Usage-based insurance (UBI) leverages telematics technology to monitor driver behavior, offering personalized premiums based on real-time data such as speed, braking, and mileage, thus promoting safer driving habits. Pay-as-you-drive (PAYD) insurance focuses primarily on the distance driven, assigning insurance costs directly proportional to miles traveled, benefiting low-mileage drivers with reduced rates. Explore more to understand which insurance model aligns best with your driving patterns and financial goals.

Why it is important

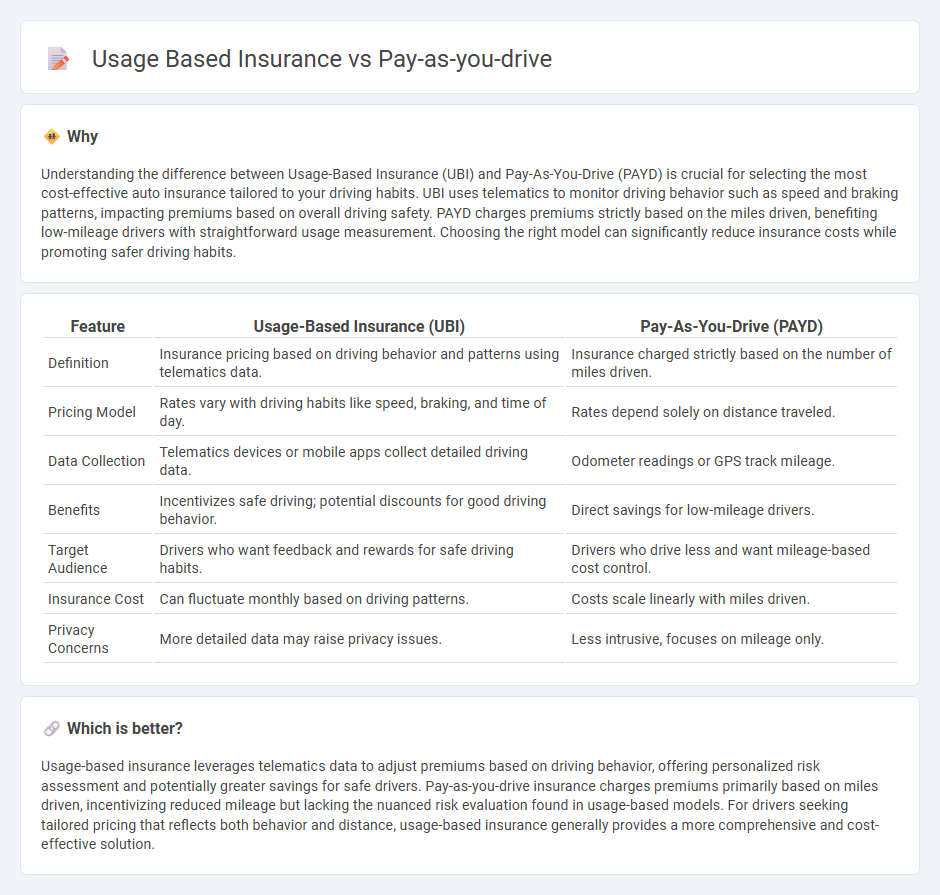

Understanding the difference between Usage-Based Insurance (UBI) and Pay-As-You-Drive (PAYD) is crucial for selecting the most cost-effective auto insurance tailored to your driving habits. UBI uses telematics to monitor driving behavior such as speed and braking patterns, impacting premiums based on overall driving safety. PAYD charges premiums strictly based on the miles driven, benefiting low-mileage drivers with straightforward usage measurement. Choosing the right model can significantly reduce insurance costs while promoting safer driving habits.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | Pay-As-You-Drive (PAYD) |

|---|---|---|

| Definition | Insurance pricing based on driving behavior and patterns using telematics data. | Insurance charged strictly based on the number of miles driven. |

| Pricing Model | Rates vary with driving habits like speed, braking, and time of day. | Rates depend solely on distance traveled. |

| Data Collection | Telematics devices or mobile apps collect detailed driving data. | Odometer readings or GPS track mileage. |

| Benefits | Incentivizes safe driving; potential discounts for good driving behavior. | Direct savings for low-mileage drivers. |

| Target Audience | Drivers who want feedback and rewards for safe driving habits. | Drivers who drive less and want mileage-based cost control. |

| Insurance Cost | Can fluctuate monthly based on driving patterns. | Costs scale linearly with miles driven. |

| Privacy Concerns | More detailed data may raise privacy issues. | Less intrusive, focuses on mileage only. |

Which is better?

Usage-based insurance leverages telematics data to adjust premiums based on driving behavior, offering personalized risk assessment and potentially greater savings for safe drivers. Pay-as-you-drive insurance charges premiums primarily based on miles driven, incentivizing reduced mileage but lacking the nuanced risk evaluation found in usage-based models. For drivers seeking tailored pricing that reflects both behavior and distance, usage-based insurance generally provides a more comprehensive and cost-effective solution.

Connection

Usage-based insurance (UBI) and Pay-As-You-Drive (PAYD) are connected through their reliance on telematics technology to monitor driving behavior and mileage, enabling personalized premiums based on actual usage. Both models emphasize risk assessment by collecting data such as distance traveled, driving patterns, and time of day to tailor insurance costs more accurately. This data-driven approach promotes safer driving habits and offers cost savings for low-mileage drivers.

Key Terms

Telematics

Pay-as-you-drive (PAYD) insurance calculates premiums based on miles driven, promoting cost-efficiency and safer driving habits by directly linking insurance costs to vehicle usage. Usage-based insurance (UBI) incorporates telematics devices to monitor various driving behaviors, such as speed, acceleration, and braking patterns, enabling highly personalized risk assessment and premium adjustments. Discover in-depth insights on how telematics technology revolutionizes insurance models and offers drivers greater control over their costs.

Mileage Tracking

Pay-as-you-drive (PAYD) insurance directly links premiums to the miles driven, using mileage tracking to incentivize lower driving distances and reduce risk exposure. Usage-based insurance (UBI) expands on this by incorporating detailed driving behavior data such as speed, braking, and time of day alongside mileage tracking for a comprehensive risk assessment. Discover how advanced telematics technology enhances mileage tracking accuracy and impacts your insurance costs.

Premium Adjustment

Pay-as-you-drive (PAYD) insurance adjusts premiums based solely on the number of miles driven, offering a straightforward model where lower mileage results in reduced premiums. Usage-based insurance (UBI) incorporates a broader range of driving behaviors such as speed, braking patterns, and time of day, enabling more precise and personalized premium adjustments. Explore detailed comparisons to understand which model optimizes cost savings and risk assessment best for your driving habits.

Source and External Links

What Is Pay As You Go Car Insurance? - This article explains pay-as-you-go car insurance as a usage-based policy where premiums are calculated based on the frequency and distance of driving.

Usage-based insurance - This page describes pay-as-you-drive as part of usage-based insurance, which calculates premiums based on how, when, and where you drive.

The Impact of Pay-As-You-Drive Auto Insurance in California - This article discusses the potential benefits and impacts of pay-as-you-drive insurance in California, including reduced driving and emissions.

dowidth.com

dowidth.com