Flood insurance integration focuses on mitigating property and asset damage caused by water-related disasters, providing financial protection for homeowners and businesses in flood-prone areas. Workers' compensation insurance integration addresses workplace injuries and related medical expenses, ensuring employee safety and legal compliance for employers. Explore the differences and benefits of integrating these insurance types to enhance your risk management strategy.

Why it is important

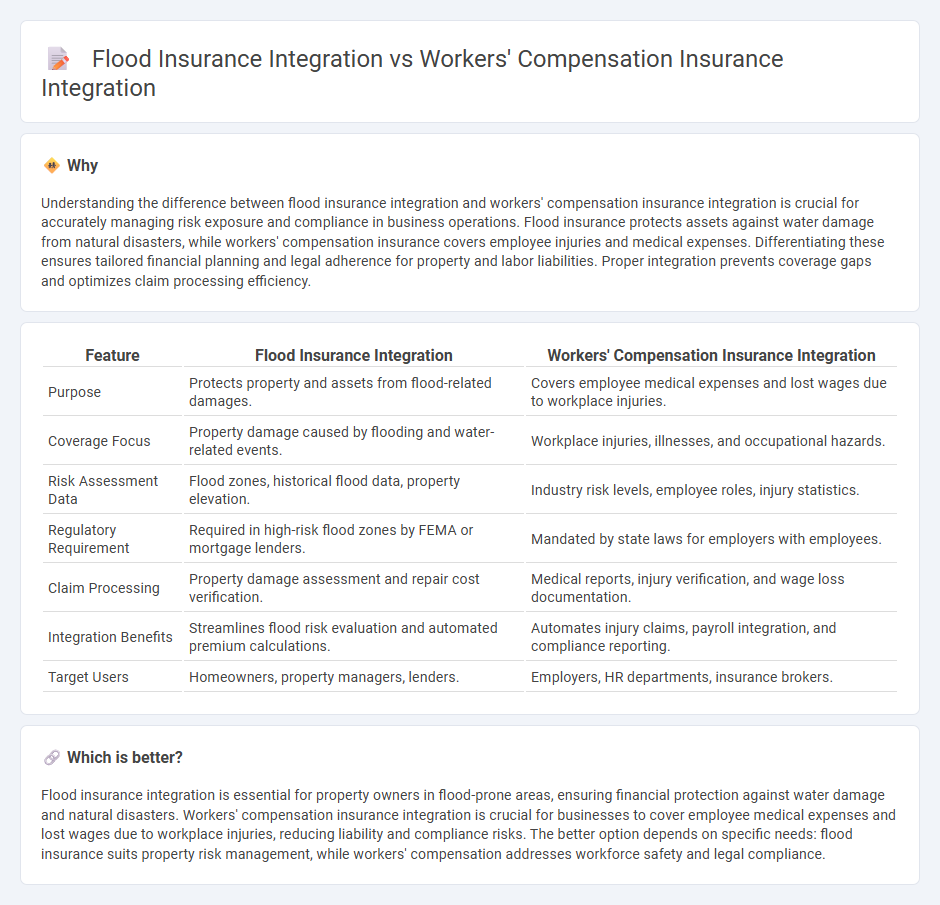

Understanding the difference between flood insurance integration and workers' compensation insurance integration is crucial for accurately managing risk exposure and compliance in business operations. Flood insurance protects assets against water damage from natural disasters, while workers' compensation insurance covers employee injuries and medical expenses. Differentiating these ensures tailored financial planning and legal adherence for property and labor liabilities. Proper integration prevents coverage gaps and optimizes claim processing efficiency.

Comparison Table

| Feature | Flood Insurance Integration | Workers' Compensation Insurance Integration |

|---|---|---|

| Purpose | Protects property and assets from flood-related damages. | Covers employee medical expenses and lost wages due to workplace injuries. |

| Coverage Focus | Property damage caused by flooding and water-related events. | Workplace injuries, illnesses, and occupational hazards. |

| Risk Assessment Data | Flood zones, historical flood data, property elevation. | Industry risk levels, employee roles, injury statistics. |

| Regulatory Requirement | Required in high-risk flood zones by FEMA or mortgage lenders. | Mandated by state laws for employers with employees. |

| Claim Processing | Property damage assessment and repair cost verification. | Medical reports, injury verification, and wage loss documentation. |

| Integration Benefits | Streamlines flood risk evaluation and automated premium calculations. | Automates injury claims, payroll integration, and compliance reporting. |

| Target Users | Homeowners, property managers, lenders. | Employers, HR departments, insurance brokers. |

Which is better?

Flood insurance integration is essential for property owners in flood-prone areas, ensuring financial protection against water damage and natural disasters. Workers' compensation insurance integration is crucial for businesses to cover employee medical expenses and lost wages due to workplace injuries, reducing liability and compliance risks. The better option depends on specific needs: flood insurance suits property risk management, while workers' compensation addresses workforce safety and legal compliance.

Connection

Flood insurance integration and workers' compensation insurance integration both enhance risk management by incorporating specialized coverage into broader insurance policies. Integrating these insurances streamlines claims processing and improves financial protection for businesses prone to natural disasters or workplace injuries. This connection ensures comprehensive coverage, reduces administrative costs, and supports regulatory compliance in industries with environmental and employee safety risks.

Key Terms

Coverage Coordination

Workers' compensation insurance integration focuses on seamless management of employee injury claims, ensuring benefits are handled efficiently without overlap from other policies. Flood insurance integration centers on coordinating coverage for property damage due to flooding, often requiring coordination with general property insurance to avoid gaps or duplication. Explore more about optimizing coverage coordination between these distinct insurance types to safeguard your risks effectively.

Benefit Offsets

Workers' compensation insurance integration typically involves Benefit Offsets that reduce workers' compensation payments by the amount received from other income sources, preventing overcompensation for work-related injuries. Flood insurance integration differs as it generally does not include Benefit Offsets, ensuring full coverage for property damage without reductions based on other benefits. Explore how these distinct approaches affect claims and coverage in different insurance frameworks.

Claims Administration

Workers' compensation insurance integration streamlines claims administration by automating employee injury reporting, tracking medical treatments, and managing indemnity payments, improving efficiency and reducing fraud. Flood insurance integration enhances claims processing by using real-time flood risk data, automated damage assessments, and accelerated payout workflows to address natural disaster impacts swiftly. Explore how tailored integration solutions optimize claims administration for diverse insurance types in greater detail.

Source and External Links

How to Integrate Your Workers' Compensation Insurance with Your Payroll Program - This article explains how integrating workers' compensation with payroll enhances payment accuracy and simplifies audits, improving overall cash flow management.

Workers' Compensation for Small Business: The Stress-Free Guide - This guide describes how Homebase integrates payroll data with workers' compensation policies to eliminate manual calculations and reduce errors in premium payments.

Workers' Comp Insurance for Small Business Made Easy - OnPay offers easy integration of workers' compensation insurance with payroll, providing automatic policy updates and streamlined compliance for small businesses.

dowidth.com

dowidth.com