Decoupled insurance separates policy issuance from risk management, allowing specialized entities to handle underwriting and claims independently for increased flexibility and efficiency. Microinsurance targets low-income populations, offering affordable coverage for specific risks such as health, property, or crop insurance tailored to their needs. Explore how decoupled insurance and microinsurance are transforming risk protection in underserved markets.

Why it is important

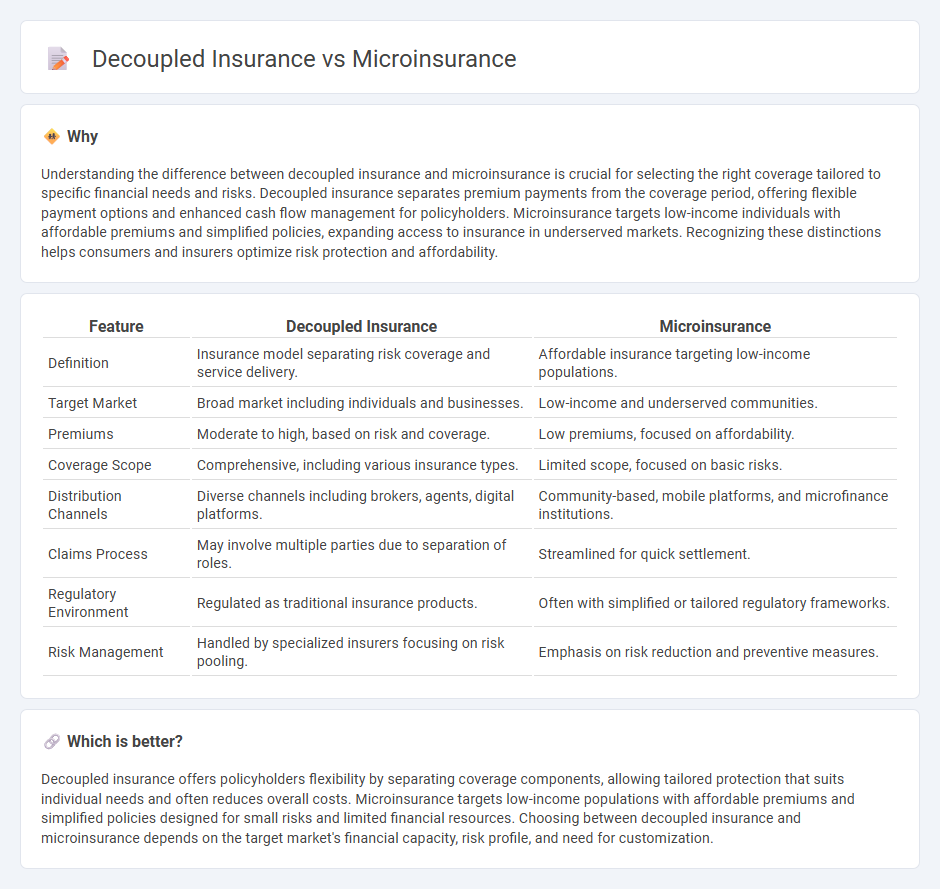

Understanding the difference between decoupled insurance and microinsurance is crucial for selecting the right coverage tailored to specific financial needs and risks. Decoupled insurance separates premium payments from the coverage period, offering flexible payment options and enhanced cash flow management for policyholders. Microinsurance targets low-income individuals with affordable premiums and simplified policies, expanding access to insurance in underserved markets. Recognizing these distinctions helps consumers and insurers optimize risk protection and affordability.

Comparison Table

| Feature | Decoupled Insurance | Microinsurance |

|---|---|---|

| Definition | Insurance model separating risk coverage and service delivery. | Affordable insurance targeting low-income populations. |

| Target Market | Broad market including individuals and businesses. | Low-income and underserved communities. |

| Premiums | Moderate to high, based on risk and coverage. | Low premiums, focused on affordability. |

| Coverage Scope | Comprehensive, including various insurance types. | Limited scope, focused on basic risks. |

| Distribution Channels | Diverse channels including brokers, agents, digital platforms. | Community-based, mobile platforms, and microfinance institutions. |

| Claims Process | May involve multiple parties due to separation of roles. | Streamlined for quick settlement. |

| Regulatory Environment | Regulated as traditional insurance products. | Often with simplified or tailored regulatory frameworks. |

| Risk Management | Handled by specialized insurers focusing on risk pooling. | Emphasis on risk reduction and preventive measures. |

Which is better?

Decoupled insurance offers policyholders flexibility by separating coverage components, allowing tailored protection that suits individual needs and often reduces overall costs. Microinsurance targets low-income populations with affordable premiums and simplified policies designed for small risks and limited financial resources. Choosing between decoupled insurance and microinsurance depends on the target market's financial capacity, risk profile, and need for customization.

Connection

Decoupled insurance and microinsurance are connected through their shared goal of increasing accessibility and affordability of insurance products for underserved populations. Decoupled insurance leverages digital platforms and APIs to separate insurance services from traditional distribution channels, enabling microinsurance to reach low-income clients efficiently. This integration allows microinsurance providers to offer tailored, low-cost coverage with streamlined claims processing, enhancing financial inclusion globally.

Key Terms

Coverage Scope

Microinsurance offers targeted policies designed for low-income individuals, covering essential risks like health, agriculture, and property with affordable premiums. Decoupled insurance separates risk coverage from traditional underwriting processes, often enabling more flexible and tailored insurance solutions across diverse sectors. Explore the nuances and benefits of each model to determine which coverage scope best fits your needs.

Premium Structure

Microinsurance typically features low, flexible premiums designed to accommodate low-income individuals, often paid in small, frequent amounts tailored to the policyholder's cash flow. Decoupled insurance separates the premium payment from the risk coverage, allowing for innovative pricing models such as parametric triggers or installment-based payments that enhance affordability and transparency. Explore further to understand how these premium structures impact customer accessibility and risk management.

Target Market

Microinsurance primarily targets low-income individuals and underserved communities, offering affordable coverage tailored to their specific risks such as agriculture, health, and natural disasters. Decoupled insurance focuses on segmenting risk by separating traditional bundled policies into standalone products, appealing to niche markets seeking customized insurance solutions. Explore the differences in target markets and benefits to understand which insurance model best suits your needs.

Source and External Links

Microinsurance - Microinsurance provides low-cost insurance products designed for low-income individuals, focusing on health, belongings, and accidents with low premiums and coverage caps.

Background on Microinsurance and Emerging Markets - This article discusses how insurers are expanding into emerging markets through microinsurance projects, offering affordable protection to underserved populations.

Microinsurance Network - The Microinsurance Network is a global organization dedicated to promoting microinsurance development and delivery for low-income individuals.

dowidth.com

dowidth.com