Telematics insurance uses real-time driving data collected via GPS and onboard sensors to tailor premiums based on driving behavior, whereas Snapshot insurance relies on periodic data snapshots gathered through a connected device or app to assess risk. Both methods aim to provide personalized rates, reward safe driving, and reduce costs compared to traditional insurance. Discover how these innovative approaches can transform your insurance experience and savings.

Why it is important

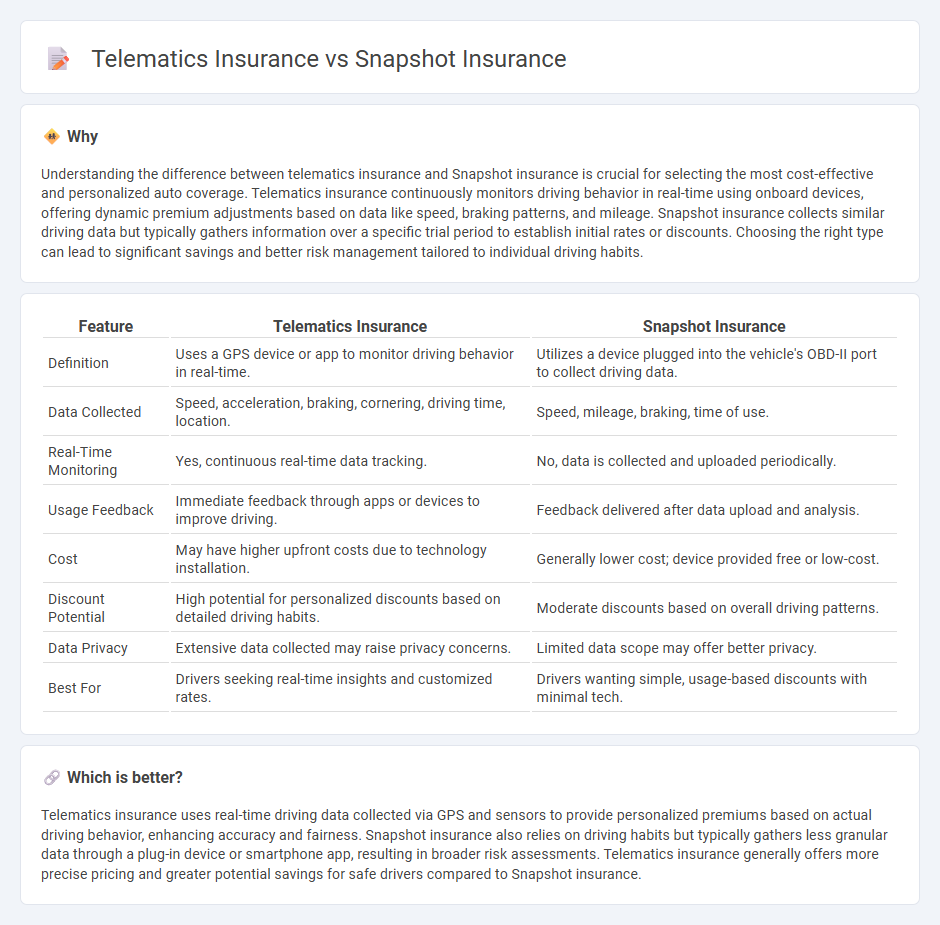

Understanding the difference between telematics insurance and Snapshot insurance is crucial for selecting the most cost-effective and personalized auto coverage. Telematics insurance continuously monitors driving behavior in real-time using onboard devices, offering dynamic premium adjustments based on data like speed, braking patterns, and mileage. Snapshot insurance collects similar driving data but typically gathers information over a specific trial period to establish initial rates or discounts. Choosing the right type can lead to significant savings and better risk management tailored to individual driving habits.

Comparison Table

| Feature | Telematics Insurance | Snapshot Insurance |

|---|---|---|

| Definition | Uses a GPS device or app to monitor driving behavior in real-time. | Utilizes a device plugged into the vehicle's OBD-II port to collect driving data. |

| Data Collected | Speed, acceleration, braking, cornering, driving time, location. | Speed, mileage, braking, time of use. |

| Real-Time Monitoring | Yes, continuous real-time data tracking. | No, data is collected and uploaded periodically. |

| Usage Feedback | Immediate feedback through apps or devices to improve driving. | Feedback delivered after data upload and analysis. |

| Cost | May have higher upfront costs due to technology installation. | Generally lower cost; device provided free or low-cost. |

| Discount Potential | High potential for personalized discounts based on detailed driving habits. | Moderate discounts based on overall driving patterns. |

| Data Privacy | Extensive data collected may raise privacy concerns. | Limited data scope may offer better privacy. |

| Best For | Drivers seeking real-time insights and customized rates. | Drivers wanting simple, usage-based discounts with minimal tech. |

Which is better?

Telematics insurance uses real-time driving data collected via GPS and sensors to provide personalized premiums based on actual driving behavior, enhancing accuracy and fairness. Snapshot insurance also relies on driving habits but typically gathers less granular data through a plug-in device or smartphone app, resulting in broader risk assessments. Telematics insurance generally offers more precise pricing and greater potential savings for safe drivers compared to Snapshot insurance.

Connection

Telematics insurance and Snapshot insurance both use real-time data collected from a vehicle to assess driver behavior and calculate personalized premiums. These usage-based insurance models monitor metrics such as speed, braking patterns, and mileage to reward safe driving with lower costs. By leveraging advanced telematics technology, Snapshot insurance is a specific implementation designed to offer customized rates based on individual driving habits.

Key Terms

Usage-Based Insurance (UBI)

Usage-Based Insurance (UBI) offers personalized auto coverage by utilizing telematics technology, which tracks real-time driving behavior like speed, mileage, and braking patterns for accurate risk assessment. Snapshot insurance, a popular form of UBI provided by companies like Progressive, employs a plug-in device or mobile app to monitor driving habits over a trial period, potentially lowering premiums for safe drivers. Explore how telematics and Snapshot insurance can optimize your policy and deliver tailored savings on car insurance.

Driving Behavior Monitoring

Snapshot insurance uses periodic data collection from a vehicle or smartphone to assess driving behavior, providing discounts based on overall risk profiles. Telematics insurance employs real-time, continuous monitoring through GPS and onboard diagnostics to analyze detailed metrics such as speed, acceleration, braking, and driving patterns. Explore how these technologies redefine personalized auto insurance and improve road safety by learning more about their features and benefits.

Data Collection Devices (e.g., Plug-In Device vs. Smartphone App)

Snapshot insurance utilizes plug-in devices installed directly into a vehicle's OBD-II port to gather precise driving metrics such as speed, braking patterns, and mileage, ensuring highly accurate data collection. Telematics insurance often employs smartphone apps that leverage GPS and accelerometer sensors to monitor driving behavior, offering convenience but potentially less consistent data due to phone placement and battery variability. Explore the detailed differences in these data collection methods to determine the most effective insurance solution for your driving profile.

Source and External Links

Progressive Snapshot Review 2025 - Progressive Snapshot is a usage-based insurance program offering discounts for safe driving, but may increase premiums for risky behavior.

Progressive Snapshot Review: How Does it Work? - This review explains how Progressive Snapshot works by tracking driving habits to potentially offer discounts or increases in insurance rates.

Snapshot Frequently Asked Questions - Provides answers to common questions about Progressive Snapshot, including how it affects insurance rates based on driving behavior.

dowidth.com

dowidth.com