Pet insurance covers veterinary expenses for illnesses and injuries in pets, ensuring affordable access to quality care, while long-term care insurance helps cover costs associated with extended personal care services due to chronic illness or disability. Both types of insurance protect against significant financial burdens, but serve distinct purposes tailored to the policyholder's or pet's specific needs. Explore more to understand which insurance best fits your or your pet's future care requirements.

Why it is important

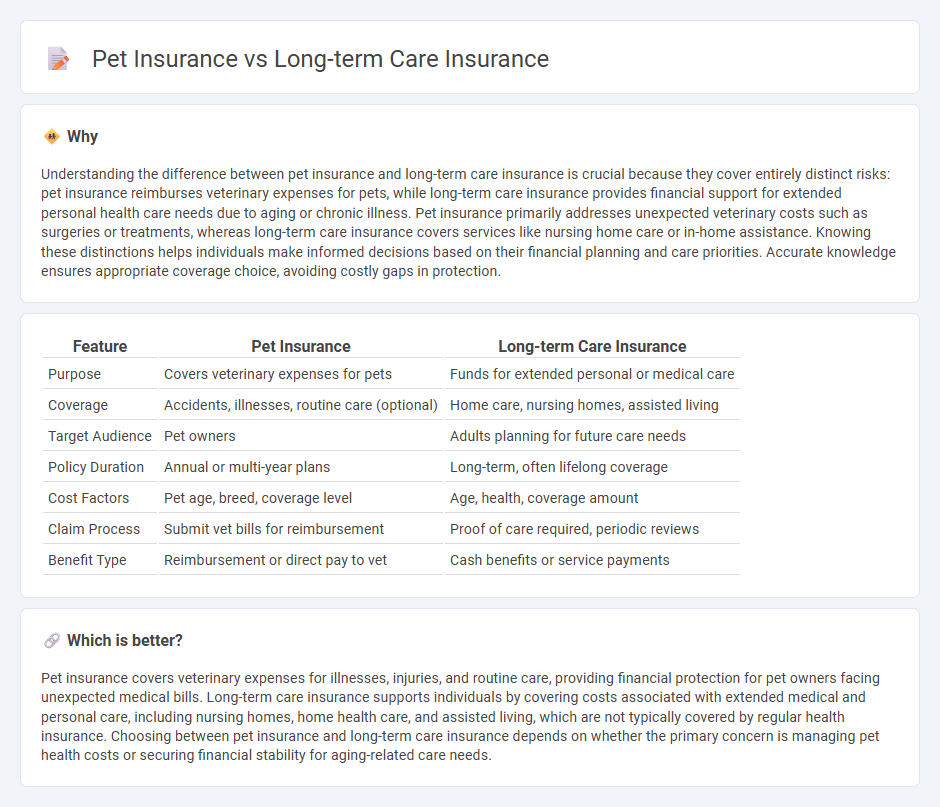

Understanding the difference between pet insurance and long-term care insurance is crucial because they cover entirely distinct risks: pet insurance reimburses veterinary expenses for pets, while long-term care insurance provides financial support for extended personal health care needs due to aging or chronic illness. Pet insurance primarily addresses unexpected veterinary costs such as surgeries or treatments, whereas long-term care insurance covers services like nursing home care or in-home assistance. Knowing these distinctions helps individuals make informed decisions based on their financial planning and care priorities. Accurate knowledge ensures appropriate coverage choice, avoiding costly gaps in protection.

Comparison Table

| Feature | Pet Insurance | Long-term Care Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Funds for extended personal or medical care |

| Coverage | Accidents, illnesses, routine care (optional) | Home care, nursing homes, assisted living |

| Target Audience | Pet owners | Adults planning for future care needs |

| Policy Duration | Annual or multi-year plans | Long-term, often lifelong coverage |

| Cost Factors | Pet age, breed, coverage level | Age, health, coverage amount |

| Claim Process | Submit vet bills for reimbursement | Proof of care required, periodic reviews |

| Benefit Type | Reimbursement or direct pay to vet | Cash benefits or service payments |

Which is better?

Pet insurance covers veterinary expenses for illnesses, injuries, and routine care, providing financial protection for pet owners facing unexpected medical bills. Long-term care insurance supports individuals by covering costs associated with extended medical and personal care, including nursing homes, home health care, and assisted living, which are not typically covered by regular health insurance. Choosing between pet insurance and long-term care insurance depends on whether the primary concern is managing pet health costs or securing financial stability for aging-related care needs.

Connection

Pet insurance and long-term care insurance both address financial preparedness for ongoing healthcare needs, emphasizing risk management in age-related or chronic conditions. They provide policyholders with coverage for extended medical expenses, reducing the burden of costly treatments over time. This connection highlights the growing insurance market trend toward specialized plans supporting lifelong health and wellness.

Key Terms

Long-term care insurance:

Long-term care insurance provides financial coverage for individuals needing assistance with daily activities due to chronic illness or disability, covering services such as nursing home care, home health care, and assisted living. This insurance helps protect savings and ensures access to quality care by offsetting high costs that Medicare and traditional health insurance typically do not cover. Explore the benefits and options of long-term care insurance to secure your future healthcare needs.

Benefit period

Long-term care insurance offers extended benefit periods ranging from two years to lifetime coverage, ensuring ongoing support for chronic illnesses or disabilities. Pet insurance benefit periods are generally limited to one year per condition, with options for renewal based on the pet's health status. Explore how the benefit period affects coverage and costs to choose the best policy for your needs.

Elimination period

Long-term care insurance often features an elimination period ranging from 30 to 90 days, during which policyholders must cover their own expenses before benefits begin. Pet insurance usually has a shorter elimination period, commonly between 0 to 14 days, depending on the provider and coverage type. Explore detailed comparisons to understand how elimination periods affect claim timelines and coverage.

Source and External Links

Long-Term Care Insurance Explained - Long-term care insurance helps cover costs associated with chronic conditions or disabilities, such as Alzheimer's, and involves a selection process where the amount of coverage can be chosen and eligibility is typically based on the inability to perform certain daily activities.

Long-term care costs & options - Fidelity discusses the various options for paying for long-term care, including government assistance, traditional insurance, hybrid policies, and personal savings, depending on individual circumstances.

What Are the Three Types of Long-Term Care Insurance? - The National Council on Aging explores different types of long-term care insurance, including traditional policies, hybrid policies, and riders that provide long-term care coverage, each with unique cost structures and conditions.

dowidth.com

dowidth.com