Blue economy funds invest in sustainable ocean-based industries, targeting sectors like fisheries, renewable marine energy, and marine biotechnology for long-term ecological and financial returns. Real estate investment trusts (REITs) focus on income-producing property assets, providing investors with liquidity, diversification, and regular dividend income through commercial, residential, or industrial real estate. Explore the distinct advantages and risks of blue economy funds versus REITs to make informed investment decisions.

Why it is important

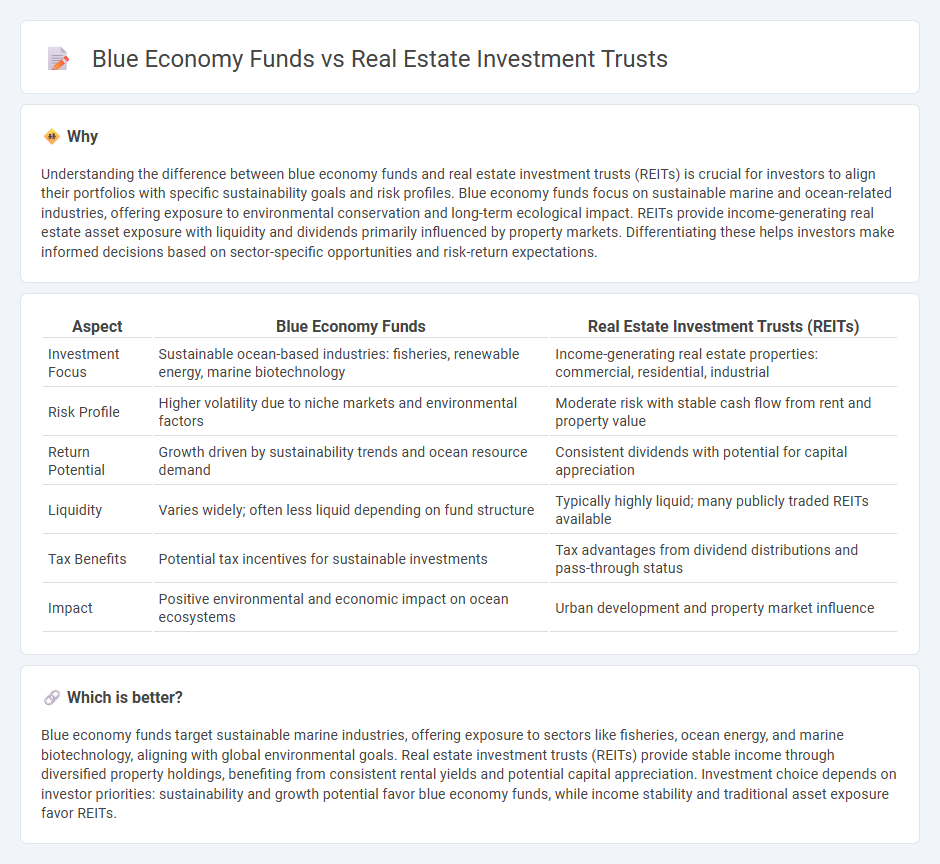

Understanding the difference between blue economy funds and real estate investment trusts (REITs) is crucial for investors to align their portfolios with specific sustainability goals and risk profiles. Blue economy funds focus on sustainable marine and ocean-related industries, offering exposure to environmental conservation and long-term ecological impact. REITs provide income-generating real estate asset exposure with liquidity and dividends primarily influenced by property markets. Differentiating these helps investors make informed decisions based on sector-specific opportunities and risk-return expectations.

Comparison Table

| Aspect | Blue Economy Funds | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Investment Focus | Sustainable ocean-based industries: fisheries, renewable energy, marine biotechnology | Income-generating real estate properties: commercial, residential, industrial |

| Risk Profile | Higher volatility due to niche markets and environmental factors | Moderate risk with stable cash flow from rent and property value |

| Return Potential | Growth driven by sustainability trends and ocean resource demand | Consistent dividends with potential for capital appreciation |

| Liquidity | Varies widely; often less liquid depending on fund structure | Typically highly liquid; many publicly traded REITs available |

| Tax Benefits | Potential tax incentives for sustainable investments | Tax advantages from dividend distributions and pass-through status |

| Impact | Positive environmental and economic impact on ocean ecosystems | Urban development and property market influence |

Which is better?

Blue economy funds target sustainable marine industries, offering exposure to sectors like fisheries, ocean energy, and marine biotechnology, aligning with global environmental goals. Real estate investment trusts (REITs) provide stable income through diversified property holdings, benefiting from consistent rental yields and potential capital appreciation. Investment choice depends on investor priorities: sustainability and growth potential favor blue economy funds, while income stability and traditional asset exposure favor REITs.

Connection

Blue economy funds invest in marine and coastal industries, supporting sustainable use of ocean resources, while real estate investment trusts (REITs) often include properties like waterfront developments and port facilities. Both investment types capitalize on the economic potential of coastal and marine assets, linking environmental sustainability with tangible asset growth. Integrating blue economy principles into REITs enhances portfolio diversification and supports long-term value creation aligned with ecological preservation.

Key Terms

Asset Diversification

Real Estate Investment Trusts (REITs) typically offer asset diversification by investing in a variety of properties such as commercial, residential, and industrial real estate, providing steady income through rental yields and capital appreciation. Blue Economy Funds focus on sustainable investments in ocean-related sectors like fisheries, marine biotechnology, and renewable ocean energy, aiming to balance financial returns with environmental conservation. Explore the distinct benefits and diversification strategies of these investment vehicles to enhance your portfolio.

Income Generation

Real estate investment trusts (REITs) generate income primarily through rental payments from commercial or residential properties, offering investors consistent dividend yields derived from property leases. Blue economy funds focus on sustainable investments in oceans and marine resources, providing income through sectors like fisheries, renewable marine energy, and marine biotechnology, often emphasizing long-term growth alongside ecological benefits. Explore how these investment vehicles align with your income generation goals and sustainability preferences to make an informed decision.

Sustainability Criteria

Real estate investment trusts (REITs) primarily focus on sustainable property management, emphasizing energy-efficient buildings, waste reduction, and green certifications to meet environmental standards. Blue economy funds invest in ocean-based industries, prioritizing sustainable fishing, marine conservation, and renewable ocean energy to support long-term ecological balance. Explore the detailed sustainability criteria and impact metrics differentiating these investment types for comprehensive insights.

Source and External Links

Real estate investment trust - Wikipedia - This article provides an overview of real estate investment trusts (REITs), including their types, benefits, and legal structures.

What's a REIT (Real Estate Investment Trust)? - Nareit - This webpage explains the basics of REITs, including their operations and investment benefits.

Real Estate Investment Trusts (REITs) | Investor.gov - This resource provides an introduction to REITs, detailing their functions and why investors choose them for real estate investments.

dowidth.com

dowidth.com