Flood risk mapping uses spatial data and historical flood patterns to identify areas vulnerable to flooding, helping insurers assess localized risks and potential damages. Catastrophe modeling combines multiple hazard scenarios, including flood, earthquake, and hurricane events, with probabilistic analysis to estimate overall financial impact on insurance portfolios. Explore further to understand how these tools improve risk management and underwriting precision.

Why it is important

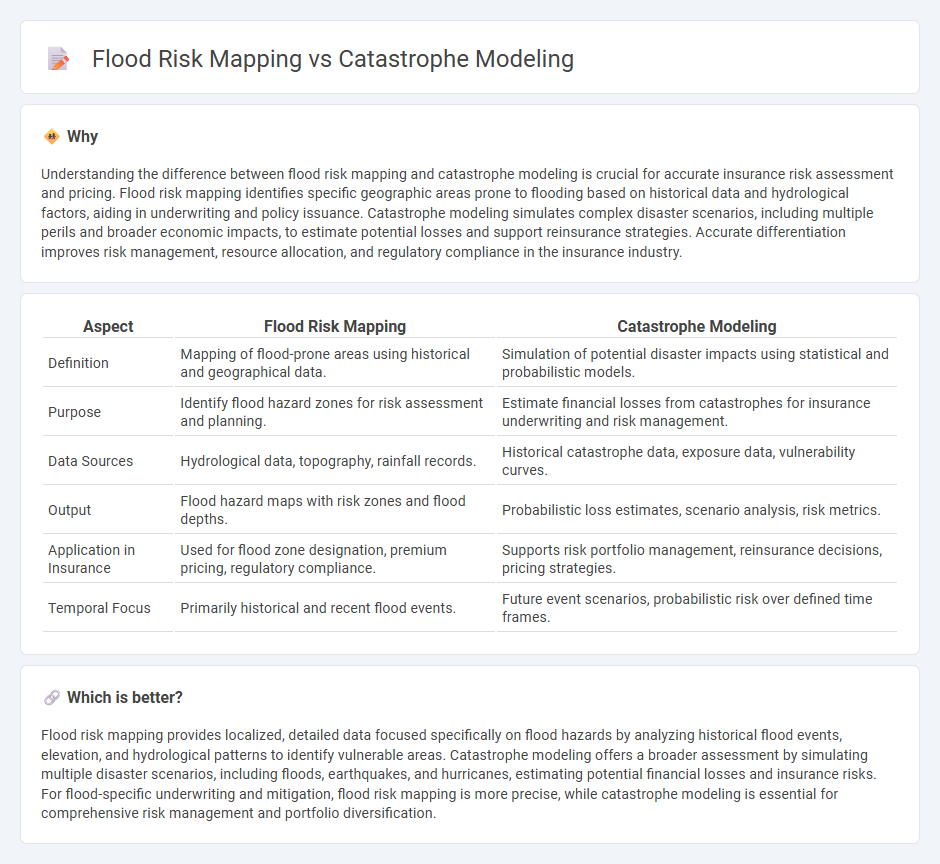

Understanding the difference between flood risk mapping and catastrophe modeling is crucial for accurate insurance risk assessment and pricing. Flood risk mapping identifies specific geographic areas prone to flooding based on historical data and hydrological factors, aiding in underwriting and policy issuance. Catastrophe modeling simulates complex disaster scenarios, including multiple perils and broader economic impacts, to estimate potential losses and support reinsurance strategies. Accurate differentiation improves risk management, resource allocation, and regulatory compliance in the insurance industry.

Comparison Table

| Aspect | Flood Risk Mapping | Catastrophe Modeling |

|---|---|---|

| Definition | Mapping of flood-prone areas using historical and geographical data. | Simulation of potential disaster impacts using statistical and probabilistic models. |

| Purpose | Identify flood hazard zones for risk assessment and planning. | Estimate financial losses from catastrophes for insurance underwriting and risk management. |

| Data Sources | Hydrological data, topography, rainfall records. | Historical catastrophe data, exposure data, vulnerability curves. |

| Output | Flood hazard maps with risk zones and flood depths. | Probabilistic loss estimates, scenario analysis, risk metrics. |

| Application in Insurance | Used for flood zone designation, premium pricing, regulatory compliance. | Supports risk portfolio management, reinsurance decisions, pricing strategies. |

| Temporal Focus | Primarily historical and recent flood events. | Future event scenarios, probabilistic risk over defined time frames. |

Which is better?

Flood risk mapping provides localized, detailed data focused specifically on flood hazards by analyzing historical flood events, elevation, and hydrological patterns to identify vulnerable areas. Catastrophe modeling offers a broader assessment by simulating multiple disaster scenarios, including floods, earthquakes, and hurricanes, estimating potential financial losses and insurance risks. For flood-specific underwriting and mitigation, flood risk mapping is more precise, while catastrophe modeling is essential for comprehensive risk management and portfolio diversification.

Connection

Flood risk mapping provides detailed geographical data on areas vulnerable to flooding by analyzing historical data, topography, and hydrology, which serves as essential input for catastrophe modeling. Catastrophe modeling utilizes this risk mapping to simulate potential flood events, estimate the financial impact on insured properties, and assess overall exposure for insurance portfolios. This integration enables insurers to set accurate premiums, design effective coverage plans, and improve disaster preparedness strategies.

Key Terms

Catastrophe modeling:

Catastrophe modeling uses advanced algorithms and historical data to quantify potential financial losses from extreme natural events like floods, hurricanes, or earthquakes, enabling insurers and governments to assess risk exposure accurately. Unlike flood risk mapping, which primarily shows areas prone to flooding based on topography and historical flood events, catastrophe modeling integrates probabilistic scenarios, vulnerability assessments, and economic impacts to guide risk management and insurance underwriting. Explore how catastrophe modeling transforms disaster preparedness and financial resilience through predictive analytics.

Stochastic events

Catastrophe modeling quantitatively assesses flood risk by simulating thousands of stochastic events to estimate probable losses and their financial impacts, incorporating variables like rainfall intensity, terrain, and infrastructure resilience. Flood risk mapping visualizes areas susceptible to flooding based on historical data and deterministic scenarios but often lacks the probabilistic depth to capture the full range of possible stochastic events. Explore detailed methodologies to understand how these approaches complement each other for comprehensive flood risk management.

Loss estimation

Catastrophe modeling employs advanced algorithms and historical data to estimate potential financial losses from floods, integrating hazard, exposure, and vulnerability factors for precise loss quantification. Flood risk mapping visually represents flood-prone areas, often emphasizing hazard probability and inundation extent but lacking detailed economic loss assessments. Explore the nuances between catastrophe modeling and flood risk mapping to enhance your understanding of loss estimation methodologies.

Source and External Links

Insurance Topics | Catastrophe Models (Property) - Catastrophe modeling uses computerized simulations of thousands of plausible catastrophic events to estimate risk by analyzing hazard, vulnerability, exposure, and financial loss based on insurance portfolio data and event characteristics.

About Catastrophe Modeling | AIR Worldwide - Catastrophe models mathematically represent natural and man-made disasters through event generation, intensity calculation, exposure data, damage estimation, and insured loss calculation to predict the financial impact of extreme events.

Catastrophe Risk Modeling | Moody's - These models help insurers and financial institutions evaluate and manage catastrophe risk by translating hypothetical perils into probable real-world financial impacts, improving risk assessment accuracy with advanced computing and data analytics.

dowidth.com

dowidth.com