Insurtech platforms leverage advanced technology to streamline insurance processes, offering personalized policies and seamless digital experiences. Embedded insurance providers integrate insurance products directly into consumer purchases, enhancing convenience by bundling coverage with everyday transactions. Explore the key differences to understand which model best suits modern insurance needs.

Why it is important

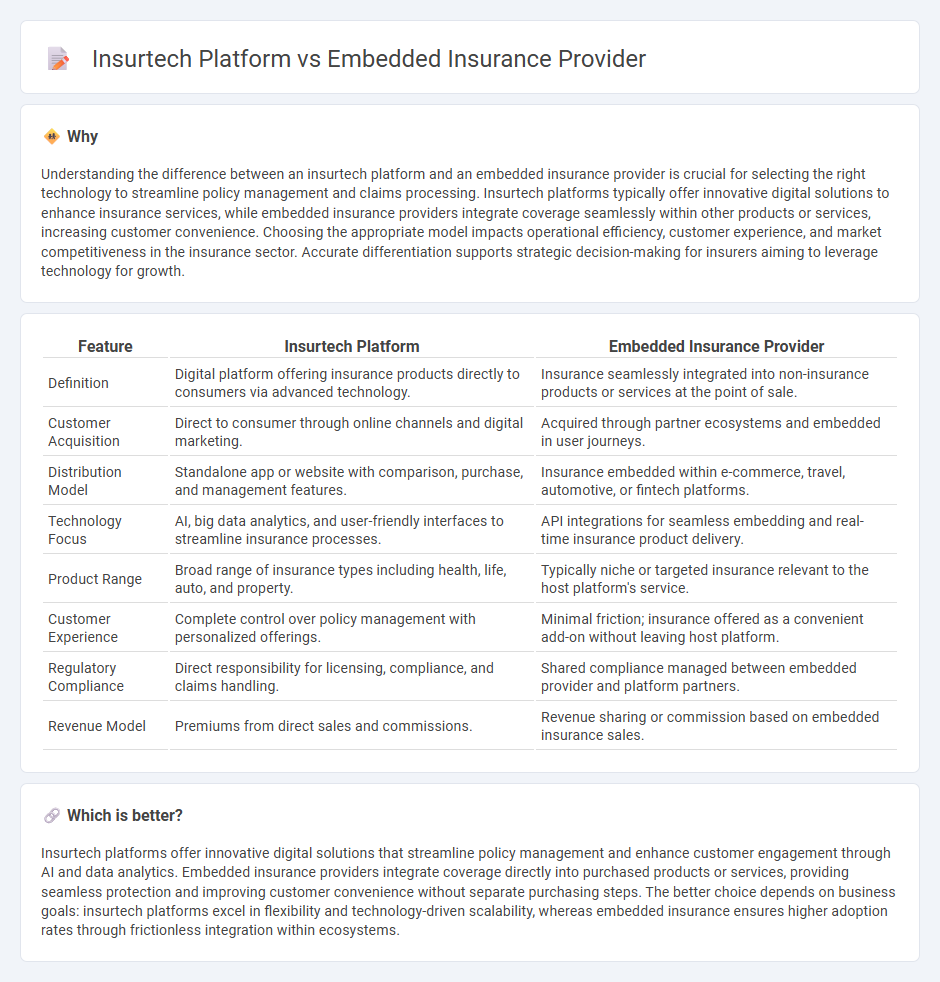

Understanding the difference between an insurtech platform and an embedded insurance provider is crucial for selecting the right technology to streamline policy management and claims processing. Insurtech platforms typically offer innovative digital solutions to enhance insurance services, while embedded insurance providers integrate coverage seamlessly within other products or services, increasing customer convenience. Choosing the appropriate model impacts operational efficiency, customer experience, and market competitiveness in the insurance sector. Accurate differentiation supports strategic decision-making for insurers aiming to leverage technology for growth.

