Credit life insurance specifically covers outstanding loan balances in case of the policyholder's death, ensuring debts are cleared without burdening beneficiaries, whereas whole life insurance provides lifelong coverage with an investment component that builds cash value over time. The former typically has lower premiums tied to the loan amount, while whole life premiums remain consistent and offer benefits beyond debt repayment. Explore the differences further to determine which insurance type aligns best with your financial goals.

Why it is important

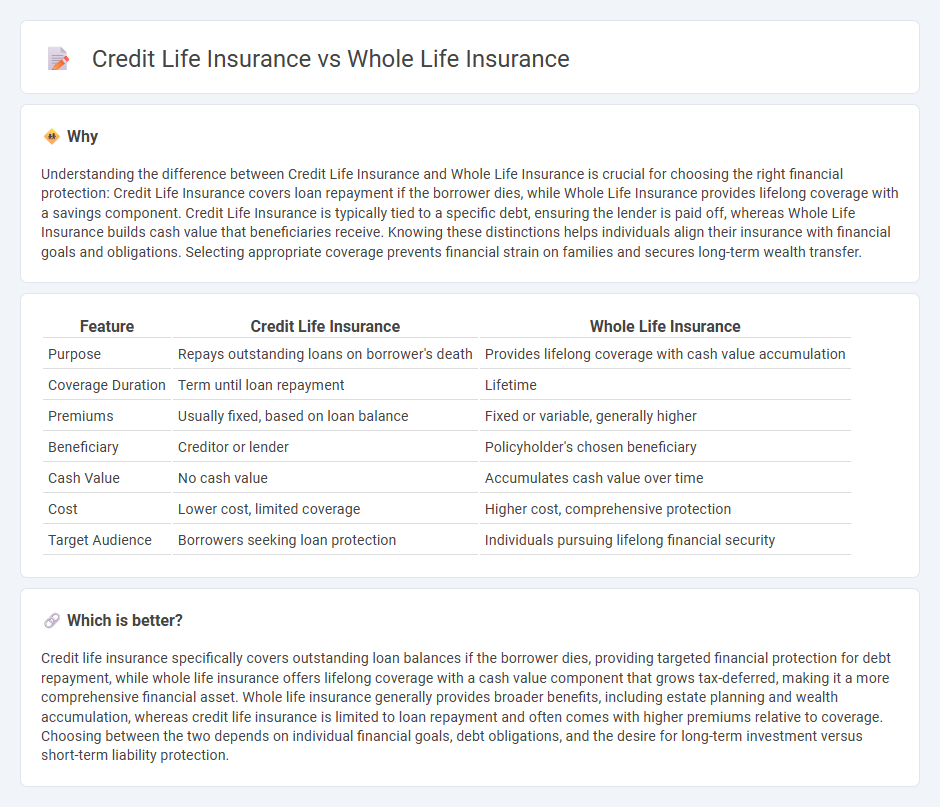

Understanding the difference between Credit Life Insurance and Whole Life Insurance is crucial for choosing the right financial protection: Credit Life Insurance covers loan repayment if the borrower dies, while Whole Life Insurance provides lifelong coverage with a savings component. Credit Life Insurance is typically tied to a specific debt, ensuring the lender is paid off, whereas Whole Life Insurance builds cash value that beneficiaries receive. Knowing these distinctions helps individuals align their insurance with financial goals and obligations. Selecting appropriate coverage prevents financial strain on families and secures long-term wealth transfer.

Comparison Table

| Feature | Credit Life Insurance | Whole Life Insurance |

|---|---|---|

| Purpose | Repays outstanding loans on borrower's death | Provides lifelong coverage with cash value accumulation |

| Coverage Duration | Term until loan repayment | Lifetime |

| Premiums | Usually fixed, based on loan balance | Fixed or variable, generally higher |

| Beneficiary | Creditor or lender | Policyholder's chosen beneficiary |

| Cash Value | No cash value | Accumulates cash value over time |

| Cost | Lower cost, limited coverage | Higher cost, comprehensive protection |

| Target Audience | Borrowers seeking loan protection | Individuals pursuing lifelong financial security |

Which is better?

Credit life insurance specifically covers outstanding loan balances if the borrower dies, providing targeted financial protection for debt repayment, while whole life insurance offers lifelong coverage with a cash value component that grows tax-deferred, making it a more comprehensive financial asset. Whole life insurance generally provides broader benefits, including estate planning and wealth accumulation, whereas credit life insurance is limited to loan repayment and often comes with higher premiums relative to coverage. Choosing between the two depends on individual financial goals, debt obligations, and the desire for long-term investment versus short-term liability protection.

Connection

Credit life insurance and whole life insurance both provide financial protection, but credit life insurance specifically covers loan repayment in the event of the borrower's death, ensuring debts are settled. Whole life insurance offers lifelong coverage with a cash value component that grows over time and can be accessed during the policyholder's lifetime. Both types share the underlying principle of safeguarding financial obligations and providing peace of mind for policyholders and their beneficiaries.

Key Terms

Cash Value

Whole life insurance builds cash value over time through fixed premiums and guaranteed interest, providing a lifelong coverage and a savings component that policyholders can borrow against or use to pay premiums. Credit life insurance, designed specifically to cover outstanding loan balances, typically lacks cash value accumulation and expires when the debt is fully repaid or the term ends. Explore more about how cash value impacts financial planning and insurance benefits.

Beneficiary

Whole life insurance names a specific beneficiary who receives the death benefit, providing long-term coverage and guaranteed cash value accumulation. Credit life insurance typically designates the lender as the beneficiary, ensuring the outstanding loan balance is paid off upon the policyholder's death. Explore more to understand which beneficiary arrangement best suits your financial protection needs.

Debt Coverage

Whole life insurance provides lifelong coverage with a cash value component that can be accessed during the policyholder's lifetime, offering a comprehensive debt protection strategy. Credit life insurance specifically covers outstanding debt, typically paying off loans or credit balances if the insured passes away, but it does not build cash value or offer broader financial benefits. Explore in-depth comparisons to determine which policy best suits your debt coverage needs.

Source and External Links

Whole Life Insurance - A whole life insurance policy provides lifelong coverage with guaranteed death benefits, fixed premiums, and a cash value component that grows tax-deferred over time.

What Is Whole Life Insurance? - Whole life insurance is a permanent policy with fixed premiums and death benefits, plus a savings component allowing cash withdrawals or loans, offering financial stability and peace of mind.

Whole Life Insurance - This permanent insurance guarantees lifelong protection, fixed premiums, cash value growth, and potential dividends, which can be used for expenses like tuition or retirement income.

dowidth.com

dowidth.com