Digital nomad insurance offers comprehensive health coverage tailored to travelers working remotely across multiple countries, including telemedicine and trip interruption benefits. Medical evacuation insurance specifically covers emergency transport to the nearest adequate medical facility, often essential in remote or high-risk locations. Explore the key differences and determine which insurance best suits your global lifestyle and safety needs.

Why it is important

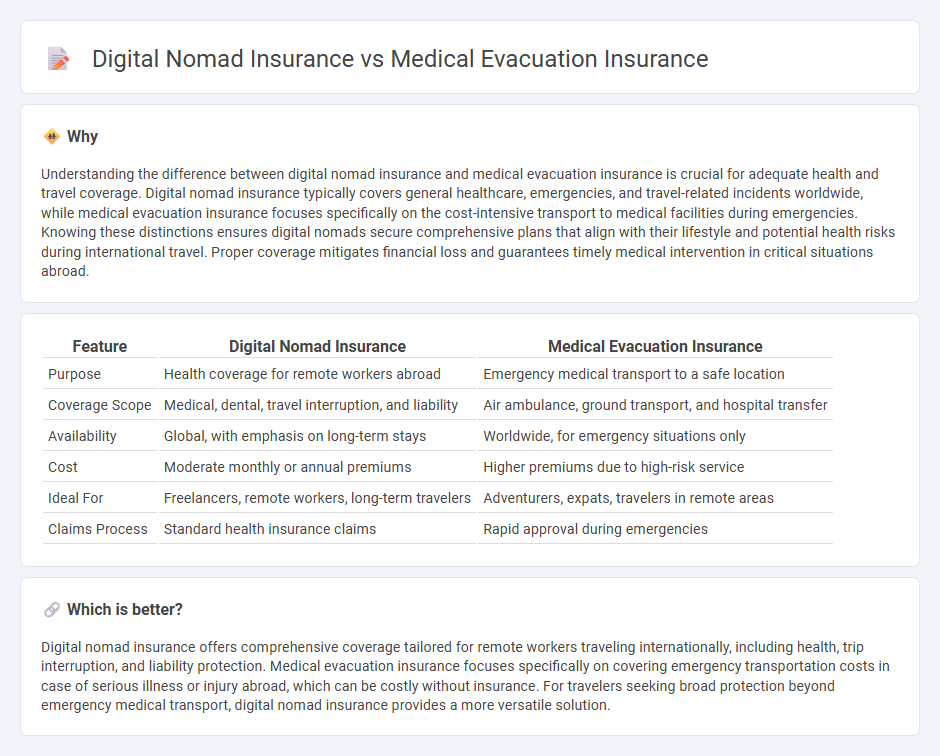

Understanding the difference between digital nomad insurance and medical evacuation insurance is crucial for adequate health and travel coverage. Digital nomad insurance typically covers general healthcare, emergencies, and travel-related incidents worldwide, while medical evacuation insurance focuses specifically on the cost-intensive transport to medical facilities during emergencies. Knowing these distinctions ensures digital nomads secure comprehensive plans that align with their lifestyle and potential health risks during international travel. Proper coverage mitigates financial loss and guarantees timely medical intervention in critical situations abroad.

Comparison Table

| Feature | Digital Nomad Insurance | Medical Evacuation Insurance |

|---|---|---|

| Purpose | Health coverage for remote workers abroad | Emergency medical transport to a safe location |

| Coverage Scope | Medical, dental, travel interruption, and liability | Air ambulance, ground transport, and hospital transfer |

| Availability | Global, with emphasis on long-term stays | Worldwide, for emergency situations only |

| Cost | Moderate monthly or annual premiums | Higher premiums due to high-risk service |

| Ideal For | Freelancers, remote workers, long-term travelers | Adventurers, expats, travelers in remote areas |

| Claims Process | Standard health insurance claims | Rapid approval during emergencies |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for remote workers traveling internationally, including health, trip interruption, and liability protection. Medical evacuation insurance focuses specifically on covering emergency transportation costs in case of serious illness or injury abroad, which can be costly without insurance. For travelers seeking broad protection beyond emergency medical transport, digital nomad insurance provides a more versatile solution.

Connection

Digital nomad insurance often includes medical evacuation insurance as a critical component to ensure global coverage for emergencies during international travel. Medical evacuation insurance provides financial protection for urgent medical transport to the nearest appropriate facility, an essential service for digital nomads who may face health risks far from their home country. Together, these insurances offer comprehensive health and safety support tailored to the mobility and unpredictability of a nomadic lifestyle.

Key Terms

**Medical Evacuation Insurance:**

Medical evacuation insurance primarily covers emergency transportation costs to the nearest adequate medical facility, crucial for serious injuries or illnesses occurring abroad. This specialized insurance often includes air ambulance services, ensuring rapid and safe evacuation during critical health incidents, which general digital nomad insurance may not fully cover. Explore more about how medical evacuation insurance safeguards your health during international travel and complements other coverage options.

Emergency Transport

Medical evacuation insurance specializes in covering emergency transport costs, ensuring swift and safe air or ground evacuation to the nearest adequate medical facility in critical situations. Digital nomad insurance, while often inclusive of medical evacuation, prioritizes broader health coverage tailored for remote workers living abroad, but may have limits or conditions for emergency transport. Explore detailed differences and coverage specifics to select the best insurance model for your travel and health safety needs.

Repatriation

Medical evacuation insurance specifically covers repatriation costs, ensuring transport to the home country for urgent medical treatment or end-of-life care. Digital nomad insurance often includes repatriation as part of broader travel and health coverage tailored for remote workers abroad. Explore detailed benefits and coverage options to choose the best repatriation solution for your needs.

Source and External Links

Medical Evacuation Insurance - an Overview of Medevac Plans - Medical evacuation insurance, or Medevac plans, cover emergency medical and security evacuations and repatriation for international travelers, typically costing about $200 annually or $45-$68 for single trips, and often include related benefits like emergency medical reunion and return of minor children.

Medical Evacuation Insurance: What to Know - NerdWallet - Medical evacuation insurance covers transportation costs like ambulance or airlift to the nearest adequate medical facility during travel and may be included in travel insurance plans, supplementing existing health insurance which often does not cover such transport abroad.

Travel Medical Expense Travel Insurance Plans | Our Benefits - Travel Guard's MedEvac Plan offers medical coverage and air evacuation services to the nearest adequate medical facility and potentially home, providing coverage from short trips to year-long travel along with emergency medical expenses often not covered by health insurance.

dowidth.com

dowidth.com