Cyber risk underwriting focuses on assessing and managing exposures related to digital threats such as data breaches, ransomware attacks, and system vulnerabilities. Directors and Officers (D&O) underwriting evaluates the risks associated with legal actions against company executives for alleged wrongful acts in managing the organization. Explore how these distinct underwriting approaches protect businesses from evolving liabilities.

Why it is important

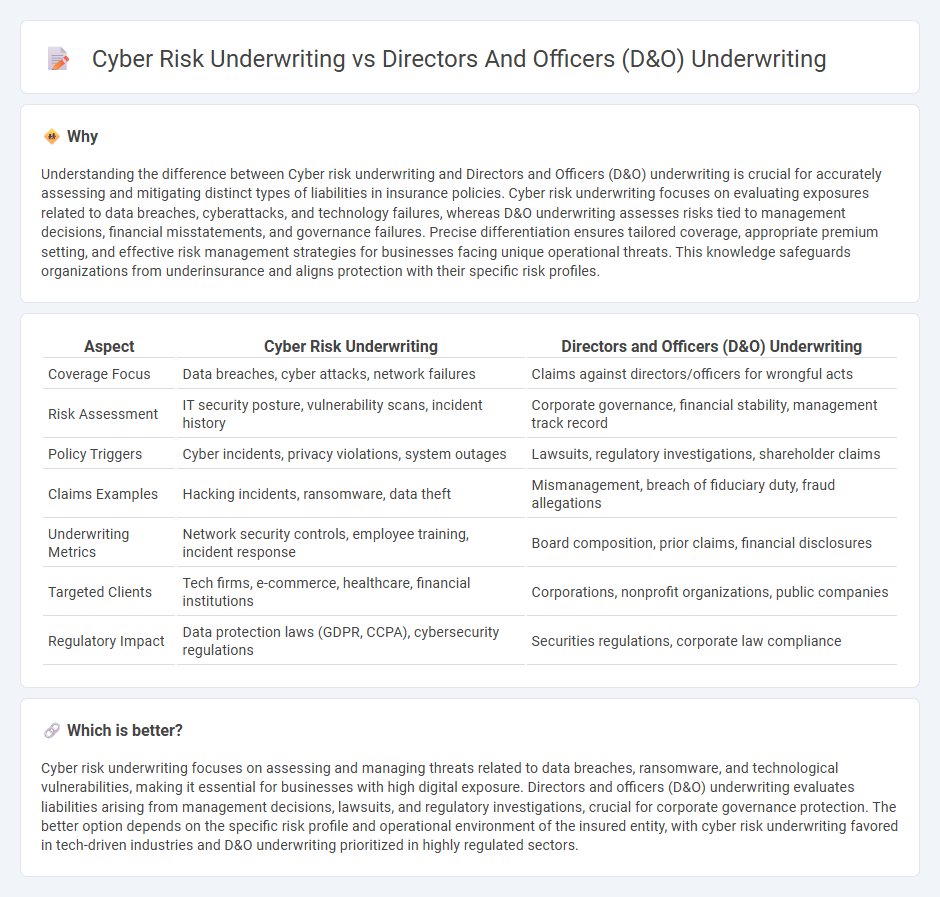

Understanding the difference between Cyber risk underwriting and Directors and Officers (D&O) underwriting is crucial for accurately assessing and mitigating distinct types of liabilities in insurance policies. Cyber risk underwriting focuses on evaluating exposures related to data breaches, cyberattacks, and technology failures, whereas D&O underwriting assesses risks tied to management decisions, financial misstatements, and governance failures. Precise differentiation ensures tailored coverage, appropriate premium setting, and effective risk management strategies for businesses facing unique operational threats. This knowledge safeguards organizations from underinsurance and aligns protection with their specific risk profiles.

