Gig worker insurance offers tailored coverage for independent contractors managing irregular work and income streams, focusing on liability and income protection specific to freelance or platform-based jobs. Temporary worker insurance provides employers with policies that cover short-term employees against workplace injuries and ensure compliance with labor regulations, emphasizing workers' compensation and liability coverage. Explore the key differences and benefits of each insurance type to choose the right protection for your work arrangement.

Why it is important

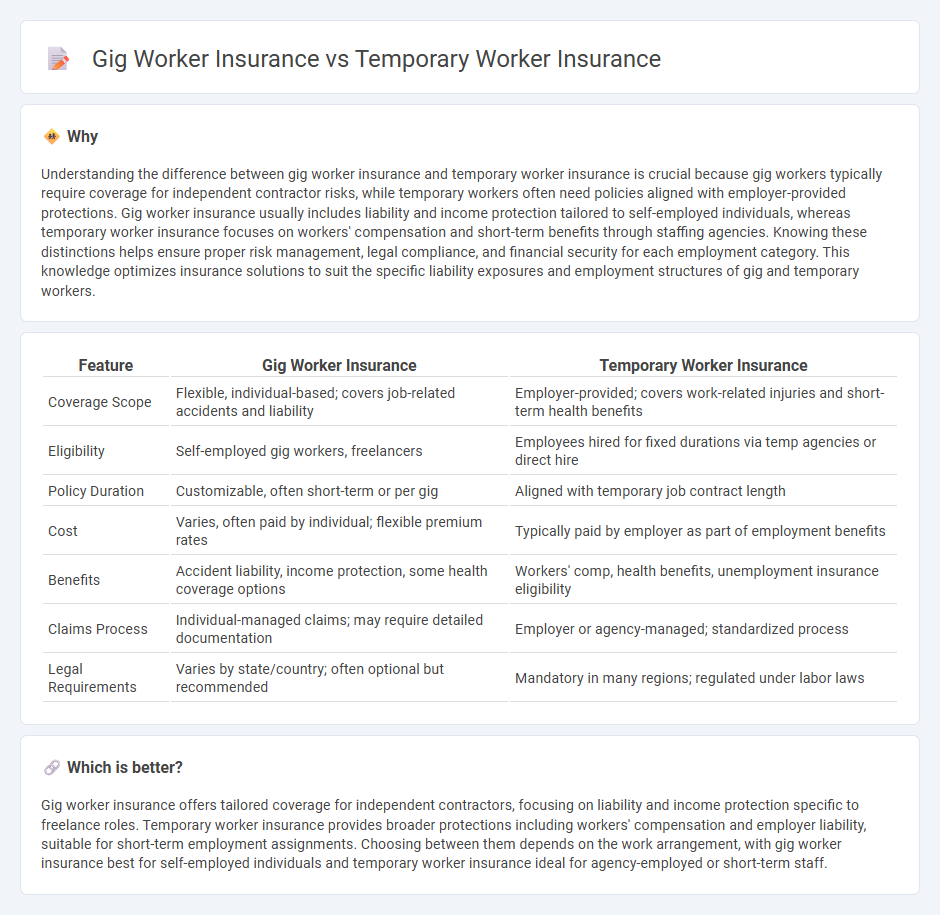

Understanding the difference between gig worker insurance and temporary worker insurance is crucial because gig workers typically require coverage for independent contractor risks, while temporary workers often need policies aligned with employer-provided protections. Gig worker insurance usually includes liability and income protection tailored to self-employed individuals, whereas temporary worker insurance focuses on workers' compensation and short-term benefits through staffing agencies. Knowing these distinctions helps ensure proper risk management, legal compliance, and financial security for each employment category. This knowledge optimizes insurance solutions to suit the specific liability exposures and employment structures of gig and temporary workers.

Comparison Table

| Feature | Gig Worker Insurance | Temporary Worker Insurance |

|---|---|---|

| Coverage Scope | Flexible, individual-based; covers job-related accidents and liability | Employer-provided; covers work-related injuries and short-term health benefits |

| Eligibility | Self-employed gig workers, freelancers | Employees hired for fixed durations via temp agencies or direct hire |

| Policy Duration | Customizable, often short-term or per gig | Aligned with temporary job contract length |

| Cost | Varies, often paid by individual; flexible premium rates | Typically paid by employer as part of employment benefits |

| Benefits | Accident liability, income protection, some health coverage options | Workers' comp, health benefits, unemployment insurance eligibility |

| Claims Process | Individual-managed claims; may require detailed documentation | Employer or agency-managed; standardized process |

| Legal Requirements | Varies by state/country; often optional but recommended | Mandatory in many regions; regulated under labor laws |

Which is better?

Gig worker insurance offers tailored coverage for independent contractors, focusing on liability and income protection specific to freelance roles. Temporary worker insurance provides broader protections including workers' compensation and employer liability, suitable for short-term employment assignments. Choosing between them depends on the work arrangement, with gig worker insurance best for self-employed individuals and temporary worker insurance ideal for agency-employed or short-term staff.

Connection

Gig worker insurance and temporary worker insurance both provide tailored coverage for non-permanent employment arrangements, addressing unique risks such as income volatility and lack of traditional employee benefits. These insurance types often include protections like liability coverage, health benefits, and workers' compensation designed to safeguard individuals in flexible or short-term jobs. By bridging gaps left by conventional employer-based insurance, they ensure financial security and risk management for those engaged in gig or temporary work.

Key Terms

Temporary worker insurance:

Temporary worker insurance provides coverage specifically tailored for individuals employed on short-term contracts, protecting against risks such as workplace injuries, liability claims, and wage disputes. This insurance often includes workers' compensation and liability coverage to ensure compliance with labor laws and safeguard employers from financial losses. Explore detailed policy options to understand how temporary worker insurance can effectively mitigate risks in your workforce.

Short-term Coverage

Temporary worker insurance provides short-term coverage tailored for individuals employed on fixed, limited durations, ensuring protection against workplace injuries and liabilities during employment periods. Gig worker insurance offers flexible short-term policies designed for independent contractors and freelancers, covering diverse risks like equipment damage and income loss amid unpredictable job schedules. Explore detailed comparisons to find the ideal short-term insurance solution that fits your work arrangement.

Employer Liability

Temporary worker insurance primarily covers employer liability related to workplace injuries and compliance with labor laws, ensuring protection against claims made by temporary staff. Gig worker insurance, on the other hand, often provides more specialized coverage tailored to independent contractors, addressing risks unique to gig economy roles, such as liability for non-employment-related incidents. Explore the key differences and benefits of each insurance type to safeguard your business effectively.

Source and External Links

Are Temporary Full-Time Employees Eligible for Benefits? - This article discusses the eligibility of temporary full-time employees for benefits, including health insurance under the Affordable Care Act (ACA) and the conditions for offering these benefits.

Guide to insurance for temporary workers - Explains various health insurance options available to temporary and part-time workers, such as individual plans, COBRA, and short-term health insurance.

Temporary workers: understand your liability - Provides insights into the liability risks associated with hiring temporary workers, including workers' compensation and general liability claims.

dowidth.com

dowidth.com