On-demand insurance offers flexible, usage-based coverage activated instantly via digital platforms, ideal for temporary or specific needs. Parametric insurance provides predetermined payouts based on quantifiable triggers like weather events or natural disasters, streamlining claims without traditional loss assessments. Discover more about how these innovative insurance models can optimize risk management and coverage efficiency.

Why it is important

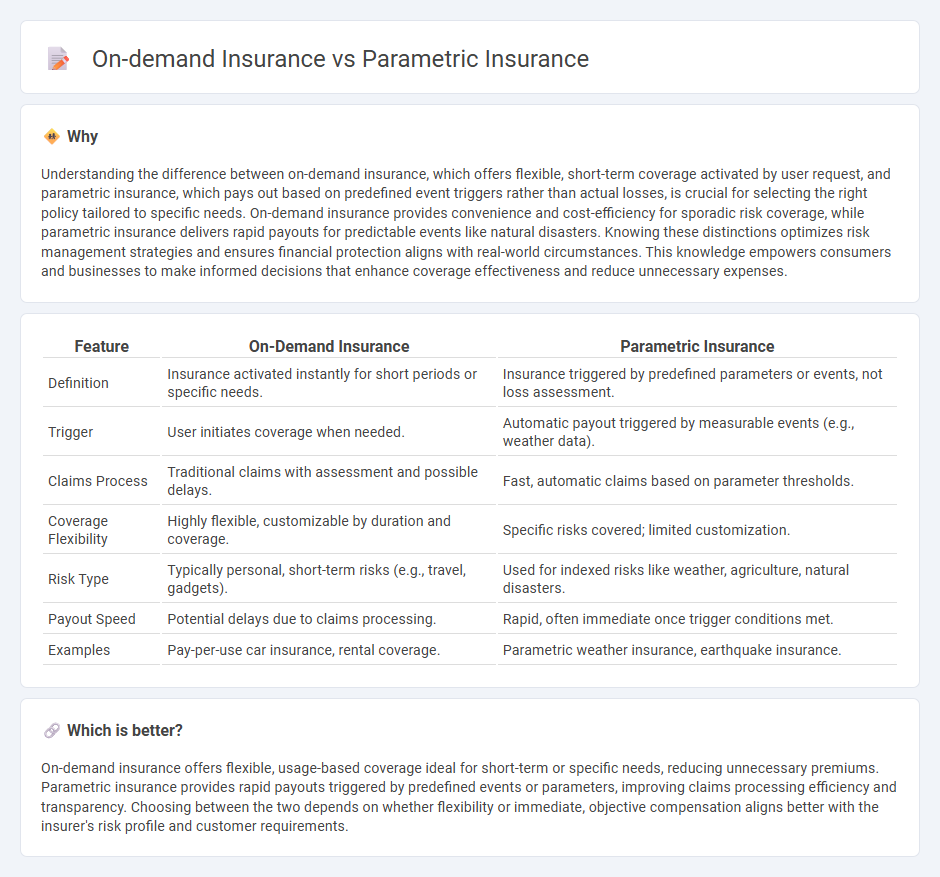

Understanding the difference between on-demand insurance, which offers flexible, short-term coverage activated by user request, and parametric insurance, which pays out based on predefined event triggers rather than actual losses, is crucial for selecting the right policy tailored to specific needs. On-demand insurance provides convenience and cost-efficiency for sporadic risk coverage, while parametric insurance delivers rapid payouts for predictable events like natural disasters. Knowing these distinctions optimizes risk management strategies and ensures financial protection aligns with real-world circumstances. This knowledge empowers consumers and businesses to make informed decisions that enhance coverage effectiveness and reduce unnecessary expenses.

Comparison Table

| Feature | On-Demand Insurance | Parametric Insurance |

|---|---|---|

| Definition | Insurance activated instantly for short periods or specific needs. | Insurance triggered by predefined parameters or events, not loss assessment. |

| Trigger | User initiates coverage when needed. | Automatic payout triggered by measurable events (e.g., weather data). |

| Claims Process | Traditional claims with assessment and possible delays. | Fast, automatic claims based on parameter thresholds. |

| Coverage Flexibility | Highly flexible, customizable by duration and coverage. | Specific risks covered; limited customization. |

| Risk Type | Typically personal, short-term risks (e.g., travel, gadgets). | Used for indexed risks like weather, agriculture, natural disasters. |

| Payout Speed | Potential delays due to claims processing. | Rapid, often immediate once trigger conditions met. |

| Examples | Pay-per-use car insurance, rental coverage. | Parametric weather insurance, earthquake insurance. |

Which is better?

On-demand insurance offers flexible, usage-based coverage ideal for short-term or specific needs, reducing unnecessary premiums. Parametric insurance provides rapid payouts triggered by predefined events or parameters, improving claims processing efficiency and transparency. Choosing between the two depends on whether flexibility or immediate, objective compensation aligns better with the insurer's risk profile and customer requirements.

Connection

On-demand insurance and parametric insurance are connected through their focus on flexibility and rapid claims processing, leveraging technology to provide customized coverage and immediate payouts based on predefined parameters. Both models reduce administrative overhead by automating underwriting and claims settlement, enhancing customer convenience and operational efficiency. The integration of IoT and real-time data analytics is central to enabling these innovative insurance solutions.

Key Terms

Trigger Event (Parametric Insurance)

Trigger events in parametric insurance are predefined measurable parameters such as rainfall levels, wind speeds, or earthquake magnitudes that activate automatic payouts, streamlining claims processes and minimizing assessment delays. Unlike traditional insurance relying on loss verification, parametric insurance enables rapid financial relief by leveraging real-time data from trusted sources. Discover more about how trigger events fundamentally transform risk management and claim efficiency.

Instant Coverage Activation (On-Demand Insurance)

Instant Coverage Activation in on-demand insurance eliminates traditional waiting periods by allowing policyholders to activate protection immediately through mobile apps or online platforms. Parametric insurance relies on pre-defined triggers such as weather data or seismic readings to automatically provide payouts, but it may not offer instant user-controlled activation. Explore more about how instant coverage enhances flexibility and responsiveness in modern insurance solutions.

Payout Mechanism

Parametric insurance offers predetermined payouts based on objective triggers such as weather data or seismic activity, bypassing the traditional claims adjustment process. On-demand insurance provides flexible coverage with payouts contingent on specific, often user-selected events, tailored to real-time needs and enhancing consumer control. Explore more to understand which payout mechanism aligns best with your risk management strategy.

Source and External Links

What is parametric insurance? - Parametric insurance is a type of coverage that pays out a predetermined amount when a specific, objectively measurable event (like an earthquake reaching a certain magnitude) occurs, rather than reimbursing actual losses incurred.

Parametric insurance - Unlike traditional indemnity insurance, parametric insurance provides fast, pre-specified payouts based on trigger events verified by independent data, making it especially useful for catastrophic or hard-to-model risks, though it may not fully cover all actual damages.

Parametric Insurance Solutions - Parametric policies pay out quickly based on pre-defined event thresholds (such as wind speed or seismic activity), using real-time data to provide clarity and certainty in the claims process, which helps businesses recover faster after a disaster.

dowidth.com

dowidth.com