Drone insurance provides coverage for damages, liability, and theft related to unmanned aerial vehicles, protecting commercial operators against operational risks. Workers' compensation insurance offers medical and wage benefits to employees injured on the job, ensuring compliance with labor laws and safeguarding both employers and workers. Explore detailed comparisons and benefits of drone insurance versus workers' compensation insurance to make informed decisions.

Why it is important

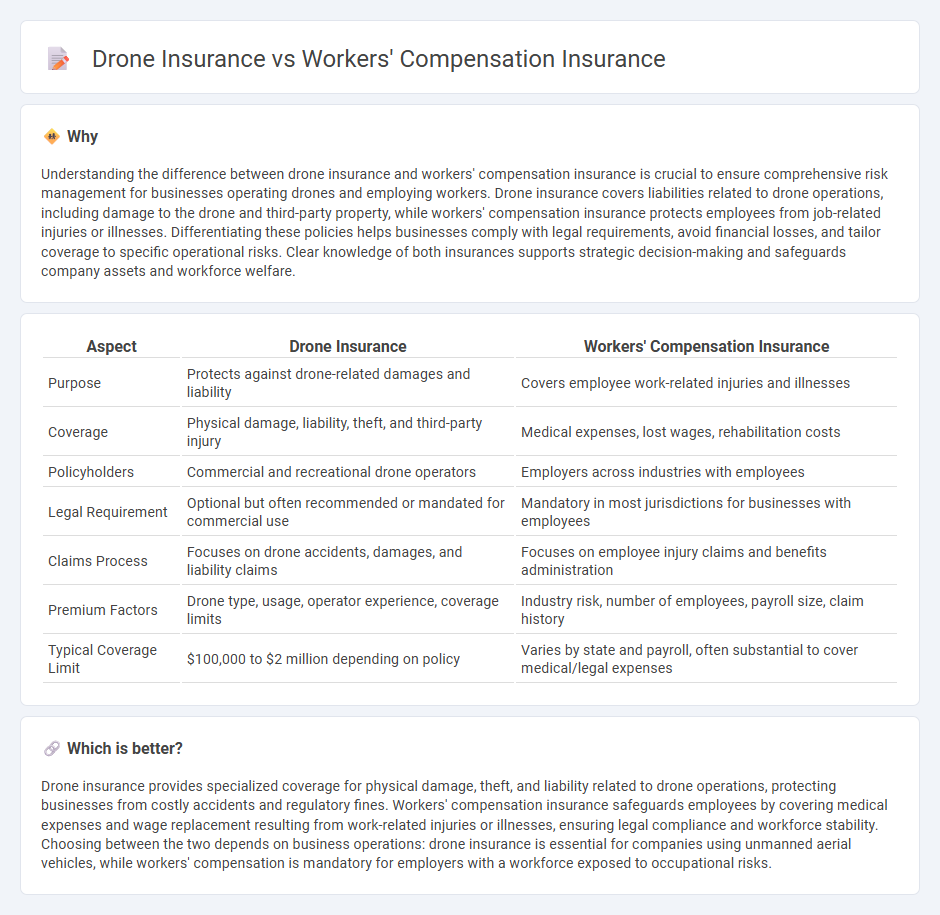

Understanding the difference between drone insurance and workers' compensation insurance is crucial to ensure comprehensive risk management for businesses operating drones and employing workers. Drone insurance covers liabilities related to drone operations, including damage to the drone and third-party property, while workers' compensation insurance protects employees from job-related injuries or illnesses. Differentiating these policies helps businesses comply with legal requirements, avoid financial losses, and tailor coverage to specific operational risks. Clear knowledge of both insurances supports strategic decision-making and safeguards company assets and workforce welfare.

Comparison Table

| Aspect | Drone Insurance | Workers' Compensation Insurance |

|---|---|---|

| Purpose | Protects against drone-related damages and liability | Covers employee work-related injuries and illnesses |

| Coverage | Physical damage, liability, theft, and third-party injury | Medical expenses, lost wages, rehabilitation costs |

| Policyholders | Commercial and recreational drone operators | Employers across industries with employees |

| Legal Requirement | Optional but often recommended or mandated for commercial use | Mandatory in most jurisdictions for businesses with employees |

| Claims Process | Focuses on drone accidents, damages, and liability claims | Focuses on employee injury claims and benefits administration |

| Premium Factors | Drone type, usage, operator experience, coverage limits | Industry risk, number of employees, payroll size, claim history |

| Typical Coverage Limit | $100,000 to $2 million depending on policy | Varies by state and payroll, often substantial to cover medical/legal expenses |

Which is better?

Drone insurance provides specialized coverage for physical damage, theft, and liability related to drone operations, protecting businesses from costly accidents and regulatory fines. Workers' compensation insurance safeguards employees by covering medical expenses and wage replacement resulting from work-related injuries or illnesses, ensuring legal compliance and workforce stability. Choosing between the two depends on business operations: drone insurance is essential for companies using unmanned aerial vehicles, while workers' compensation is mandatory for employers with a workforce exposed to occupational risks.

Connection

Drone insurance and workers' compensation insurance intersect in industries employing drones for work-related tasks, ensuring both equipment protection and employee injury coverage. Drone insurance covers damages or liability arising from drone operations, while workers' compensation insurance safeguards employees against workplace injuries, including incidents involving drone use. Coordinated coverage mitigates financial risks for businesses integrating drones into their workforce activities.

Key Terms

**Workers' Compensation Insurance:**

Workers' compensation insurance provides financial protection for employees injured on the job, covering medical expenses, rehabilitation, and lost wages, ensuring workforce stability and compliance with labor laws. Unlike drone insurance, which specifically addresses liabilities and damages related to unmanned aerial vehicle operations, workers' compensation focuses on workplace injury risks across all industries. Explore the distinct benefits and coverage details to determine the best insurance solution for your business needs.

Employer Liability

Workers' compensation insurance provides financial protection to employees injured on the job, covering medical expenses and lost wages, while employer liability insurance safeguards employers against claims arising from workplace injuries not covered by workers' compensation. Drone insurance primarily covers damages or liability resulting from drone operations, including property damage or bodily injury caused by the drone, but typically does not extend to employee-related claims. To explore how these insurance types address employer liability and protect your business, learn more about their specific coverage scopes and benefits.

Medical Benefits

Workers' compensation insurance covers medical expenses, rehabilitation costs, and lost wages for employees injured on the job, ensuring timely access to necessary healthcare and financial support. Drone insurance, particularly liability coverage, primarily addresses property damage and bodily injury caused by drone operations, but may not comprehensively cover medical benefits for the drone operator or third parties. Explore further to understand the specific medical benefit protections each insurance type offers for workplace and drone-related incidents.

Source and External Links

What is Workers' Compensation? - Nationwide - Workers' compensation insurance provides medical and wage benefits to employees injured or ill due to work, offering protection to both employers and employees.

Workers' Compensation Requirements - CSLB - In California, employers must have workers' compensation insurance, which covers medical care, disability benefits, and death benefits for work-related injuries.

Workers' Compensation | Department of Labor & Employment - In Colorado, all businesses with employees must have workers' compensation insurance to cover medical and lost wage benefits for on-the-job injuries.

dowidth.com

dowidth.com