Pay per mile insurance charges policyholders based on the number of miles driven, making it cost-effective for low-mileage drivers, while short-term car insurance offers flexible coverage for brief periods, ideal for temporary vehicle use. Each option addresses specific driving habits and insurance needs, with pay per mile focusing on long-term savings and short-term insurance providing immediate, short-duration protection. Explore which type best suits your driving patterns and coverage requirements.

Why it is important

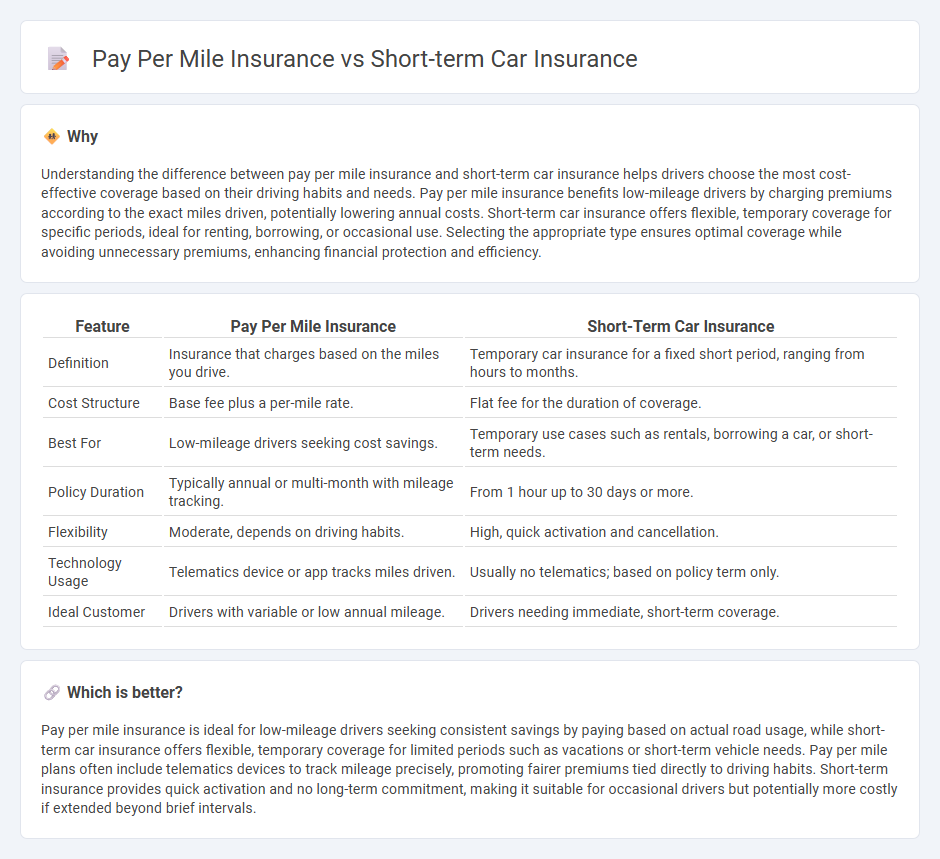

Understanding the difference between pay per mile insurance and short-term car insurance helps drivers choose the most cost-effective coverage based on their driving habits and needs. Pay per mile insurance benefits low-mileage drivers by charging premiums according to the exact miles driven, potentially lowering annual costs. Short-term car insurance offers flexible, temporary coverage for specific periods, ideal for renting, borrowing, or occasional use. Selecting the appropriate type ensures optimal coverage while avoiding unnecessary premiums, enhancing financial protection and efficiency.

Comparison Table

| Feature | Pay Per Mile Insurance | Short-Term Car Insurance |

|---|---|---|

| Definition | Insurance that charges based on the miles you drive. | Temporary car insurance for a fixed short period, ranging from hours to months. |

| Cost Structure | Base fee plus a per-mile rate. | Flat fee for the duration of coverage. |

| Best For | Low-mileage drivers seeking cost savings. | Temporary use cases such as rentals, borrowing a car, or short-term needs. |

| Policy Duration | Typically annual or multi-month with mileage tracking. | From 1 hour up to 30 days or more. |

| Flexibility | Moderate, depends on driving habits. | High, quick activation and cancellation. |

| Technology Usage | Telematics device or app tracks miles driven. | Usually no telematics; based on policy term only. |

| Ideal Customer | Drivers with variable or low annual mileage. | Drivers needing immediate, short-term coverage. |

Which is better?

Pay per mile insurance is ideal for low-mileage drivers seeking consistent savings by paying based on actual road usage, while short-term car insurance offers flexible, temporary coverage for limited periods such as vacations or short-term vehicle needs. Pay per mile plans often include telematics devices to track mileage precisely, promoting fairer premiums tied directly to driving habits. Short-term insurance provides quick activation and no long-term commitment, making it suitable for occasional drivers but potentially more costly if extended beyond brief intervals.

Connection

Pay per mile insurance and short-term car insurance both offer flexible coverage options tailored to specific driving needs, making them cost-effective for infrequent or temporary drivers. Pay per mile insurance charges premiums based on the actual miles driven, while short-term car insurance provides coverage for a limited duration, often from one day up to a few months. Both models are designed to optimize affordability by aligning insurance costs directly with usage and time, appealing to occasional drivers, rental situations, or temporary vehicle needs.

Key Terms

Coverage Duration

Short-term car insurance typically offers coverage for periods ranging from one day to a few months, ideal for temporary needs such as vacations, car rentals, or occasional use. Pay per mile insurance charges drivers based on actual miles driven, providing a flexible option for low-mileage drivers with ongoing coverage. Explore the benefits and choose the best plan tailored to your driving habits.

Mileage Tracking

Short-term car insurance offers coverage for a fixed period, typically without detailed mileage monitoring, while pay-per-mile insurance relies heavily on precise mileage tracking to calculate premiums based on actual usage, often using telematics devices or smartphone apps. Pay-per-mile insurance benefits infrequent drivers with cost-effective rates tied to minimal mileage, promoting safe driving habits and reducing overall expenses. Explore more to understand which mileage tracking model best suits your driving pattern and budget.

Premium Calculation

Short-term car insurance premiums are calculated based on the policy duration, vehicle type, driver's age, and driving history, resulting in a fixed cost for the coverage period. Pay per mile insurance determines premiums primarily by the number of miles driven, combined with base rates and risk factors like vehicle usage and location. Explore detailed comparisons to determine which premium model best suits your driving needs and budget.

Source and External Links

Temporary Car Insurance in New York | Bankrate - Short-term car insurance in New York covers drivers for a day, week, or month, and is often used when renting, borrowing, or storing a vehicle, though availability and policy lengths vary by insurer.

Compare Cheap Temporary Car Insurance Quotes - Short-term car insurance typically lasts from one to 28 days (sometimes up to 84 days), is more expensive per day than annual policies, and is useful for new car purchases, learner drivers, or occasional business use.

Temporary Car Insurance - Insurance Navy Brokers - Temporary car insurance offers flexible, comprehensive coverage for short-term needs like borrowing a car or holiday driving, but daily rates are higher and gaps in coverage may occur if not carefully managed.

dowidth.com

dowidth.com