Embedded insurance integrates coverage options directly within products or services, offering seamless risk protection tailored to customer needs. Self-insurance involves setting aside financial reserves to cover potential losses internally, providing greater control but requiring significant capital management. Explore more to understand which insurance strategy aligns best with your risk management goals.

Why it is important

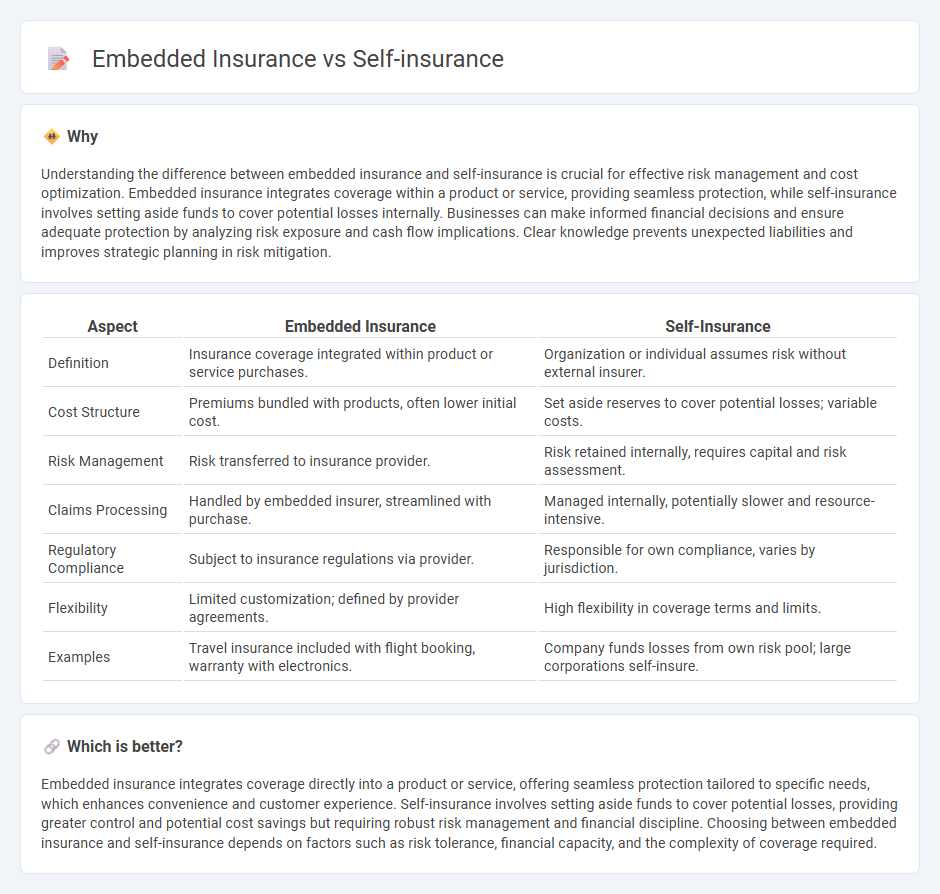

Understanding the difference between embedded insurance and self-insurance is crucial for effective risk management and cost optimization. Embedded insurance integrates coverage within a product or service, providing seamless protection, while self-insurance involves setting aside funds to cover potential losses internally. Businesses can make informed financial decisions and ensure adequate protection by analyzing risk exposure and cash flow implications. Clear knowledge prevents unexpected liabilities and improves strategic planning in risk mitigation.

Comparison Table

| Aspect | Embedded Insurance | Self-Insurance |

|---|---|---|

| Definition | Insurance coverage integrated within product or service purchases. | Organization or individual assumes risk without external insurer. |

| Cost Structure | Premiums bundled with products, often lower initial cost. | Set aside reserves to cover potential losses; variable costs. |

| Risk Management | Risk transferred to insurance provider. | Risk retained internally, requires capital and risk assessment. |

| Claims Processing | Handled by embedded insurer, streamlined with purchase. | Managed internally, potentially slower and resource-intensive. |

| Regulatory Compliance | Subject to insurance regulations via provider. | Responsible for own compliance, varies by jurisdiction. |

| Flexibility | Limited customization; defined by provider agreements. | High flexibility in coverage terms and limits. |

| Examples | Travel insurance included with flight booking, warranty with electronics. | Company funds losses from own risk pool; large corporations self-insure. |

Which is better?

Embedded insurance integrates coverage directly into a product or service, offering seamless protection tailored to specific needs, which enhances convenience and customer experience. Self-insurance involves setting aside funds to cover potential losses, providing greater control and potential cost savings but requiring robust risk management and financial discipline. Choosing between embedded insurance and self-insurance depends on factors such as risk tolerance, financial capacity, and the complexity of coverage required.

Connection

Embedded insurance integrates coverage directly into products or services, enabling businesses to offer tailored risk protection seamlessly within customer experiences. Self-insurance involves companies setting aside funds to cover potential losses internally rather than purchasing external insurance. Both approaches focus on risk management control, with embedded insurance enhancing customer convenience and self-insurance emphasizing internal financial strategy.

Key Terms

Risk Retention

Self-insurance involves organizations retaining risk internally by setting aside funds to cover potential losses, offering greater control over claims management and cost predictability. Embedded insurance integrates coverage directly into a product or service through a third-party provider, transferring risk while enhancing customer experience and simplifying claim processes. Explore detailed insights on how risk retention strategies differ between self-insurance and embedded insurance models.

Distribution Channel

Self-insurance distribution channels rely heavily on internal risk management teams and direct company resources to manage coverage, often bypassing traditional intermediaries. Embedded insurance integrates seamlessly into non-insurance platforms like e-commerce sites or product purchases, utilizing APIs and partner ecosystems to offer coverage at the point of sale. Explore how these distinct distribution approaches impact customer reach and operational efficiency in the insurance industry.

Customization

Self-insurance offers businesses full control over risk management, allowing tailored coverage and cost structures to meet specific organizational needs. Embedded insurance integrates protection directly into product offerings, providing seamless customization options that enhance customer experience through automated, context-specific policies. Explore the nuances of customization between self-insurance and embedded insurance to optimize your risk strategy.

Source and External Links

Self-insurance - Wikipedia - Self-insurance is a risk management method where an organization assumes the risk itself instead of buying third-party insurance, setting aside funds to cover future losses and potentially saving money by avoiding insurance premiums.

Self-Insured Vs. Fully Insured Health Plans - Aetna - In self-insurance (or self-funded plans), employers pay health benefit claims directly while the insurer manages payments, offering flexibility, cost management, and access to provider networks.

SIP - Overview and Requirements for Becoming Self-Insured - To self-insure workers' compensation in California, employers must apply for approval demonstrating financial strength and meet regulatory requirements, including years in business and credit rating.

dowidth.com

dowidth.com