Flood insurance integration involves incorporating specialized coverage that protects properties against water damage caused by flooding, often requiring collaboration with meteorological data and local government floodplain maps. Earthquake insurance integration focuses on providing financial protection against seismic activity, utilizing geological risk assessments and structural vulnerability analyses to tailor premiums and coverage limits. Discover more about how integrating these specific insurances enhances risk management and financial resilience.

Why it is important

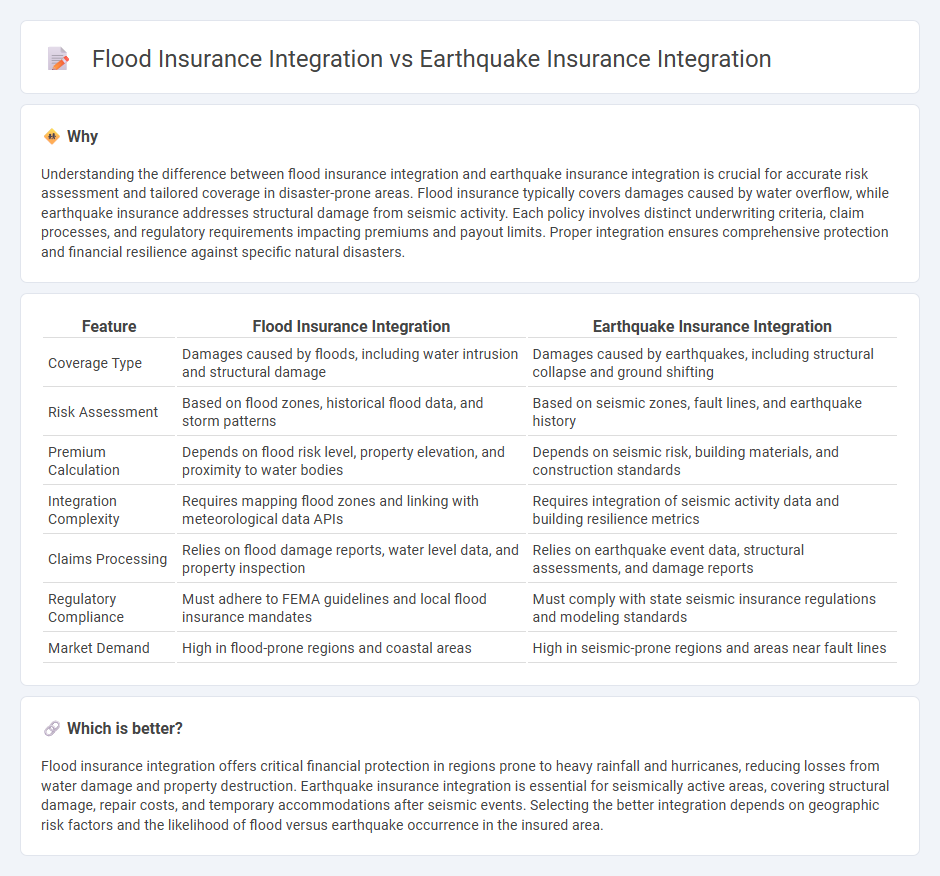

Understanding the difference between flood insurance integration and earthquake insurance integration is crucial for accurate risk assessment and tailored coverage in disaster-prone areas. Flood insurance typically covers damages caused by water overflow, while earthquake insurance addresses structural damage from seismic activity. Each policy involves distinct underwriting criteria, claim processes, and regulatory requirements impacting premiums and payout limits. Proper integration ensures comprehensive protection and financial resilience against specific natural disasters.

Comparison Table

| Feature | Flood Insurance Integration | Earthquake Insurance Integration |

|---|---|---|

| Coverage Type | Damages caused by floods, including water intrusion and structural damage | Damages caused by earthquakes, including structural collapse and ground shifting |

| Risk Assessment | Based on flood zones, historical flood data, and storm patterns | Based on seismic zones, fault lines, and earthquake history |

| Premium Calculation | Depends on flood risk level, property elevation, and proximity to water bodies | Depends on seismic risk, building materials, and construction standards |

| Integration Complexity | Requires mapping flood zones and linking with meteorological data APIs | Requires integration of seismic activity data and building resilience metrics |

| Claims Processing | Relies on flood damage reports, water level data, and property inspection | Relies on earthquake event data, structural assessments, and damage reports |

| Regulatory Compliance | Must adhere to FEMA guidelines and local flood insurance mandates | Must comply with state seismic insurance regulations and modeling standards |

| Market Demand | High in flood-prone regions and coastal areas | High in seismic-prone regions and areas near fault lines |

Which is better?

Flood insurance integration offers critical financial protection in regions prone to heavy rainfall and hurricanes, reducing losses from water damage and property destruction. Earthquake insurance integration is essential for seismically active areas, covering structural damage, repair costs, and temporary accommodations after seismic events. Selecting the better integration depends on geographic risk factors and the likelihood of flood versus earthquake occurrence in the insured area.

Connection

Flood insurance integration and earthquake insurance integration are connected through their role in comprehensive natural disaster risk management, enabling policyholders to secure coverage against distinct yet potentially concurrent hazards. Both types of insurance often require specialized underwriting criteria and government-backed programs, such as the National Flood Insurance Program (NFIP) and earthquake insurance pools, to address geographic and seismic risk factors effectively. Integrated insurance solutions enhance resilience by providing financial protection that accounts for multiple environmental threats within high-risk regions.

Key Terms

Risk Assessment

Earthquake insurance integration emphasizes seismic hazard mapping, ground acceleration data, and building structural resilience to assess risk accurately. Flood insurance integration relies heavily on hydrological data, floodplain mapping, and historical flood frequency to evaluate potential damage and financial exposure. Explore deeper insights into how these distinct risk assessment approaches shape comprehensive insurance solutions.

Coverage Exclusions

Earthquake insurance integration typically excludes damage resulting from floods, landslides, or tsunamis, whereas flood insurance integration excludes damages caused by earthquakes or structural fires. These coverage exclusions emphasize the importance of understanding policy-specific limits within multi-hazard insurance frameworks. Explore how combining both earthquake and flood insurance can optimize comprehensive property protection.

Premium Calculation

Earthquake insurance integration typically involves complex seismic risk modeling based on fault lines, ground motion data, and regional construction resilience, resulting in highly variable premium calculations tailored to specific locales. Flood insurance integration relies heavily on hydrological analysis, flood zones, and historical water level data, which standardizes premium rates but requires dynamic assessment due to changing climate patterns. Explore the detailed mechanisms behind these premium calculation methodologies to better understand their impact on insurance pricing strategies.

Source and External Links

Residential Earthquake Insurance - This webpage provides information on how earthquake insurance covers damages to homes and personal belongings, and how it can be integrated into existing insurance policies.

Earthquake Insurance: Understanding Coverage & Costs - The page discusses the importance of having earthquake insurance, its coverage options, and how it can be integrated as a separate policy to protect against earth movement damage.

Earthquake Insurance - California Department of Insurance - This guide explains how earthquake insurance integrates basic coverage for homes and belongings through the California Earthquake Authority, offering deductibles and limits that match homeowners insurance.

dowidth.com

dowidth.com