NFT insurance offers tailored protection for digital assets stored on blockchain, addressing risks such as cyber theft, smart contract vulnerabilities, and market volatility. Traditional insurance focuses on physical assets and liabilities with standardized coverage options, including property, health, and auto insurance. Explore the evolving landscape of insurance to understand how NFT policies complement or differ from conventional insurance solutions.

Why it is important

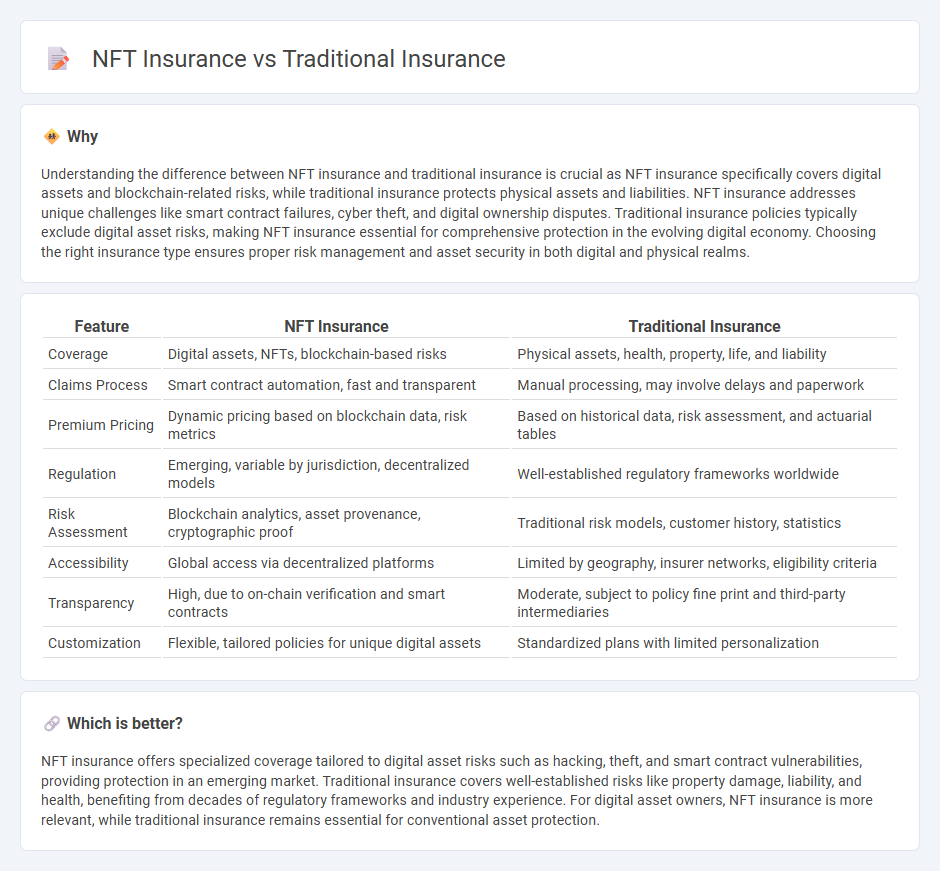

Understanding the difference between NFT insurance and traditional insurance is crucial as NFT insurance specifically covers digital assets and blockchain-related risks, while traditional insurance protects physical assets and liabilities. NFT insurance addresses unique challenges like smart contract failures, cyber theft, and digital ownership disputes. Traditional insurance policies typically exclude digital asset risks, making NFT insurance essential for comprehensive protection in the evolving digital economy. Choosing the right insurance type ensures proper risk management and asset security in both digital and physical realms.

Comparison Table

| Feature | NFT Insurance | Traditional Insurance |

|---|---|---|

| Coverage | Digital assets, NFTs, blockchain-based risks | Physical assets, health, property, life, and liability |

| Claims Process | Smart contract automation, fast and transparent | Manual processing, may involve delays and paperwork |

| Premium Pricing | Dynamic pricing based on blockchain data, risk metrics | Based on historical data, risk assessment, and actuarial tables |

| Regulation | Emerging, variable by jurisdiction, decentralized models | Well-established regulatory frameworks worldwide |

| Risk Assessment | Blockchain analytics, asset provenance, cryptographic proof | Traditional risk models, customer history, statistics |

| Accessibility | Global access via decentralized platforms | Limited by geography, insurer networks, eligibility criteria |

| Transparency | High, due to on-chain verification and smart contracts | Moderate, subject to policy fine print and third-party intermediaries |

| Customization | Flexible, tailored policies for unique digital assets | Standardized plans with limited personalization |

Which is better?

NFT insurance offers specialized coverage tailored to digital asset risks such as hacking, theft, and smart contract vulnerabilities, providing protection in an emerging market. Traditional insurance covers well-established risks like property damage, liability, and health, benefiting from decades of regulatory frameworks and industry experience. For digital asset owners, NFT insurance is more relevant, while traditional insurance remains essential for conventional asset protection.

Connection

NFT insurance leverages blockchain technology to provide transparent and immutable proof of ownership, addressing risks unique to digital assets while traditional insurance focuses on physical asset protection and risk mitigation. Both types of insurance involve risk assessment, underwriting, and claims management, but NFT insurance adapts these principles to the decentralized and digital nature of non-fungible tokens. Integration of smart contracts in NFT insurance enables automated policy enforcement and faster claims processing, bridging gaps between emerging digital asset markets and conventional insurance frameworks.

Key Terms

Underwriting

Traditional insurance underwriting relies on historical data, actuarial analysis, and risk assessment through manual processes to determine coverage and premiums. NFT insurance utilizes blockchain technology to automate underwriting with real-time data, smart contracts, and decentralized risk evaluation, enhancing transparency and reducing fraud. Explore how NFT insurance transforms underwriting by combining cutting-edge technology with innovative risk modeling.

Smart Contracts

Traditional insurance relies on paper-based policies and manual claims processing, often resulting in delayed settlements and administrative overhead. NFT insurance leverages blockchain technology and smart contracts to automate policy issuance, claim verification, and payouts, ensuring transparency, efficiency, and reduced fraud. Explore how smart contracts are revolutionizing insurance by enhancing security and streamlining operations.

Claims Settlement

Traditional insurance claims settlement involves manual processing, often leading to lengthy approval times and paperwork verification. NFT insurance leverages blockchain technology to automate claims validation, ensuring faster, transparent, and tamper-proof settlements. Discover the future of claims settlement and how NFT insurance is revolutionizing the industry.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional insurance plans, especially in life insurance, include long-established types such as term insurance, endowment plans, and retirement plans, offering guaranteed returns with life coverage, fixed incomes, tax benefits, and sometimes bonuses, classified mainly into pure life protection or a combination of insurance and investment.

Traditional Indemnity Insurance Plans - Traditional health insurance plans operate on a fee-for-service basis, reimbursing patients based on usual, customary, and reasonable charges, allowing freedom to choose healthcare providers without network restrictions, with reimbursement often contingent on deductibles and co-insurance.

Traditional vs Managed Care - Traditional health insurance permits policyholders to select any healthcare providers with direct billing or reimbursement, contrasting with managed care plans that limit provider choice but often reduce costs and manage care access.

dowidth.com

dowidth.com