Ghost broking involves fraudsters impersonating legitimate insurance brokers to sell fake or invalid insurance policies, leaving clients uninsured and vulnerable. Claims padding refers to the deliberate inflation or exaggeration of insurance claims to receive higher payouts, which increases premiums for all policyholders. Explore our detailed analysis to understand the risks and detection methods of these insurance frauds.

Why it is important

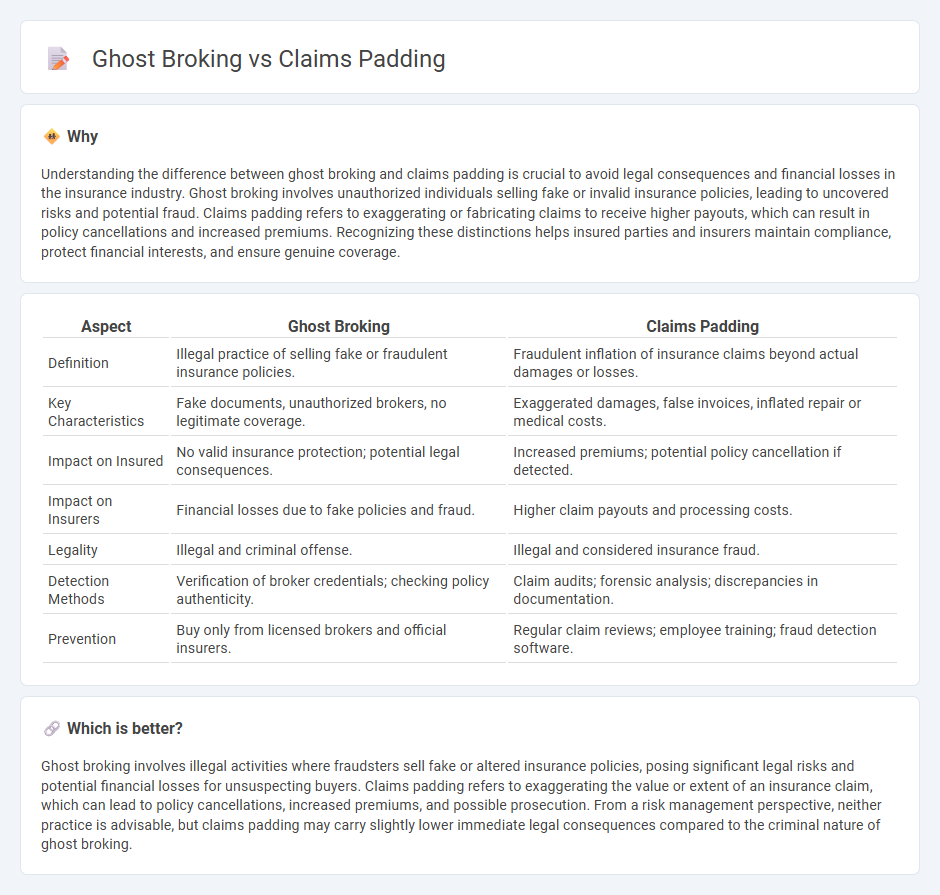

Understanding the difference between ghost broking and claims padding is crucial to avoid legal consequences and financial losses in the insurance industry. Ghost broking involves unauthorized individuals selling fake or invalid insurance policies, leading to uncovered risks and potential fraud. Claims padding refers to exaggerating or fabricating claims to receive higher payouts, which can result in policy cancellations and increased premiums. Recognizing these distinctions helps insured parties and insurers maintain compliance, protect financial interests, and ensure genuine coverage.

Comparison Table

| Aspect | Ghost Broking | Claims Padding |

|---|---|---|

| Definition | Illegal practice of selling fake or fraudulent insurance policies. | Fraudulent inflation of insurance claims beyond actual damages or losses. |

| Key Characteristics | Fake documents, unauthorized brokers, no legitimate coverage. | Exaggerated damages, false invoices, inflated repair or medical costs. |

| Impact on Insured | No valid insurance protection; potential legal consequences. | Increased premiums; potential policy cancellation if detected. |

| Impact on Insurers | Financial losses due to fake policies and fraud. | Higher claim payouts and processing costs. |

| Legality | Illegal and criminal offense. | Illegal and considered insurance fraud. |

| Detection Methods | Verification of broker credentials; checking policy authenticity. | Claim audits; forensic analysis; discrepancies in documentation. |

| Prevention | Buy only from licensed brokers and official insurers. | Regular claim reviews; employee training; fraud detection software. |

Which is better?

Ghost broking involves illegal activities where fraudsters sell fake or altered insurance policies, posing significant legal risks and potential financial losses for unsuspecting buyers. Claims padding refers to exaggerating the value or extent of an insurance claim, which can lead to policy cancellations, increased premiums, and possible prosecution. From a risk management perspective, neither practice is advisable, but claims padding may carry slightly lower immediate legal consequences compared to the criminal nature of ghost broking.

Connection

Ghost broking and claims padding are connected through fraudulent insurance activities that exploit policyholders and insurers. Ghost broking involves unauthorized intermediaries selling fake or invalid insurance policies, which often leads to claims padding, where false or exaggerated claims are submitted to receive higher payouts. Both practices increase insurance fraud risks, resulting in higher premiums and financial losses for genuine customers and insurance companies.

Key Terms

Fraud

Claims padding involves inflating insurance claims by exaggerating damages or including false items to receive higher payouts, representing a common form of fraudulent activity targeting insurers. Ghost broking is a sophisticated scam where fraudsters illegally sell fake or stolen insurance policies, leaving victims unprotected and unknowingly committing legal violations. Explore more on how these fraud types impact the insurance industry and ways to detect and prevent them effectively.

Policyholder

Claims padding involves policyholders exaggerating or fabricating losses to receive higher insurance payouts, often resulting in policy disputes or potential legal consequences. Ghost broking refers to fraudulent intermediaries selling fake insurance policies or altering legitimate ones, leaving policyholders unprotected and financially vulnerable. Explore how to identify and safeguard against these risks to protect your insurance interests effectively.

Underwriting

Claims padding inflates genuine insurance claims by exaggerating damages or losses, resulting in higher payouts from underwriters, which increases risk exposure and undermines underwriting accuracy. Ghost broking involves fraudulent intermediaries selling fake or altered insurance policies, bypassing proper underwriting procedures and exposing insurers to unassessed risks. Explore how underwriting processes identify and mitigate these fraudulent practices to protect insurer portfolios and policyholders.

Source and External Links

Unveiling Insurance Fraud: Understanding Padding Claims and Fabricating Loss Scenarios - Padding a claim in insurance means inflating the value of losses or including false items to receive more money than genuinely owed, which is a form of fraud that misrepresents losses and financially harms insurers and honest policyholders by raising premiums.

Can You Stop Insurance Fraud Padding? - Insurance claim padding often involves exaggerating injuries or damages, sometimes staging accidents or faking injuries, and can cause huge financial impacts, with anti-fraud investigations examining accident scenes and reports for signs of deception to prevent inflated claims.

Bill Padding | Atlanta Health Care Fraud Attorneys - Evans Bowers - In health care, bill padding is a related fraud where providers inflate Medicare claims by adding charges for unnecessary or unprovided services, harming patients and increasing costs for all who pay insurance premiums or taxes.

dowidth.com

dowidth.com