Insurtech sandboxes provide a controlled regulatory environment enabling innovative insurance technology solutions to be tested with real customers while mitigating risks. Cyber insurance offers specialized coverage protecting businesses against financial losses from cyberattacks, data breaches, and digital threats. Discover how these advancements shape the future of risk management and digital insurance solutions.

Why it is important

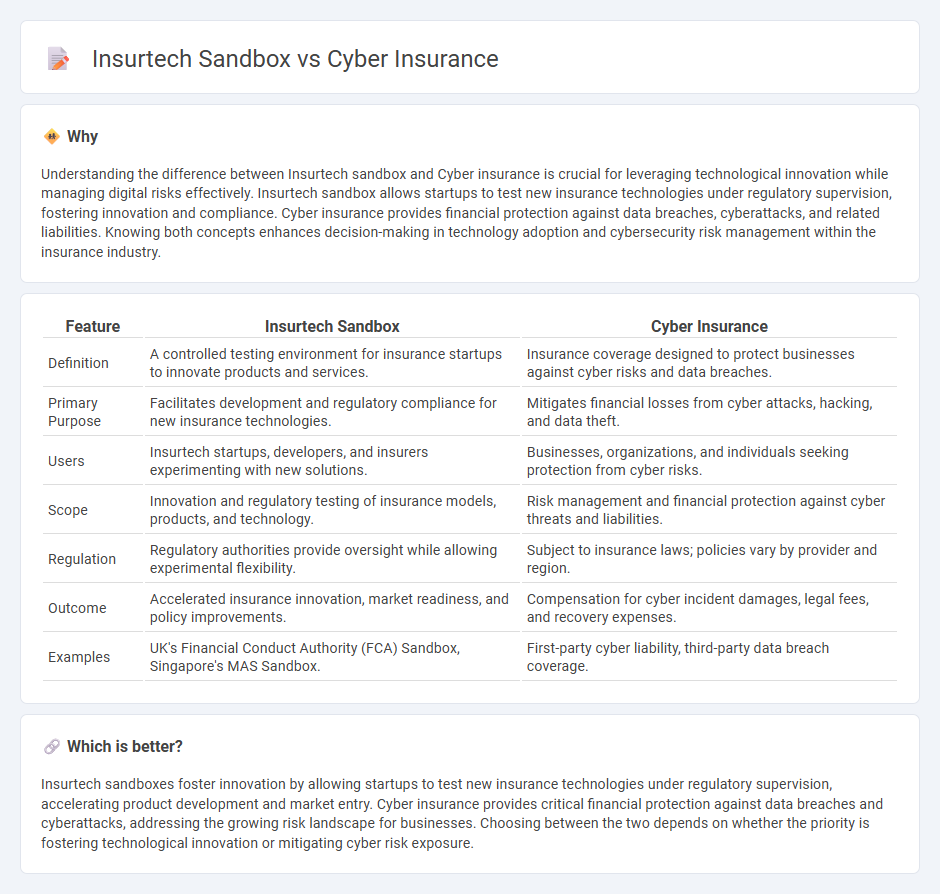

Understanding the difference between Insurtech sandbox and Cyber insurance is crucial for leveraging technological innovation while managing digital risks effectively. Insurtech sandbox allows startups to test new insurance technologies under regulatory supervision, fostering innovation and compliance. Cyber insurance provides financial protection against data breaches, cyberattacks, and related liabilities. Knowing both concepts enhances decision-making in technology adoption and cybersecurity risk management within the insurance industry.

Comparison Table

| Feature | Insurtech Sandbox | Cyber Insurance |

|---|---|---|

| Definition | A controlled testing environment for insurance startups to innovate products and services. | Insurance coverage designed to protect businesses against cyber risks and data breaches. |

| Primary Purpose | Facilitates development and regulatory compliance for new insurance technologies. | Mitigates financial losses from cyber attacks, hacking, and data theft. |

| Users | Insurtech startups, developers, and insurers experimenting with new solutions. | Businesses, organizations, and individuals seeking protection from cyber risks. |

| Scope | Innovation and regulatory testing of insurance models, products, and technology. | Risk management and financial protection against cyber threats and liabilities. |

| Regulation | Regulatory authorities provide oversight while allowing experimental flexibility. | Subject to insurance laws; policies vary by provider and region. |

| Outcome | Accelerated insurance innovation, market readiness, and policy improvements. | Compensation for cyber incident damages, legal fees, and recovery expenses. |

| Examples | UK's Financial Conduct Authority (FCA) Sandbox, Singapore's MAS Sandbox. | First-party cyber liability, third-party data breach coverage. |

Which is better?

Insurtech sandboxes foster innovation by allowing startups to test new insurance technologies under regulatory supervision, accelerating product development and market entry. Cyber insurance provides critical financial protection against data breaches and cyberattacks, addressing the growing risk landscape for businesses. Choosing between the two depends on whether the priority is fostering technological innovation or mitigating cyber risk exposure.

Connection

Insurtech sandboxes accelerate innovation by providing a controlled environment for testing new cyber insurance products and risk models, enhancing cybersecurity coverage. Cyber insurance benefits from sandbox-driven advancements by integrating real-time threat data and adaptive policy frameworks to address emerging cyber threats. This synergy promotes more accurate risk assessment and claims processing, improving resilience against cyberattacks.

Key Terms

**Cyber insurance:**

Cyber insurance protects businesses from financial losses due to cyberattacks, data breaches, and other digital threats, offering coverage for liability, data recovery, and business interruption. This insurance is crucial for organizations handling sensitive customer information or operating critical infrastructure amid rising cybercrime incidents. Explore how cyber insurance can safeguard your enterprise and enhance resilience in an increasingly digital world.

Data Breach

Cyber insurance provides financial protection against data breaches by covering costs like notification, remediation, and legal fees, while insurtech sandboxes facilitate the testing of innovative cybersecurity solutions in a controlled regulatory environment to improve breach response. Data breach risk assessment within cyber insurance uses real-time threat data and historical breach analysis, whereas insurtech sandboxes enable startups to develop adaptive tools for early breach detection and mitigation strategies. Discover how these complementary approaches evolve data breach management and enhance organizational cybersecurity resilience.

Ransomware

Cyber insurance policies provide financial protection against ransomware attacks by covering costs such as data recovery, legal fees, and business interruption. Insurtech sandboxes allow startups and insurers to test innovative ransomware risk models and automated claim processes in a controlled regulatory environment. Explore how these tools are transforming ransomware risk management and resilience strategies.

Source and External Links

What is Cyber Insurance? | IBM - This webpage provides an overview of cyber insurance, highlighting its role in covering financial losses due to cyberattacks and helping businesses recover from such incidents.

Cyber Insurance: What You Need to Consider Before Purchasing a Policy - This document explores considerations for purchasing cyber insurance, including cost management and coverage for various cyber-related incidents.

Cyber insurance - Wikipedia - This Wikipedia page defines cyber insurance as a specialty product protecting businesses from risks related to IT infrastructure and activities, highlighting its benefits and market dynamics.

dowidth.com

dowidth.com