Crop yield insurance compensates farmers based on the actual harvest amount, protecting against losses from pests, diseases, and natural disasters. Weather index insurance offers payouts triggered by specific weather parameters like rainfall or temperature, removing the need for on-site loss assessments. Explore how these insurance types mitigate agricultural risks and support farmer income stability.

Why it is important

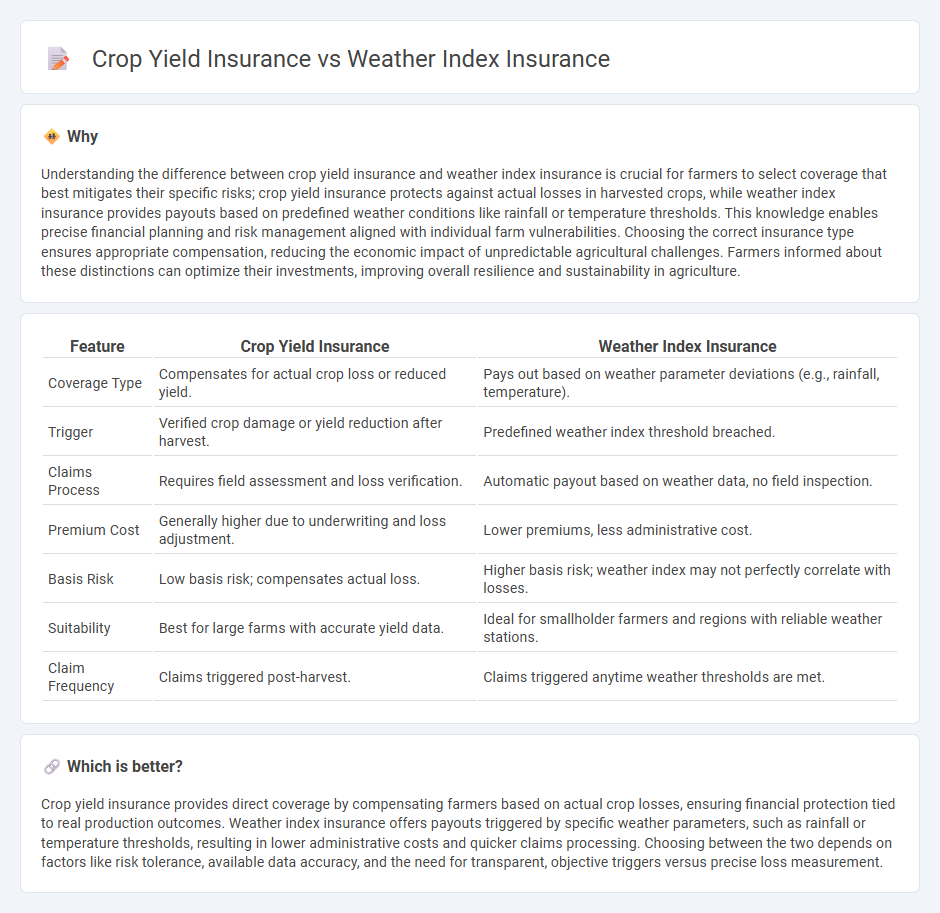

Understanding the difference between crop yield insurance and weather index insurance is crucial for farmers to select coverage that best mitigates their specific risks; crop yield insurance protects against actual losses in harvested crops, while weather index insurance provides payouts based on predefined weather conditions like rainfall or temperature thresholds. This knowledge enables precise financial planning and risk management aligned with individual farm vulnerabilities. Choosing the correct insurance type ensures appropriate compensation, reducing the economic impact of unpredictable agricultural challenges. Farmers informed about these distinctions can optimize their investments, improving overall resilience and sustainability in agriculture.

Comparison Table

| Feature | Crop Yield Insurance | Weather Index Insurance |

|---|---|---|

| Coverage Type | Compensates for actual crop loss or reduced yield. | Pays out based on weather parameter deviations (e.g., rainfall, temperature). |

| Trigger | Verified crop damage or yield reduction after harvest. | Predefined weather index threshold breached. |

| Claims Process | Requires field assessment and loss verification. | Automatic payout based on weather data, no field inspection. |

| Premium Cost | Generally higher due to underwriting and loss adjustment. | Lower premiums, less administrative cost. |

| Basis Risk | Low basis risk; compensates actual loss. | Higher basis risk; weather index may not perfectly correlate with losses. |

| Suitability | Best for large farms with accurate yield data. | Ideal for smallholder farmers and regions with reliable weather stations. |

| Claim Frequency | Claims triggered post-harvest. | Claims triggered anytime weather thresholds are met. |

Which is better?

Crop yield insurance provides direct coverage by compensating farmers based on actual crop losses, ensuring financial protection tied to real production outcomes. Weather index insurance offers payouts triggered by specific weather parameters, such as rainfall or temperature thresholds, resulting in lower administrative costs and quicker claims processing. Choosing between the two depends on factors like risk tolerance, available data accuracy, and the need for transparent, objective triggers versus precise loss measurement.

Connection

Crop yield insurance and weather index insurance both mitigate agricultural risks by providing financial protection linked to crop production outcomes. Crop yield insurance compensates farmers based on actual harvested yields falling below a guaranteed threshold, while weather index insurance offers payouts triggered by specific weather parameters like rainfall or temperature deviations. These interconnected instruments help stabilize farmers' income by addressing yield losses caused by adverse weather conditions.

Key Terms

Parametric Trigger

Weather index insurance uses parametric triggers based on predefined weather metrics such as rainfall or temperature thresholds to pay claims, offering faster and more objective payouts without requiring crop damage assessment. Crop yield insurance relies on actual farm-level yield losses, typically assessed through field inspections, making it more precise but administratively complex. Explore the advantages and limitations of parametric triggers to understand how these insurance models mitigate agricultural risks effectively.

Indemnity-based

Weather index insurance provides payouts based on predefined weather parameters such as rainfall or temperature, reducing moral hazard and simplifying claim processes. Crop yield insurance offers indemnity-based coverage tied directly to actual crop losses, ensuring compensation reflects the farmer's financial impact from reduced harvests. Explore further to understand how indemnity-based mechanisms optimize risk management in agriculture.

Basis Risk

Weather index insurance relies on meteorological data such as rainfall and temperature to trigger payouts, limiting basis risk by avoiding direct measurement of individual crop losses. Crop yield insurance indemnifies farmers based on actual harvest outcomes, but is prone to higher basis risk due to localized damage not reflected in area-level yield averages. Explore detailed comparisons between weather index and crop yield insurance to better understand their impact on basis risk mitigation.

Source and External Links

Weather index-based insurance - CGSpace - Weather index-based insurance uses a weather index (such as rainfall) to determine automatic payouts when predefined conditions are met, allowing faster and less contentious compensation for farmers without field inspections.

What is Weather Index Insurance? - Columbia University - Weather index insurance pays out based on an objective weather index (like rainfall) measured at a local station or by satellite, rather than individual losses, reducing transaction costs and avoiding moral hazard.

Linking Weather Index Insurance and Credit to Improve Agricultural Productivity - Poverty Action Lab - Weather index insurance makes payouts to farmers during extreme weather events like droughts or floods, helping manage income risk, but uptake may be limited by lack of access to credit.

dowidth.com

dowidth.com