Pay-as-you-drive insurance calculates premiums based on actual miles driven, offering cost-effective coverage for low-mileage drivers by linking rates to driving behavior and distance. Named driver insurance restricts coverage to specified individuals, providing tailored protection based on the driving history of those listed on the policy. Explore the benefits and differences between these insurance types to find the best fit for your driving needs.

Why it is important

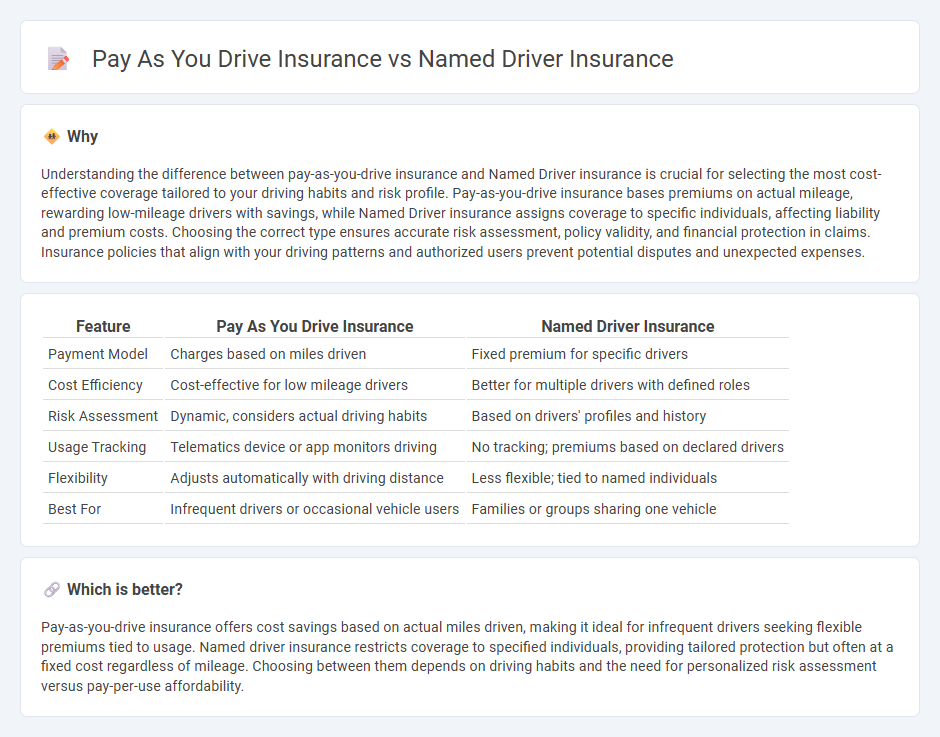

Understanding the difference between pay-as-you-drive insurance and Named Driver insurance is crucial for selecting the most cost-effective coverage tailored to your driving habits and risk profile. Pay-as-you-drive insurance bases premiums on actual mileage, rewarding low-mileage drivers with savings, while Named Driver insurance assigns coverage to specific individuals, affecting liability and premium costs. Choosing the correct type ensures accurate risk assessment, policy validity, and financial protection in claims. Insurance policies that align with your driving patterns and authorized users prevent potential disputes and unexpected expenses.

Comparison Table

| Feature | Pay As You Drive Insurance | Named Driver Insurance |

|---|---|---|

| Payment Model | Charges based on miles driven | Fixed premium for specific drivers |

| Cost Efficiency | Cost-effective for low mileage drivers | Better for multiple drivers with defined roles |

| Risk Assessment | Dynamic, considers actual driving habits | Based on drivers' profiles and history |

| Usage Tracking | Telematics device or app monitors driving | No tracking; premiums based on declared drivers |

| Flexibility | Adjusts automatically with driving distance | Less flexible; tied to named individuals |

| Best For | Infrequent drivers or occasional vehicle users | Families or groups sharing one vehicle |

Which is better?

Pay-as-you-drive insurance offers cost savings based on actual miles driven, making it ideal for infrequent drivers seeking flexible premiums tied to usage. Named driver insurance restricts coverage to specified individuals, providing tailored protection but often at a fixed cost regardless of mileage. Choosing between them depends on driving habits and the need for personalized risk assessment versus pay-per-use affordability.

Connection

Pay-as-you-drive insurance calculates premiums based on actual mileage, rewarding low-mileage drivers with cost savings, while named driver insurance allows policyholders to specify who is covered under the policy. Both insurance types focus on personalized risk assessment by limiting coverage to specific drivers or driving habits, enhancing affordability and customization. By combining these approaches, insurers offer tailored premiums that reflect individual usage patterns and driver profiles.

Key Terms

Policyholder

Named driver insurance restricts coverage to specific individuals listed on the policy, ensuring precise risk assessment based on their driving history and behavior. Pay as you drive insurance charges premiums according to actual mileage and driving habits, offering dynamic cost savings for low-mileage drivers. Explore detailed comparisons to determine which policyholder-focused insurance suits your driving patterns best.

Mileage Tracking

Named driver insurance assigns coverage to specific drivers, ensuring tailored premiums based on individual driving habits, while pay as you drive insurance directly monitors real-time mileage through telematics devices or smartphone apps for precise cost calculation. Mileage tracking in pay as you drive insurance provides accurate usage data, giving policyholders the advantage of paying strictly for the miles they travel, contrasting with the fixed premiums in named driver plans. Explore the nuances of mileage tracking to determine which insurance model aligns best with your driving patterns and cost preferences.

Named Driver

Named driver insurance assigns coverage exclusively to specified individuals, ensuring tailored risk assessment and potentially lower premiums for low-risk drivers. Unlike pay as you drive insurance, which charges based on actual mileage and driving behavior, named driver policies focus on who drives rather than how much they drive. Discover more about how named driver insurance can offer personalized protection and cost savings.

Source and External Links

What is a Named Driver Policy? - This article explains that a named driver policy only covers drivers listed on the policy, unlike standard insurance policies which may include permissive use clauses.

Named Drivers - Discusses how adding named drivers can affect insurance premiums and the main driver's accountability in the event of an accident.

What is a Named Driver? - Explains how named drivers are added to insurance policies and how they can impact premiums based on their driving experience and history.

dowidth.com

dowidth.com