Natural catastrophe bonds transfer risk from insurers to capital market investors, providing funding for disaster-related losses while offering attractive yields. Weather derivatives are financial instruments used to hedge against weather-related risks, such as temperature or rainfall variability, without direct loss transfer. Explore more about these innovative insurance tools and their impact on risk management.

Why it is important

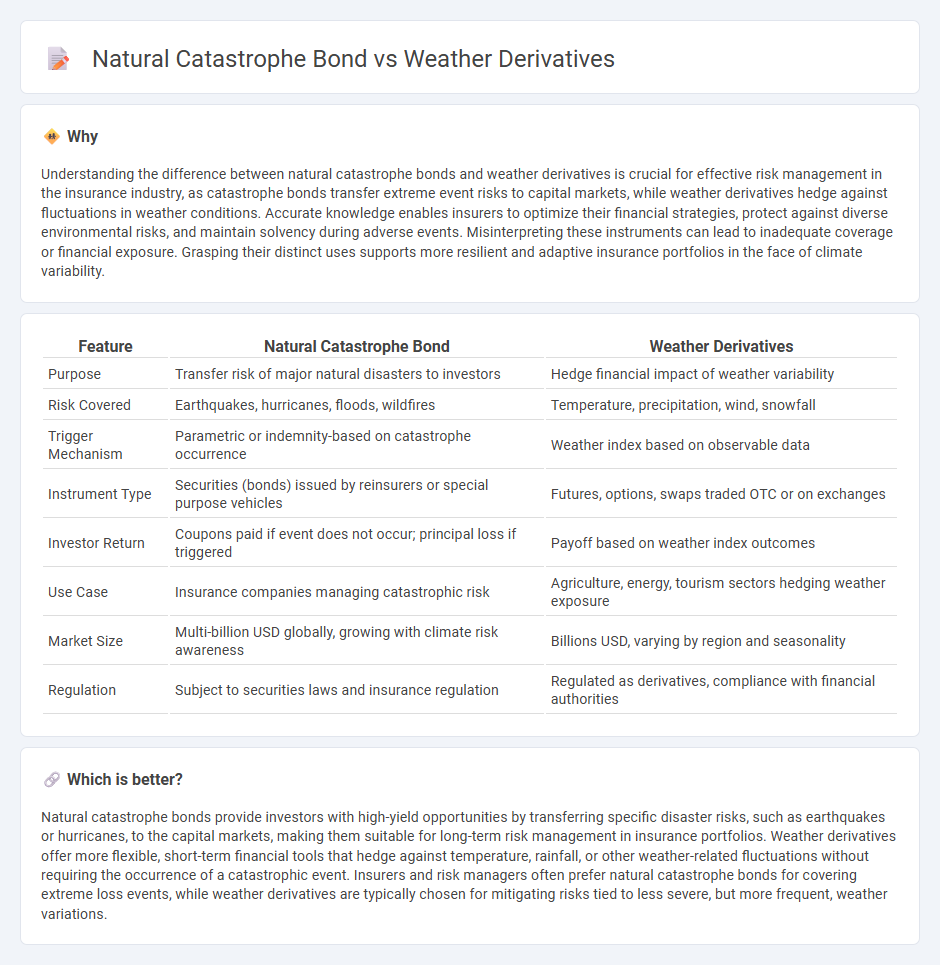

Understanding the difference between natural catastrophe bonds and weather derivatives is crucial for effective risk management in the insurance industry, as catastrophe bonds transfer extreme event risks to capital markets, while weather derivatives hedge against fluctuations in weather conditions. Accurate knowledge enables insurers to optimize their financial strategies, protect against diverse environmental risks, and maintain solvency during adverse events. Misinterpreting these instruments can lead to inadequate coverage or financial exposure. Grasping their distinct uses supports more resilient and adaptive insurance portfolios in the face of climate variability.