Comparison Table

| Feature | Insurtech Platform | Embedded Insurance Provider |

|---|---|---|

| Definition | Digital platform offering insurance products directly to consumers via advanced technology. | Insurance seamlessly integrated into non-insurance products or services at the point of sale. |

| Customer Acquisition | Direct to consumer through online channels and digital marketing. | Acquired through partner ecosystems and embedded in user journeys. |

| Distribution Model | Standalone app or website with comparison, purchase, and management features. | Insurance embedded within e-commerce, travel, automotive, or fintech platforms. |

| Technology Focus | AI, big data analytics, and user-friendly interfaces to streamline insurance processes. | API integrations for seamless embedding and real-time insurance product delivery. |

| Product Range | Broad range of insurance types including health, life, auto, and property. | Typically niche or targeted insurance relevant to the host platform's service. |

| Customer Experience | Complete control over policy management with personalized offerings. | Minimal friction; insurance offered as a convenient add-on without leaving host platform. |

| Regulatory Compliance | Direct responsibility for licensing, compliance, and claims handling. | Shared compliance managed between embedded provider and platform partners. |

| Revenue Model | Premiums from direct sales and commissions. | Revenue sharing or commission based on embedded insurance sales. |

Which is better?

Insurtech platforms offer innovative digital solutions that streamline policy management and enhance customer engagement through AI and data analytics. Embedded insurance providers integrate coverage directly into purchased products or services, providing seamless protection and improving customer convenience without separate purchasing steps. The better choice depends on business goals: insurtech platforms excel in flexibility and technology-driven scalability, whereas embedded insurance ensures higher adoption rates through frictionless integration within ecosystems.

Connection

Insurtech platforms leverage advanced technologies like AI, machine learning, and big data analytics to streamline insurance processes, enabling embedded insurance providers to integrate coverage seamlessly into non-insurance products. Embedded insurance providers utilize insurtech platforms' APIs and digital infrastructure to offer real-time, personalized insurance solutions within ecosystems such as e-commerce, travel, and automotive industries. This symbiotic relationship enhances customer experience, reduces acquisition costs, and accelerates policy issuance by automating underwriting, claims management, and payment processing.

Key Terms

**Embedded Insurance Provider:**

Embedded insurance providers integrate insurance products directly into the customer journey of non-insurance platforms, offering seamless risk protection at the point of purchase. They leverage APIs and partnerships to deliver tailored coverage, enhancing user experience and driving higher conversion rates compared to traditional distribution methods. Explore how embedded insurance providers transform risk management and customer engagement in the digital economy.

API Integration

Embedded insurance providers prioritize seamless API integration to embed insurance products directly within third-party platforms, enhancing user experience and increasing conversion rates. Insurtech platforms leverage API integration to connect multiple insurance products, enabling customization and streamlined workflows for brokers and customers alike. Explore how API integration transforms insurance delivery models by diving deeper into embedded insurance and insurtech solutions.

White-label Solutions

Embedded insurance providers specialize in integrating insurance products directly into third-party platforms, offering seamless white-label solutions tailored to specific business needs. Insurtech platforms leverage advanced technology to deliver flexible, scalable white-label insurance services that enhance customization and user experience. Explore how each approach can revolutionize your insurance offerings and drive customer engagement.

Source and External Links

Top 5 Embedded Insurance Providers in 2025 - Openkoda - Leading embedded insurance providers include Cover Genius, Qover, Tigerlab, Bsurance, and Openkoda, all offering API-driven, customizable insurance solutions that integrate seamlessly at the point of sale across various industries worldwide.

Embedded Insurance Solutions EMEA - Duck Creek - Duck Creek offers a comprehensive embedded insurance platform optimized for vehicle and travel insurance, enabling rapid product deployment, personalized coverages, and integration through pre-built APIs for distribution partners like automobile dealers and airlines.

What is embedded insurance | Chubb - Embedded insurance integrates risk protection directly into consumers' purchase journeys at the point of sale, allowing for seamless, personalized coverage without leaving the buying process, applicable to diverse products such as travel, electronics, and financial services.

dowidth.com

dowidth.com