Crop insurance protects farmers against losses caused by natural disasters, pests, and adverse weather conditions, ensuring financial stability for agricultural production. Fire insurance offers coverage for property damage and losses resulting from fire incidents, including residential, commercial, and industrial structures. Explore detailed comparisons to understand which insurance best suits your risk management needs.

Why it is important

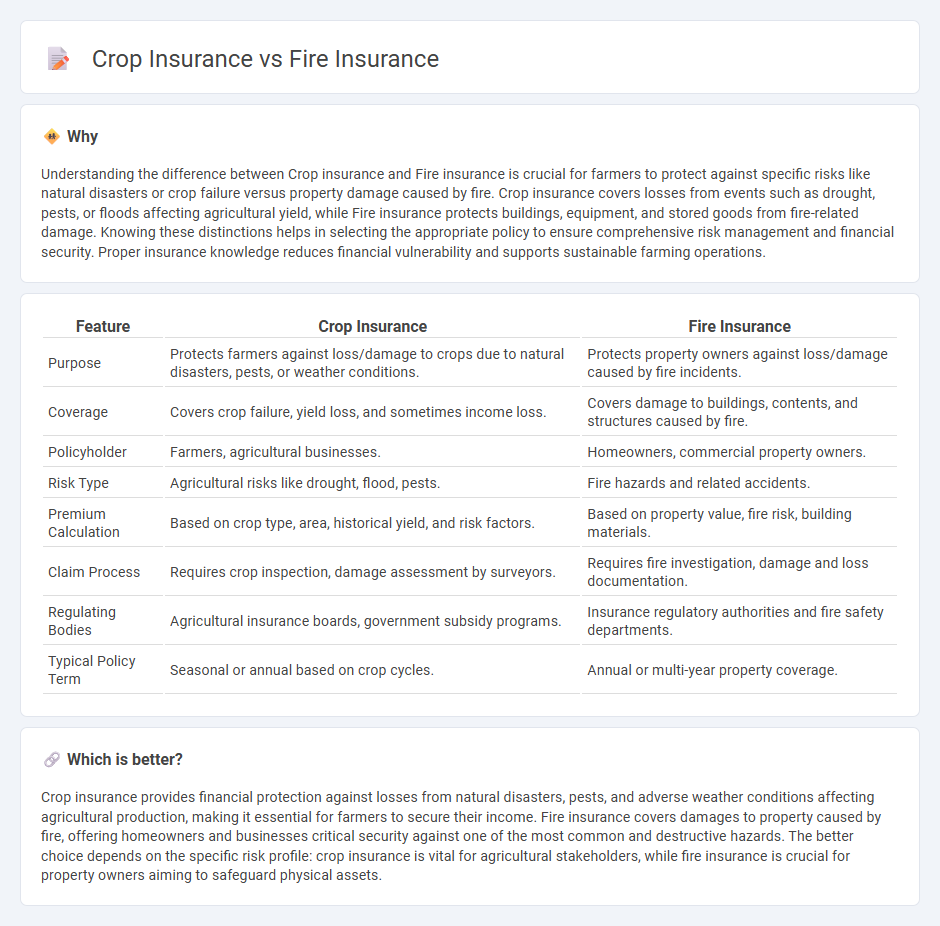

Understanding the difference between Crop insurance and Fire insurance is crucial for farmers to protect against specific risks like natural disasters or crop failure versus property damage caused by fire. Crop insurance covers losses from events such as drought, pests, or floods affecting agricultural yield, while Fire insurance protects buildings, equipment, and stored goods from fire-related damage. Knowing these distinctions helps in selecting the appropriate policy to ensure comprehensive risk management and financial security. Proper insurance knowledge reduces financial vulnerability and supports sustainable farming operations.

Comparison Table

| Feature | Crop Insurance | Fire Insurance |

|---|---|---|

| Purpose | Protects farmers against loss/damage to crops due to natural disasters, pests, or weather conditions. | Protects property owners against loss/damage caused by fire incidents. |

| Coverage | Covers crop failure, yield loss, and sometimes income loss. | Covers damage to buildings, contents, and structures caused by fire. |

| Policyholder | Farmers, agricultural businesses. | Homeowners, commercial property owners. |

| Risk Type | Agricultural risks like drought, flood, pests. | Fire hazards and related accidents. |

| Premium Calculation | Based on crop type, area, historical yield, and risk factors. | Based on property value, fire risk, building materials. |

| Claim Process | Requires crop inspection, damage assessment by surveyors. | Requires fire investigation, damage and loss documentation. |

| Regulating Bodies | Agricultural insurance boards, government subsidy programs. | Insurance regulatory authorities and fire safety departments. |

| Typical Policy Term | Seasonal or annual based on crop cycles. | Annual or multi-year property coverage. |

Which is better?

Crop insurance provides financial protection against losses from natural disasters, pests, and adverse weather conditions affecting agricultural production, making it essential for farmers to secure their income. Fire insurance covers damages to property caused by fire, offering homeowners and businesses critical security against one of the most common and destructive hazards. The better choice depends on the specific risk profile: crop insurance is vital for agricultural stakeholders, while fire insurance is crucial for property owners aiming to safeguard physical assets.

Connection

Crop insurance and fire insurance are interconnected by their mutual goal of mitigating financial losses caused by natural and man-made disasters, ensuring agricultural sustainability and property protection. Crop insurance primarily covers losses due to weather events, pests, and diseases affecting crops, while fire insurance safeguards farm structures, equipment, and stored produce from fire damage. Together, these insurance types provide comprehensive risk management for farmers, stabilizing income and promoting resilience against unpredictable hazards.

Key Terms

Fire Insurance:

Fire insurance provides financial protection against losses or damages caused by fire to residential or commercial properties, covering structural damage, personal belongings, and sometimes additional living expenses. It is essential for homeowners and businesses to mitigate the high risk of fire-related incidents and ensure swift recovery without severe financial setbacks. Explore more about fire insurance policies, coverage options, and claims processes to safeguard your assets effectively.

Indemnity

Fire insurance provides indemnity by compensating the insured for losses directly caused by fire damage to property, ensuring restoration to pre-loss conditions. Crop insurance offers indemnity based on yield loss or revenue reduction due to natural perils like drought, pests, or fire, often using area-yield or individual-loss assessment methods. Explore detailed comparisons to understand how indemnity terms affect your risk management strategy.

Insurable Interest

Fire insurance requires insurable interest at the time of the contract's inception and loss occurrence, ensuring the policyholder has a direct financial stake in the insured property. Crop insurance mandates insurable interest based on ownership or financial loss related to the crops or agricultural produce at risk. Explore further to understand the nuances of insurable interest in these insurance types.

Source and External Links

Fire Insurance: How Much You Might Need | Hippo - This article discusses what is typically covered by fire insurance, including home, other structures, and personal belongings, and situations where additional coverage might be needed.

fire insurance | Wex | US Law | LII - Explains that fire insurance protects property from fire damage and may cover other risks like lightning and explosions, but excludes intentional fires.

The California FAIR Plan: Home page - Provides basic fire insurance coverage for high-risk properties when traditional insurance companies will not, offering dwelling and commercial options.

dowidth.com

dowidth.com