Comparison Table

| Feature | Natural Catastrophe Bond | Weather Derivatives |

|---|---|---|

| Purpose | Transfer risk of major natural disasters to investors | Hedge financial impact of weather variability |

| Risk Covered | Earthquakes, hurricanes, floods, wildfires | Temperature, precipitation, wind, snowfall |

| Trigger Mechanism | Parametric or indemnity-based on catastrophe occurrence | Weather index based on observable data |

| Instrument Type | Securities (bonds) issued by reinsurers or special purpose vehicles | Futures, options, swaps traded OTC or on exchanges |

| Investor Return | Coupons paid if event does not occur; principal loss if triggered | Payoff based on weather index outcomes |

| Use Case | Insurance companies managing catastrophic risk | Agriculture, energy, tourism sectors hedging weather exposure |

| Market Size | Multi-billion USD globally, growing with climate risk awareness | Billions USD, varying by region and seasonality |

| Regulation | Subject to securities laws and insurance regulation | Regulated as derivatives, compliance with financial authorities |

Which is better?

Natural catastrophe bonds provide investors with high-yield opportunities by transferring specific disaster risks, such as earthquakes or hurricanes, to the capital markets, making them suitable for long-term risk management in insurance portfolios. Weather derivatives offer more flexible, short-term financial tools that hedge against temperature, rainfall, or other weather-related fluctuations without requiring the occurrence of a catastrophic event. Insurers and risk managers often prefer natural catastrophe bonds for covering extreme loss events, while weather derivatives are typically chosen for mitigating risks tied to less severe, but more frequent, weather variations.

Connection

Natural catastrophe bonds and weather derivatives both serve as financial instruments designed to transfer and mitigate risks associated with extreme weather events and natural disasters. Catastrophe bonds provide insurance companies with capital relief by transferring risk to investors, while weather derivatives allow businesses to hedge against fluctuations in weather conditions affecting revenue or costs. Together, these instruments enable more effective risk management and financial stability in the face of climate-related uncertainties.

Key Terms

**Weather Derivatives:**

Weather derivatives are financial instruments used by companies to hedge against the risk of weather-related losses, such as temperature fluctuations, rainfall, or snowfall deviations. These derivatives are often traded on exchanges or over-the-counter markets, providing customizable contracts based on weather indexes like heating degree days (HDD) or cooling degree days (CDD). Explore the mechanisms and benefits of weather derivatives to better manage financial exposure to climate variability.

Hedging

Weather derivatives provide financial protection by allowing companies to hedge against specific weather-related risks such as temperature fluctuations or rainfall variations, using contracts tied to measurable weather indices. Natural catastrophe bonds transfer the risk of large-scale disasters like hurricanes or earthquakes to investors, paying out when predefined catastrophic events occur, thus offering capital relief to insurers. Explore the detailed mechanisms and benefits of these hedging instruments to optimize your risk management strategy.

Index-based payout

Weather derivatives provide financial protection by using index-based payouts tied to specific weather metrics, such as temperature or rainfall, enabling precise hedging against weather volatility without direct loss assessment. Natural catastrophe bonds offer investors risk transfer through payouts triggered by predefined catastrophe indices like hurricane wind speed or earthquake magnitude, linking bond returns to event severity rather than insured losses. Explore how these index-based financial instruments uniquely manage climate-related risks and investment strategies.

Source and External Links

Weathering the Storm: The Rise of $25B Weather Derivatives Market - Weather derivatives are financial instruments that provide protection against various weather conditions like rainfall or temperature, allowing companies to hedge against weather-related risks by trading contracts that pay out based on predefined weather indices, with significant market growth fueled by climate volatility and regulatory pressures.

What are weather derivatives? - Artemis - Resource Library - Weather derivatives help companies reduce financial risks caused by adverse weather by using measurable indices such as temperature, snowfall, or rainfall, and are widely used across sectors such as agriculture, tourism, and energy to smooth earnings during unfavorable weather events.

Weather derivative - Wikipedia - Weather derivatives are index-based contracts that use observed weather data to create payout triggers, modeled using statistical or physical weather models, and allow users to hedge weather-related risks for periods beyond typical weather forecasts, often combining multiple modeling approaches for accurate risk management.

dowidth.com

dowidth.com