Flood risk modeling focuses on assessing potential damages and losses caused by flood events at a specific location or region, using hydrological data and geographic information systems (GIS). Portfolio risk modeling evaluates the aggregated risk of multiple insurance policies, quantifying exposure across diverse perils and regions to optimize underwriting and capital allocation. Explore the differences and applications of flood risk and portfolio risk modeling to enhance insurance decision-making.

Why it is important

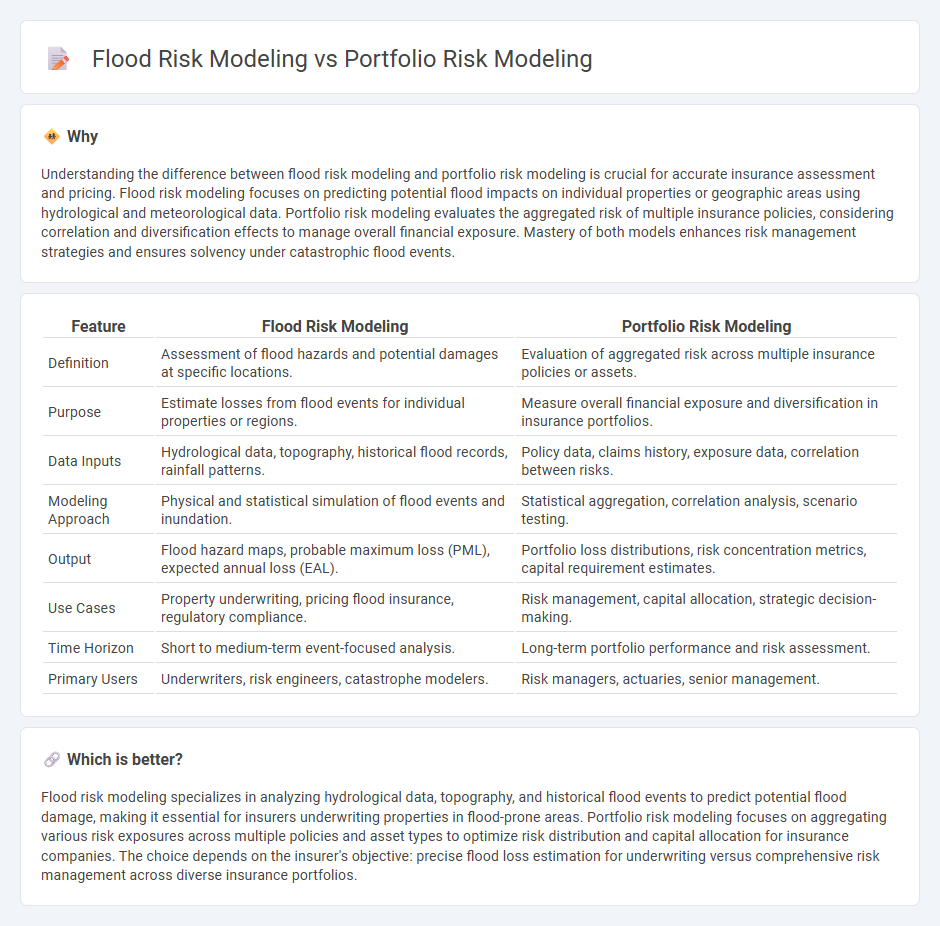

Understanding the difference between flood risk modeling and portfolio risk modeling is crucial for accurate insurance assessment and pricing. Flood risk modeling focuses on predicting potential flood impacts on individual properties or geographic areas using hydrological and meteorological data. Portfolio risk modeling evaluates the aggregated risk of multiple insurance policies, considering correlation and diversification effects to manage overall financial exposure. Mastery of both models enhances risk management strategies and ensures solvency under catastrophic flood events.

Comparison Table

| Feature | Flood Risk Modeling | Portfolio Risk Modeling |

|---|---|---|

| Definition | Assessment of flood hazards and potential damages at specific locations. | Evaluation of aggregated risk across multiple insurance policies or assets. |

| Purpose | Estimate losses from flood events for individual properties or regions. | Measure overall financial exposure and diversification in insurance portfolios. |

| Data Inputs | Hydrological data, topography, historical flood records, rainfall patterns. | Policy data, claims history, exposure data, correlation between risks. |

| Modeling Approach | Physical and statistical simulation of flood events and inundation. | Statistical aggregation, correlation analysis, scenario testing. |

| Output | Flood hazard maps, probable maximum loss (PML), expected annual loss (EAL). | Portfolio loss distributions, risk concentration metrics, capital requirement estimates. |

| Use Cases | Property underwriting, pricing flood insurance, regulatory compliance. | Risk management, capital allocation, strategic decision-making. |

| Time Horizon | Short to medium-term event-focused analysis. | Long-term portfolio performance and risk assessment. |

| Primary Users | Underwriters, risk engineers, catastrophe modelers. | Risk managers, actuaries, senior management. |

Which is better?

Flood risk modeling specializes in analyzing hydrological data, topography, and historical flood events to predict potential flood damage, making it essential for insurers underwriting properties in flood-prone areas. Portfolio risk modeling focuses on aggregating various risk exposures across multiple policies and asset types to optimize risk distribution and capital allocation for insurance companies. The choice depends on the insurer's objective: precise flood loss estimation for underwriting versus comprehensive risk management across diverse insurance portfolios.

Connection

Flood risk modeling quantifies potential financial losses from flood events by analyzing hydrological data, geographic factors, and property exposure. Portfolio risk modeling aggregates individual flood risk assessments to evaluate the overall risk exposure of insurance portfolios, enabling insurers to optimize underwriting and capital allocation. Integrating flood risk data into portfolio models enhances predictive accuracy, improves risk diversification strategies, and supports regulatory compliance.

Key Terms

**Portfolio risk modeling:**

Portfolio risk modeling evaluates the potential financial losses across a diverse set of investments by assessing correlations, market volatility, and asset-specific risks to optimize return and minimize exposure. It incorporates quantitative techniques like Value at Risk (VaR), stress testing, and scenario analysis to predict the impact of market fluctuations on portfolio value. Explore deeper methodologies and applications in portfolio risk modeling to enhance investment decision-making.

Correlation

Portfolio risk modeling uses correlation to assess how individual asset returns move together, helping to diversify investments and reduce overall financial risk. Flood risk modeling leverages correlation to understand the relationship between environmental factors like rainfall, river flow, and topography, improving flood prediction accuracy. Explore detailed methodologies and applications of correlation in both risk modeling fields to enhance risk management strategies.

Diversification

Portfolio risk modeling evaluates financial asset correlations to minimize overall exposure through strategic diversification, leveraging historical data and statistical techniques to optimize risk-adjusted returns. Flood risk modeling assesses geographic and hydrological variables to predict flood probabilities and potential damages, informing urban planning and insurance strategies without the benefits of financial diversification. Explore deeper insights on how diversification principles uniquely influence risk mitigation in these domains.

Source and External Links

Portfolio Risk Management - This webpage discusses the importance of portfolio risk management in protecting investments and balancing risk levels within a portfolio.

Portfolio Risk Management - It outlines the process of identifying, measuring, and addressing potential risks affecting a portfolio's performance.

Financial Risk Modeling - This Wikipedia article covers the use of mathematical techniques to measure and control market, credit, and operational risks in financial portfolios.

dowidth.com

dowidth.com