Comparison Table

| Aspect | Cyber Risk Underwriting | Directors and Officers (D&O) Underwriting |

|---|---|---|

| Coverage Focus | Data breaches, cyber attacks, network failures | Claims against directors/officers for wrongful acts |

| Risk Assessment | IT security posture, vulnerability scans, incident history | Corporate governance, financial stability, management track record |

| Policy Triggers | Cyber incidents, privacy violations, system outages | Lawsuits, regulatory investigations, shareholder claims |

| Claims Examples | Hacking incidents, ransomware, data theft | Mismanagement, breach of fiduciary duty, fraud allegations |

| Underwriting Metrics | Network security controls, employee training, incident response | Board composition, prior claims, financial disclosures |

| Targeted Clients | Tech firms, e-commerce, healthcare, financial institutions | Corporations, nonprofit organizations, public companies |

| Regulatory Impact | Data protection laws (GDPR, CCPA), cybersecurity regulations | Securities regulations, corporate law compliance |

Which is better?

Cyber risk underwriting focuses on assessing and managing threats related to data breaches, ransomware, and technological vulnerabilities, making it essential for businesses with high digital exposure. Directors and officers (D&O) underwriting evaluates liabilities arising from management decisions, lawsuits, and regulatory investigations, crucial for corporate governance protection. The better option depends on the specific risk profile and operational environment of the insured entity, with cyber risk underwriting favored in tech-driven industries and D&O underwriting prioritized in highly regulated sectors.

Connection

Cyber risk underwriting and Directors and Officers (D&O) underwriting intersect through the evaluation of liability exposures arising from cybersecurity failures and governance decisions. Underwriters assess potential financial losses from data breaches, regulatory investigations, and shareholder lawsuits linked to directors' oversight of cyber risk management. Integrating cyber risk insights into D&O underwriting enhances risk assessment accuracy and supports tailored insurance coverage for executives facing cyber-related claims.

Key Terms

**Directors and Officers (D&O) Underwriting:**

Directors and Officers (D&O) underwriting involves evaluating risks linked to the personal liability of corporate leaders for decisions that impact shareholder value, regulatory compliance, and company reputation. Key factors assessed include the company's industry sector, financial stability, governance practices, and history of securities litigation or regulatory investigations. Discover how D&O underwriting strategies protect executives and firms from complex legal and financial exposures by exploring in-depth risk assessment criteria.

Fiduciary Duty

Directors and officers (D&O) underwriting primarily centers on evaluating fiduciary duty breaches, such as mismanagement or failure to act in shareholders' best interests, which can lead to significant financial and reputational damages. Cyber risk underwriting focuses on assessing vulnerabilities related to data breaches, ransomware, and system failures that may compromise organizational security and compliance, indirectly impacting fiduciary responsibilities. Explore the key distinctions and overlaps between D&O and cyber risk underwriting to better understand their impact on fiduciary duty protection.

Securities Claims

Directors and officers (D&O) underwriting centers on assessing exposure to securities claims stemming from alleged breaches of fiduciary duties, misstatements, or omissions affecting shareholders, with emphasis on company disclosures and governance quality. Cyber risk underwriting addresses threats related to data breaches and cyberattacks that can trigger securities claims when mismanagement or inadequate cybersecurity practices impact shareholder value. Explore the nuanced differences in risk evaluation and mitigation strategies between D&O and cyber underwriting for a comprehensive understanding of securities claims exposure.

Source and External Links

Directors and Officers' Insurance: What Are the Sides A, B and C ... - D&O underwriting involves coverage split into three sides (A, B, and C) protecting directors, officers, and the company itself against legal claims based on alleged wrongful acts or breaches of duties, with insurers assessing the specific risk exposure related to each side.

What is D&O insurance? Learn more here | Allianz Commercial - Underwriting of D&O insurance focuses on protecting executives and board members from legal claims arising from their decisions, with coverage applying to current, past, and future directors and officers for acts committed while in their positions.

directors and officers (D&O) liability insurance - IRMI - D&O underwriting assesses claims-made liability coverage that protects directors and officers against personal losses and legal fees for claims related to alleged wrongful acts during their service on boards or as officers.

dowidth.com

dowidth.com