Ghost broking involves fraudulent intermediaries selling fake or invalid insurance policies, leading to clients having no legitimate coverage despite paying premiums. Premium diversion occurs when authorized insurance agents or brokers embezzle or misappropriate clients' premium payments instead of forwarding them to the insurer, resulting in invalid policies and financial losses. Explore more to understand the risks, warning signs, and protection strategies against ghost broking and premium diversion.

Why it is important

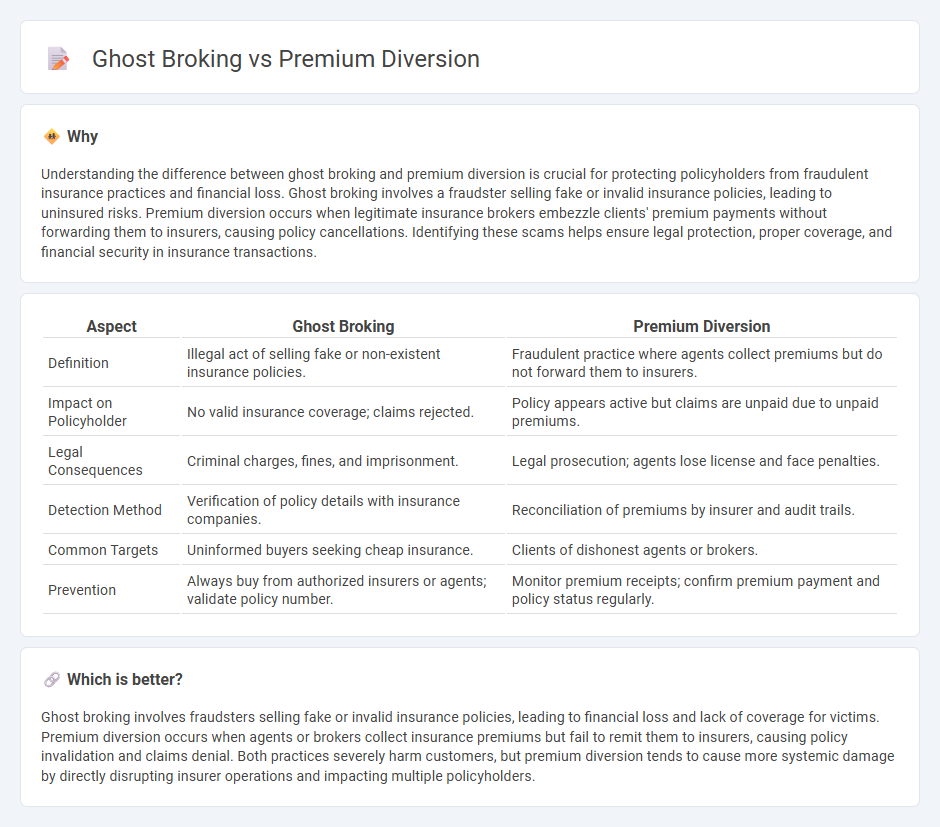

Understanding the difference between ghost broking and premium diversion is crucial for protecting policyholders from fraudulent insurance practices and financial loss. Ghost broking involves a fraudster selling fake or invalid insurance policies, leading to uninsured risks. Premium diversion occurs when legitimate insurance brokers embezzle clients' premium payments without forwarding them to insurers, causing policy cancellations. Identifying these scams helps ensure legal protection, proper coverage, and financial security in insurance transactions.

Comparison Table

| Aspect | Ghost Broking | Premium Diversion |

|---|---|---|

| Definition | Illegal act of selling fake or non-existent insurance policies. | Fraudulent practice where agents collect premiums but do not forward them to insurers. |

| Impact on Policyholder | No valid insurance coverage; claims rejected. | Policy appears active but claims are unpaid due to unpaid premiums. |

| Legal Consequences | Criminal charges, fines, and imprisonment. | Legal prosecution; agents lose license and face penalties. |

| Detection Method | Verification of policy details with insurance companies. | Reconciliation of premiums by insurer and audit trails. |

| Common Targets | Uninformed buyers seeking cheap insurance. | Clients of dishonest agents or brokers. |

| Prevention | Always buy from authorized insurers or agents; validate policy number. | Monitor premium receipts; confirm premium payment and policy status regularly. |

Which is better?

Ghost broking involves fraudsters selling fake or invalid insurance policies, leading to financial loss and lack of coverage for victims. Premium diversion occurs when agents or brokers collect insurance premiums but fail to remit them to insurers, causing policy invalidation and claims denial. Both practices severely harm customers, but premium diversion tends to cause more systemic damage by directly disrupting insurer operations and impacting multiple policyholders.

Connection

Ghost broking and premium diversion are interconnected insurance fraud schemes where ghost brokers illegally sell fake or unauthorized insurance policies, often pocketing clients' premiums. Premium diversion occurs when intermediaries collect insurance premiums but fail to forward them to the insurer, leading to policy invalidation and financial losses. Both practices undermine insurance integrity, resulting in unprotected customers and increased regulatory scrutiny.

Key Terms

Fraud

Premium diversion fraud involves criminals intercepting genuine insurance premiums intended for legitimate companies, redirecting payments to their own accounts and leaving policies unpaid and clients exposed to risk. Ghost broking refers to fraudulent brokers selling fake or non-existent insurance policies, often at reduced rates, putting customers at severe financial and legal jeopardy. Explore more to understand how to protect yourself from these deceptive insurance scams.

Unauthorized intermediary

Premium diversion and ghost broking are fraudulent practices involving unauthorized intermediaries who exploit insurance policies for illegal gain. Premium diversion occurs when intermediaries collect payments but fail to remit premiums to insurers, resulting in uninsured policies, while ghost broking involves fake brokers selling invalid insurance to unsuspecting clients. Discover more about the impacts and prevention strategies against these unauthorized intermediaries to protect your insurance investments.

Policy validity

Premium diversion involves an insurer or agent unlawfully redirecting client premiums, leading to non-payment with the insurer and resulting in invalid policies. Ghost broking entails fraudsters selling fake or manipulated insurance policies that appear genuine but are not underwritten by legitimate insurers, rendering these policies void. Understand the critical differences in policy validity and protect yourself by exploring comprehensive guides on insurance fraud prevention.

Source and External Links

Seller-Side Insurance Fraud Schemes - Premium diversion is the embezzlement of insurance premiums by sellers (such as agents or agencies) who keep the money for personal or unauthorized use instead of forwarding it to the insurer.

3 Types of Insurance Premium Fraud and How to Detect it - Premium diversion is identified as a top form of insurance fraud, costing the industry billions annually, and involves the intentional misappropriation of policyholder payments by those who collect them.

Premium Diversion - Insurance Fraud - Bukh Law Firm - Premium diversion is the theft of funds meant for insurance providers by brokers, agents, or other intermediaries, and can lead to serious felony charges, including restitution and asset seizure.

dowidth.com

dowidth.com