Flood insurance integration focuses on protecting properties against water damage from natural disasters, emphasizing risk assessment and coverage options tailored to environmental hazards. Health insurance integration centers on providing access to medical care and managing healthcare costs through coordinated benefits and provider networks. Explore further to understand the distinct advantages and implementation strategies of flood versus health insurance integration.

Why it is important

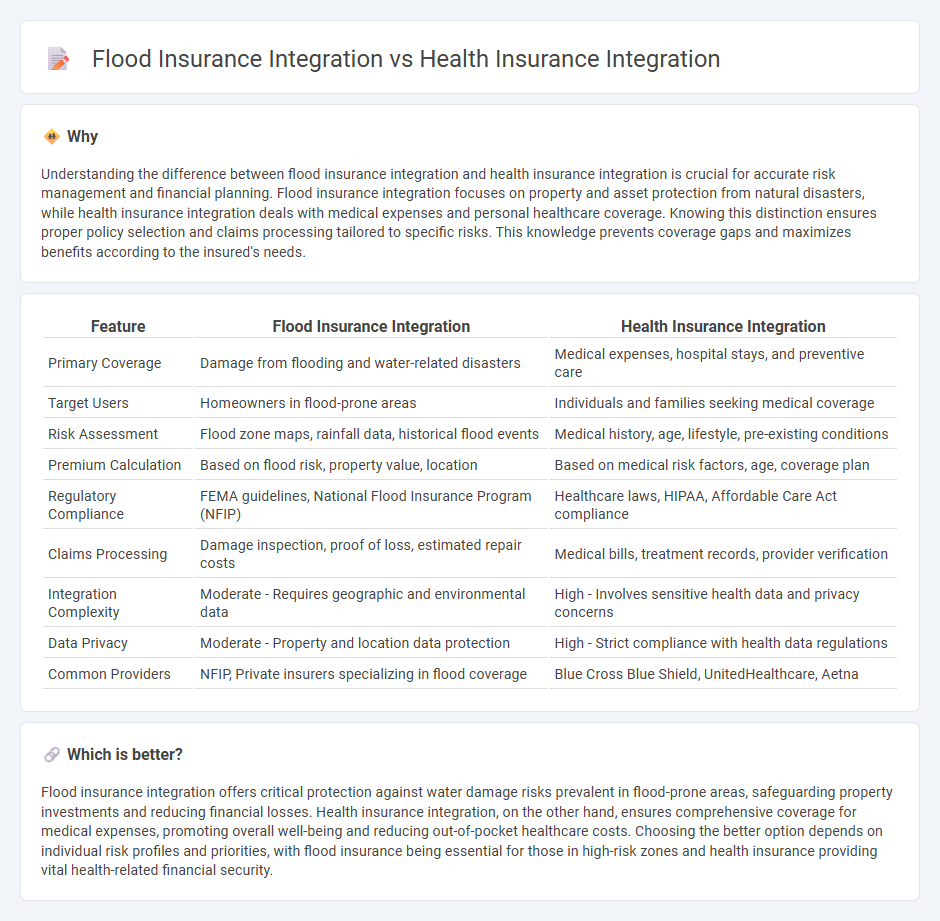

Understanding the difference between flood insurance integration and health insurance integration is crucial for accurate risk management and financial planning. Flood insurance integration focuses on property and asset protection from natural disasters, while health insurance integration deals with medical expenses and personal healthcare coverage. Knowing this distinction ensures proper policy selection and claims processing tailored to specific risks. This knowledge prevents coverage gaps and maximizes benefits according to the insured's needs.

Comparison Table

| Feature | Flood Insurance Integration | Health Insurance Integration |

|---|---|---|

| Primary Coverage | Damage from flooding and water-related disasters | Medical expenses, hospital stays, and preventive care |

| Target Users | Homeowners in flood-prone areas | Individuals and families seeking medical coverage |

| Risk Assessment | Flood zone maps, rainfall data, historical flood events | Medical history, age, lifestyle, pre-existing conditions |

| Premium Calculation | Based on flood risk, property value, location | Based on medical risk factors, age, coverage plan |

| Regulatory Compliance | FEMA guidelines, National Flood Insurance Program (NFIP) | Healthcare laws, HIPAA, Affordable Care Act compliance |

| Claims Processing | Damage inspection, proof of loss, estimated repair costs | Medical bills, treatment records, provider verification |

| Integration Complexity | Moderate - Requires geographic and environmental data | High - Involves sensitive health data and privacy concerns |

| Data Privacy | Moderate - Property and location data protection | High - Strict compliance with health data regulations |

| Common Providers | NFIP, Private insurers specializing in flood coverage | Blue Cross Blue Shield, UnitedHealthcare, Aetna |

Which is better?

Flood insurance integration offers critical protection against water damage risks prevalent in flood-prone areas, safeguarding property investments and reducing financial losses. Health insurance integration, on the other hand, ensures comprehensive coverage for medical expenses, promoting overall well-being and reducing out-of-pocket healthcare costs. Choosing the better option depends on individual risk profiles and priorities, with flood insurance being essential for those in high-risk zones and health insurance providing vital health-related financial security.

Connection

Flood insurance integration and health insurance integration are connected through their shared goal of comprehensive risk management and financial protection during emergencies. Both integrations involve aligning policy coverage with individual needs and environmental risk factors, ensuring policyholders receive timely support for property damage and medical expenses. Leveraging data analytics from flood risk assessments and health claims enables insurers to develop tailored packages that reduce overall vulnerability and enhance resilience.

Key Terms

**Health Insurance Integration:**

Health insurance integration streamlines patient access to medical services by coordinating benefits between multiple health plans, reducing out-of-pocket expenses and minimizing claim denials. It leverages advanced data-sharing technology to verify coverage in real-time, improving accuracy in billing and accelerating reimbursement processes. Discover how health insurance integration enhances healthcare efficiency and patient satisfaction by exploring key strategies and technological solutions.

Coordination of Benefits

Coordination of Benefits (COB) ensures that health insurance claims are paid correctly when multiple health plans are involved, preventing duplicate payments and optimizing coverage for medical services. In contrast, flood insurance integration focuses on coordinating policies between private insurers and the National Flood Insurance Program (NFIP) to provide comprehensive coverage for flood-related damages without overlap. Explore detailed differences in Coordination of Benefits between health and flood insurance integrations to enhance your risk management strategy.

Claims Processing

Health insurance integration streamlines claims processing by automating patient data verification and coordinating benefits across multiple providers, reducing errors and turnaround time. Flood insurance integration focuses on validating damage claims through detailed risk assessments and fast-tracking payouts based on real-time environmental data and adjuster reports. Explore how advanced claims processing technologies optimize both health and flood insurance benefits for faster, more accurate settlements.

Source and External Links

The Value of Integrated Supplemental Coverage | Anthem - Integrating supplemental health and disability benefits streamlines claims, reduces duplicate paperwork, and can support better absence management and productivity.

Integrated Health Care Plans Help Holistic Care & Costs - Combining medical, behavioral, and pharmacy coverage within a single plan leads to more coordinated care, improved health outcomes, and lower costs for both employers and employees.

5 benefits of integrated health care plans | HealthPartners Plan Blog - Consolidated insurance through one provider simplifies administration, reporting, and member access, making benefits management more convenient for employers and employees alike.

dowidth.com

dowidth.com