Social prescribing insurance covers holistic health approaches by supporting non-medical interventions such as community activities and wellness programs, aiming to improve overall well-being. Cancer insurance specifically provides financial protection against expenses related to cancer diagnosis and treatment, including chemotherapy, hospitalization, and medications. Learn more to understand which insurance best suits your health and financial needs.

Why it is important

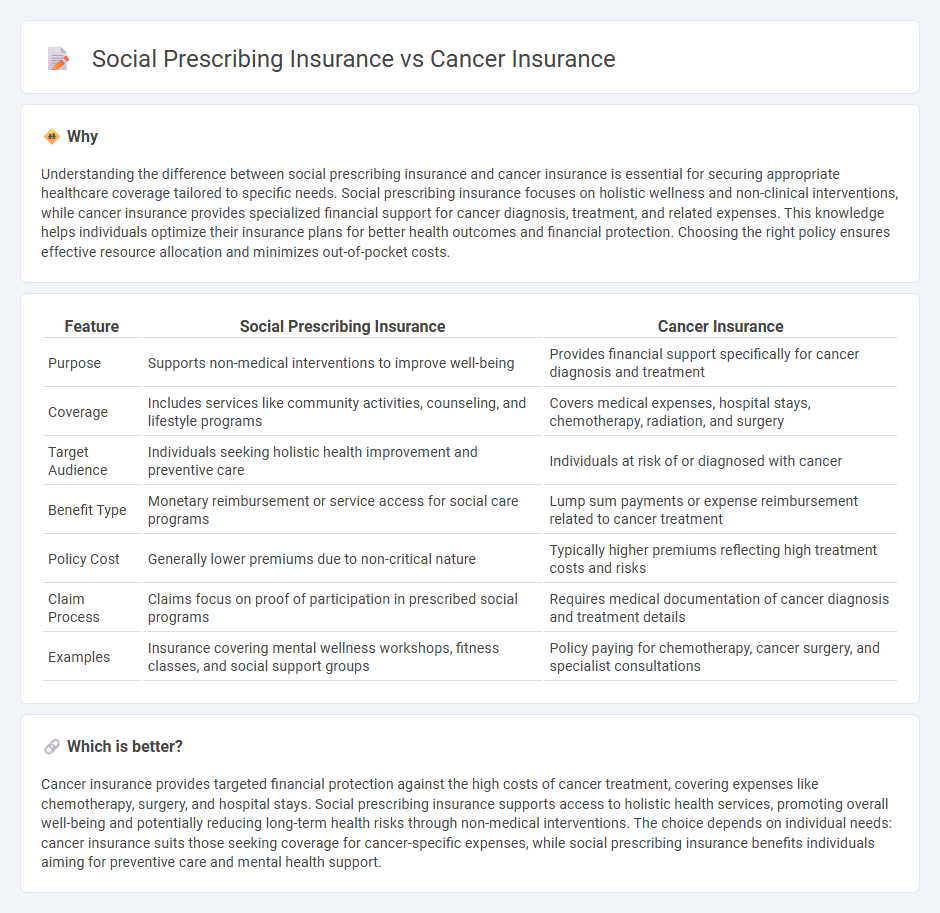

Understanding the difference between social prescribing insurance and cancer insurance is essential for securing appropriate healthcare coverage tailored to specific needs. Social prescribing insurance focuses on holistic wellness and non-clinical interventions, while cancer insurance provides specialized financial support for cancer diagnosis, treatment, and related expenses. This knowledge helps individuals optimize their insurance plans for better health outcomes and financial protection. Choosing the right policy ensures effective resource allocation and minimizes out-of-pocket costs.

Comparison Table

| Feature | Social Prescribing Insurance | Cancer Insurance |

|---|---|---|

| Purpose | Supports non-medical interventions to improve well-being | Provides financial support specifically for cancer diagnosis and treatment |

| Coverage | Includes services like community activities, counseling, and lifestyle programs | Covers medical expenses, hospital stays, chemotherapy, radiation, and surgery |

| Target Audience | Individuals seeking holistic health improvement and preventive care | Individuals at risk of or diagnosed with cancer |

| Benefit Type | Monetary reimbursement or service access for social care programs | Lump sum payments or expense reimbursement related to cancer treatment |

| Policy Cost | Generally lower premiums due to non-critical nature | Typically higher premiums reflecting high treatment costs and risks |

| Claim Process | Claims focus on proof of participation in prescribed social programs | Requires medical documentation of cancer diagnosis and treatment details |

| Examples | Insurance covering mental wellness workshops, fitness classes, and social support groups | Policy paying for chemotherapy, cancer surgery, and specialist consultations |

Which is better?

Cancer insurance provides targeted financial protection against the high costs of cancer treatment, covering expenses like chemotherapy, surgery, and hospital stays. Social prescribing insurance supports access to holistic health services, promoting overall well-being and potentially reducing long-term health risks through non-medical interventions. The choice depends on individual needs: cancer insurance suits those seeking coverage for cancer-specific expenses, while social prescribing insurance benefits individuals aiming for preventive care and mental health support.

Connection

Social prescribing insurance supports holistic patient care by covering non-medical interventions that improve mental and physical health, which can enhance the overall well-being of cancer patients. Cancer insurance offers specialized financial protection against the high costs of cancer treatment, enabling access to necessary therapies and social support services recommended through social prescribing. Integrating both insurance types helps reduce the emotional and financial burdens on cancer patients by promoting comprehensive care and financial security.

Key Terms

Cancer insurance:

Cancer insurance provides specialized financial protection that covers medical expenses, treatments, and hospitalization costs specifically related to cancer diagnosis and care. It offers policyholders a crucial safety net to manage high out-of-pocket expenses inherent in cancer treatment, such as chemotherapy, radiation, and surgery. Explore detailed cancer insurance options and benefits tailored to meet your individual healthcare needs.

Critical Illness Benefit

Cancer insurance offers targeted coverage for cancer treatments, ensuring financial support during diagnosis, surgery, chemotherapy, and radiation therapy. Social prescribing insurance, on the other hand, integrates holistic care by covering non-medical interventions like counseling and community activities to improve overall well-being alongside critical illness benefits. Explore how these insurance types optimize critical illness support with comprehensive benefits tailored to your health needs.

Lump Sum Payout

Cancer insurance provides a lump sum payout specifically upon a cancer diagnosis, offering financial support for treatment and recovery costs. Social prescribing insurance may include coverage for broader health and wellness services but typically does not offer a lump sum payout for specific conditions. Explore detailed comparisons to understand which option best suits your healthcare financing needs.

Source and External Links

Cancer Insurance Program - PSPRS - This program offers active and retired firefighters and peace officers benefits and reimbursements for cancer diagnosis and treatments, with specific limits on payments for diagnosis, treatment, testing, and other related care up to $100,000 lifetime maximum.

Lump Sum Cancer Insurance | Cigna Healthcare - Cigna offers a supplemental cancer insurance policy providing a lump sum cash benefit upon diagnosis, which can range from $5,000 to $100,000 and be used to cover medical costs and daily expenses, with premiums starting around $19/month.

What Is Cancer Insurance? - MetLife - Cancer insurance is a supplemental policy that pays a lump sum directly to the insured to help with medical and non-medical expenses related to cancer treatment, designed to reduce financial stress during recovery; coverage details and waiting periods vary by policy.

dowidth.com

dowidth.com