Peer-to-peer insurance leverages group risk-sharing among individuals to reduce costs and increase transparency, contrasting with self-insurance where individuals or entities retain financial responsibility for potential losses. This emerging model disrupts traditional insurance by promoting community trust and lower premiums, while self-insurance offers control and direct risk management tailored to specific needs. Explore the advantages and challenges of each approach to determine the best risk management strategy for your situation.

Why it is important

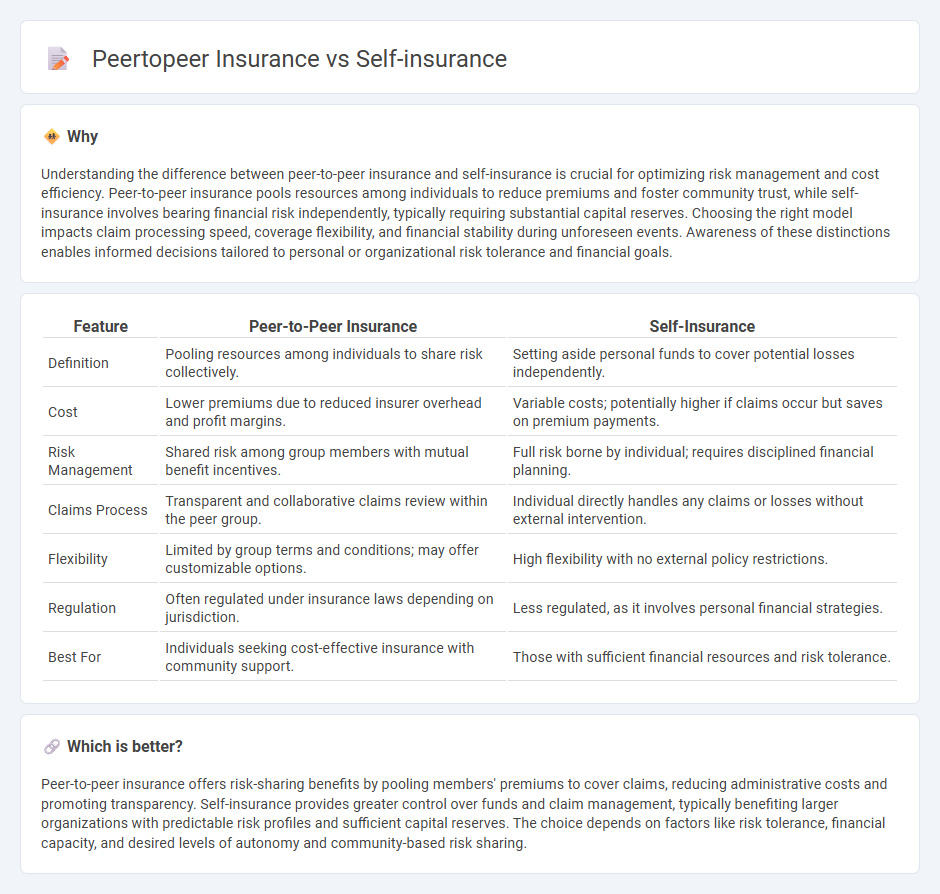

Understanding the difference between peer-to-peer insurance and self-insurance is crucial for optimizing risk management and cost efficiency. Peer-to-peer insurance pools resources among individuals to reduce premiums and foster community trust, while self-insurance involves bearing financial risk independently, typically requiring substantial capital reserves. Choosing the right model impacts claim processing speed, coverage flexibility, and financial stability during unforeseen events. Awareness of these distinctions enables informed decisions tailored to personal or organizational risk tolerance and financial goals.

Comparison Table

| Feature | Peer-to-Peer Insurance | Self-Insurance |

|---|---|---|

| Definition | Pooling resources among individuals to share risk collectively. | Setting aside personal funds to cover potential losses independently. |

| Cost | Lower premiums due to reduced insurer overhead and profit margins. | Variable costs; potentially higher if claims occur but saves on premium payments. |

| Risk Management | Shared risk among group members with mutual benefit incentives. | Full risk borne by individual; requires disciplined financial planning. |

| Claims Process | Transparent and collaborative claims review within the peer group. | Individual directly handles any claims or losses without external intervention. |

| Flexibility | Limited by group terms and conditions; may offer customizable options. | High flexibility with no external policy restrictions. |

| Regulation | Often regulated under insurance laws depending on jurisdiction. | Less regulated, as it involves personal financial strategies. |

| Best For | Individuals seeking cost-effective insurance with community support. | Those with sufficient financial resources and risk tolerance. |

Which is better?

Peer-to-peer insurance offers risk-sharing benefits by pooling members' premiums to cover claims, reducing administrative costs and promoting transparency. Self-insurance provides greater control over funds and claim management, typically benefiting larger organizations with predictable risk profiles and sufficient capital reserves. The choice depends on factors like risk tolerance, financial capacity, and desired levels of autonomy and community-based risk sharing.

Connection

Peer-to-peer insurance and self-insurance both revolve around risk management without relying heavily on traditional insurance companies. Peer-to-peer insurance pools funds among a group of individuals to cover claims collectively, closely mirroring the concept of self-insurance where an individual or organization sets aside resources to cover their own potential losses. Both models emphasize greater control over funds, cost transparency, and reduced administrative expenses compared to conventional insurance policies.

Key Terms

Risk Pooling

Self-insurance involves individuals or organizations retaining risk by setting aside funds to cover potential losses rather than transferring them to an insurer. Peer-to-peer insurance leverages risk pooling by grouping members who share risks collectively, reducing costs and enhancing transparency through mutual coverage. Discover the key differences in risk management strategies between self-insurance and peer-to-peer models to optimize your financial protection.

Claims Management

Self-insurance empowers organizations to handle claims management internally, offering direct control over claim processing, cost containment, and customized risk strategies. Peer-to-peer insurance distributes claims among a community of members, fostering transparency and reducing fraudulent activities through collective accountability and shared risk pools. Explore detailed insights on how claims management differs between these innovative insurance models for optimized risk handling.

Capital Reserve

Self-insurance involves an individual or organization setting aside a dedicated capital reserve to cover potential losses, providing direct control over fund allocation and risk management. Peer-to-peer insurance pools capital reserves from a group of participants, distributing risk collectively while reducing dependency on traditional insurers. Explore the benefits and challenges of each model to understand which capital reserve strategy aligns best with your financial goals.

Source and External Links

Self-insurance - Wikipedia - Self-insurance is a risk management method where an organization retains the risk itself rather than buying third-party insurance, setting aside funds to cover potential losses and often achieving cost savings compared to commercial insurance premiums.

SIP - Overview and Requirements for Becoming Self-Insured - Employers wishing to self-insure their workers' compensation liabilities must apply for state approval, demonstrating financial strength, audited financial statements, and credit rating among other criteria.

What Is the Difference between Self-Insurance and Captive Insurance? - Self-insurance involves retaining risk and funding future losses from set-aside money, improving profits by reducing premiums and providing control over claims and data not always available with commercial insurance.

dowidth.com

dowidth.com