Insurtech platforms leverage cutting-edge technology to offer personalized insurance solutions, enhancing customer experience through automation and data analytics. Insurance aggregators compile and compare multiple insurance policies from various providers, simplifying the selection process by presenting options side-by-side. Explore how these innovative models transform insurance purchasing by visiting our detailed guide.

Why it is important

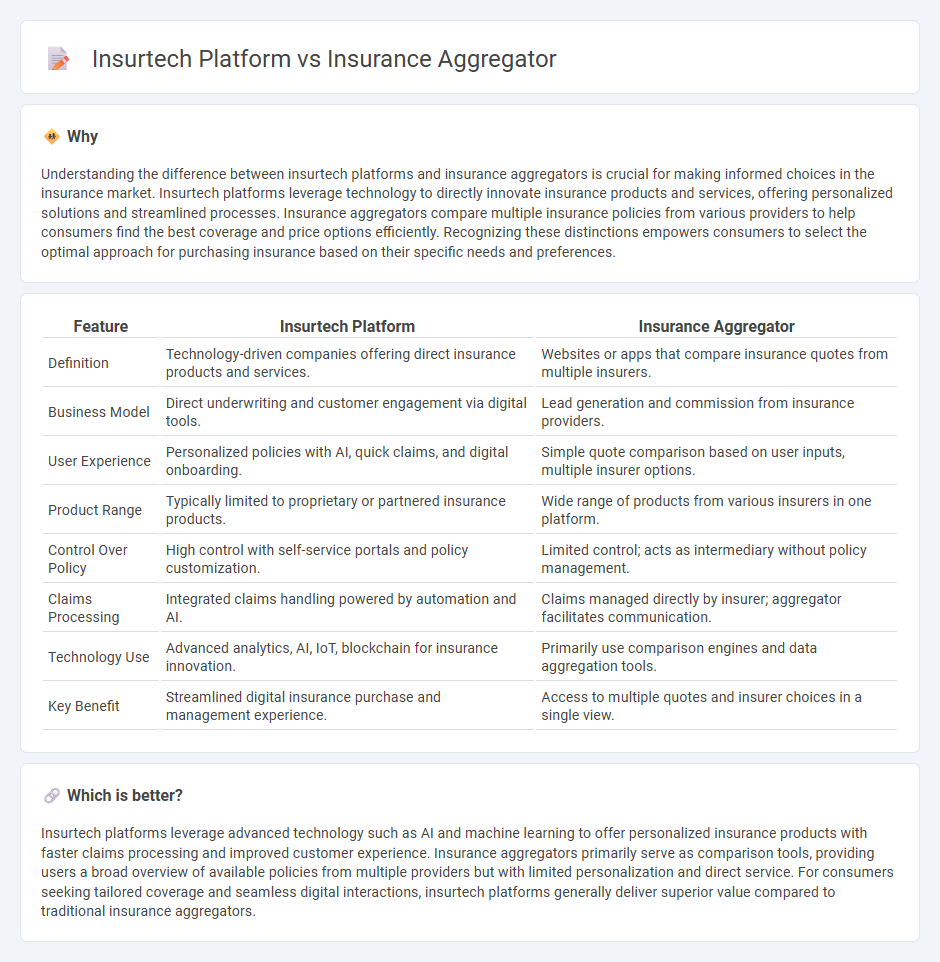

Understanding the difference between insurtech platforms and insurance aggregators is crucial for making informed choices in the insurance market. Insurtech platforms leverage technology to directly innovate insurance products and services, offering personalized solutions and streamlined processes. Insurance aggregators compare multiple insurance policies from various providers to help consumers find the best coverage and price options efficiently. Recognizing these distinctions empowers consumers to select the optimal approach for purchasing insurance based on their specific needs and preferences.

Comparison Table

| Feature | Insurtech Platform | Insurance Aggregator |

|---|---|---|

| Definition | Technology-driven companies offering direct insurance products and services. | Websites or apps that compare insurance quotes from multiple insurers. |

| Business Model | Direct underwriting and customer engagement via digital tools. | Lead generation and commission from insurance providers. |

| User Experience | Personalized policies with AI, quick claims, and digital onboarding. | Simple quote comparison based on user inputs, multiple insurer options. |

| Product Range | Typically limited to proprietary or partnered insurance products. | Wide range of products from various insurers in one platform. |

| Control Over Policy | High control with self-service portals and policy customization. | Limited control; acts as intermediary without policy management. |

| Claims Processing | Integrated claims handling powered by automation and AI. | Claims managed directly by insurer; aggregator facilitates communication. |

| Technology Use | Advanced analytics, AI, IoT, blockchain for insurance innovation. | Primarily use comparison engines and data aggregation tools. |

| Key Benefit | Streamlined digital insurance purchase and management experience. | Access to multiple quotes and insurer choices in a single view. |

Which is better?

Insurtech platforms leverage advanced technology such as AI and machine learning to offer personalized insurance products with faster claims processing and improved customer experience. Insurance aggregators primarily serve as comparison tools, providing users a broad overview of available policies from multiple providers but with limited personalization and direct service. For consumers seeking tailored coverage and seamless digital interactions, insurtech platforms generally deliver superior value compared to traditional insurance aggregators.

Connection

Insurtech platforms leverage advanced technologies like AI and big data to streamline insurance processes and enhance customer experience. Insurance aggregators utilize these platforms to compare multiple insurance policies, providing users with personalized quotes and options efficiently. The integration of insurtech solutions within aggregators enables seamless data analysis, improved risk assessment, and faster purchasing decisions.

Key Terms

**Insurance Aggregator:**

Insurance aggregators function as digital marketplaces where multiple insurance policies from various providers are compared side-by-side, enabling consumers to make informed decisions based on price, coverage, and customer reviews. Unlike insurtech platforms, which often innovate in underwriting, claims processing, or customer interaction through technology, aggregators primarily focus on streamlining the search and selection process. Discover how insurance aggregators can simplify your insurance shopping experience and save you money.

Comparison Portal

Insurance aggregators serve as comparison portals by allowing users to evaluate multiple insurance policies side-by-side based on coverage, price, and provider reputation. Insurtech platforms often include innovative features such as AI-driven risk assessment, personalized policy recommendations, and streamlined digital claims processing, differentiating them from traditional aggregator portals. Explore the evolving landscape of insurance technology to understand how these platforms can enhance your insurance buying experience.

Policy Marketplace

Insurance aggregators primarily serve as comparison tools, allowing users to browse and compare multiple insurance policies based on premium, coverage, and provider ratings within a Policy Marketplace. Insurtech platforms go beyond aggregation by offering seamless digital policy purchase, customized insurance products, and integrated claims management powered by advanced technology. Explore how these innovations transform the insurance buying experience and enhance consumer empowerment.

Source and External Links

What is an Insurance Aggregator? Unpacking the Benefits - Insurance aggregators connect independent agents with multiple carriers, offering access to a broader range of products, competitive commissions, and valuable business tools while allowing agents to maintain their independence.

Insurance 101: What Are Aggregators, Networks, And Clusters? - Insurance aggregators group together multiple agencies under a single framework, pooling premiums and resources to provide access to more carriers, centralized technology, and marketing support, reducing administrative burdens for members.

Choosing Your Path: Understanding Insurance Aggregators ... - SIAA - By banding together, independent agencies in an aggregator leverage collective volume to negotiate better terms, access a wider variety of insurance products, and often receive higher commissions and shared resources.

dowidth.com

dowidth.com