Invisible insurance integrates seamlessly with everyday transactions, offering automated coverage without the need for separate policies, unlike traditional insurance which requires explicit contracts and claims processes. This innovative approach leverages technology to provide immediate protection for specific objects or events, minimizing paperwork and delays common in conventional insurance. Explore more to understand how invisible insurance is transforming risk management and consumer convenience.

Why it is important

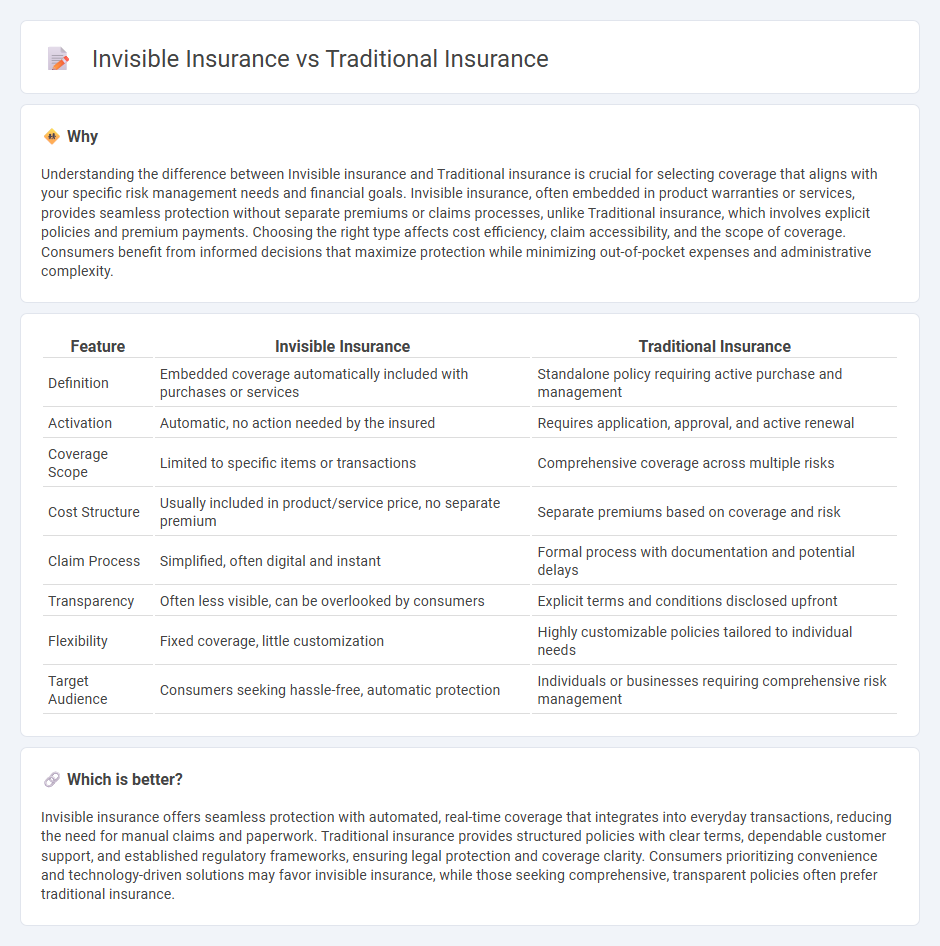

Understanding the difference between Invisible insurance and Traditional insurance is crucial for selecting coverage that aligns with your specific risk management needs and financial goals. Invisible insurance, often embedded in product warranties or services, provides seamless protection without separate premiums or claims processes, unlike Traditional insurance, which involves explicit policies and premium payments. Choosing the right type affects cost efficiency, claim accessibility, and the scope of coverage. Consumers benefit from informed decisions that maximize protection while minimizing out-of-pocket expenses and administrative complexity.

Comparison Table

| Feature | Invisible Insurance | Traditional Insurance |

|---|---|---|

| Definition | Embedded coverage automatically included with purchases or services | Standalone policy requiring active purchase and management |

| Activation | Automatic, no action needed by the insured | Requires application, approval, and active renewal |

| Coverage Scope | Limited to specific items or transactions | Comprehensive coverage across multiple risks |

| Cost Structure | Usually included in product/service price, no separate premium | Separate premiums based on coverage and risk |

| Claim Process | Simplified, often digital and instant | Formal process with documentation and potential delays |

| Transparency | Often less visible, can be overlooked by consumers | Explicit terms and conditions disclosed upfront |

| Flexibility | Fixed coverage, little customization | Highly customizable policies tailored to individual needs |

| Target Audience | Consumers seeking hassle-free, automatic protection | Individuals or businesses requiring comprehensive risk management |

Which is better?

Invisible insurance offers seamless protection with automated, real-time coverage that integrates into everyday transactions, reducing the need for manual claims and paperwork. Traditional insurance provides structured policies with clear terms, dependable customer support, and established regulatory frameworks, ensuring legal protection and coverage clarity. Consumers prioritizing convenience and technology-driven solutions may favor invisible insurance, while those seeking comprehensive, transparent policies often prefer traditional insurance.

Connection

Invisible insurance integrates seamlessly with traditional insurance by utilizing digital technology to automate claims processing and risk assessment, enhancing efficiency and customer experience. Traditional insurance providers adopt invisible insurance models to offer micro-coverage and real-time protection without complex paperwork or interruptions. This synergy expands market reach and reduces operational costs while maintaining robust risk management frameworks.

Key Terms

Underwriting

Traditional insurance underwriting relies heavily on historical data, medical exams, and credit scores to assess risk, often resulting in lengthy approval times and limited personalization. Invisible insurance leverages real-time data analytics, wearable technology, and AI-driven algorithms to provide swift, personalized risk assessments that enhance customer experience and reduce costs. Discover how invisible insurance is transforming underwriting by visiting our detailed insights.

Risk Pooling

Traditional insurance operates on the principle of risk pooling, where premiums from many policyholders are aggregated to cover the losses of a few. Invisible insurance, by contrast, embeds coverage within everyday transactions, leveraging data analytics to optimize risk assessment and minimize explicit pooling. Explore how these advancements reshape risk management by delving deeper into the mechanisms of invisible insurance.

Embedded Coverage

Traditional insurance often requires separate policies, upfront payments, and complex claims processes, creating barriers to accessibility and customer convenience. Invisible insurance, exemplified by embedded coverage, integrates protection directly into everyday purchases or services, offering seamless risk management without additional effort from consumers. Explore how embedded coverage transforms risk protection by embedding insurance into the fabric of daily transactions.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional life insurance plans are long-standing financial instruments offering benefits like life coverage, fixed incomes, and tax benefits.

5 Best Ways to Compare DPC and Traditional Insurance - This article compares Direct Primary Care (DPC) with traditional insurance, highlighting differences in coverage options and healthcare models.

Traditional Indemnity Insurance Plans - These plans reimburse patients based on the provider's bill for usual, customary, and reasonable fees, often with no restrictions on provider choice.

dowidth.com

dowidth.com