.

Key Terms

Equity

Agri-business stocks offer exposure to diversified agricultural enterprises with liquidity and ease of trading, while fractional farmland ownership provides direct equity in specific land assets, emphasizing tangible value and potential land appreciation. Investors seeking dividends and market-based returns might prefer agri-business stocks, whereas those aiming for long-term stability and inflation hedging often opt for fractional farmland ownership. Explore the benefits and risks of each equity option to determine the best fit for your agricultural investment strategy.

Diversification

Agri-business stocks offer investors exposure to established companies within the agricultural sector, providing liquidity and potential dividend income, while fractional farmland ownership enables direct investment in physical land, offering tangible asset diversification and inflation hedge benefits. Diversifying a portfolio with both assets balances market-driven volatility of stocks with the stability of land, reducing overall risk. Explore further to understand how combining these strategies can enhance your investment diversification and resilience.

Liquidity

Agri-business stocks offer higher liquidity due to their presence on public markets, enabling investors to buy or sell shares quickly compared to fractional farmland ownership, which typically involves longer holding periods and limited secondary market options. Fractional ownership provides direct exposure to farmland assets, often with potential tax benefits and income from land leases, but lacks the ease of access and rapid tradeability characteristic of agri-business equities. Explore detailed comparisons to understand which investment aligns best with your liquidity preferences and risk profile.

Source and External Links

All 46 Agriculture Stocks List For 2025 | The Best 7 Buys Now - This article provides a ranked list of the top 7 agriculture stocks to invest in 2025, including dividend-paying companies such as Ingredion Inc., Fresh Del Monte Produce, Corteva, and others, focusing on expected returns and income potential.

Agriculture Stocks To Watch Now - July 20th - MarketBeat highlights five agriculture-related stocks to watch in 2025 including Norfolk Southern, Deere & Company, and others that are heavily involved in agricultural production, transportation, and equipment sectors.

Agribusiness ETF List - This resource offers a comprehensive list and details of agribusiness ETFs trading in the USA, providing exposure to companies engaged in agriculture and farming-related industries through diversified investment funds.

dowidth.com

dowidth.com