NFT insurance protects digital assets by covering risks such as theft, fraud, and loss of value in blockchain transactions. Embedded insurance integrates coverage directly into the purchase process, providing seamless protection linked to a product or service without separate policies. Explore the differences and benefits of NFT insurance versus embedded insurance to determine the best choice for digital and physical asset protection.

Why it is important

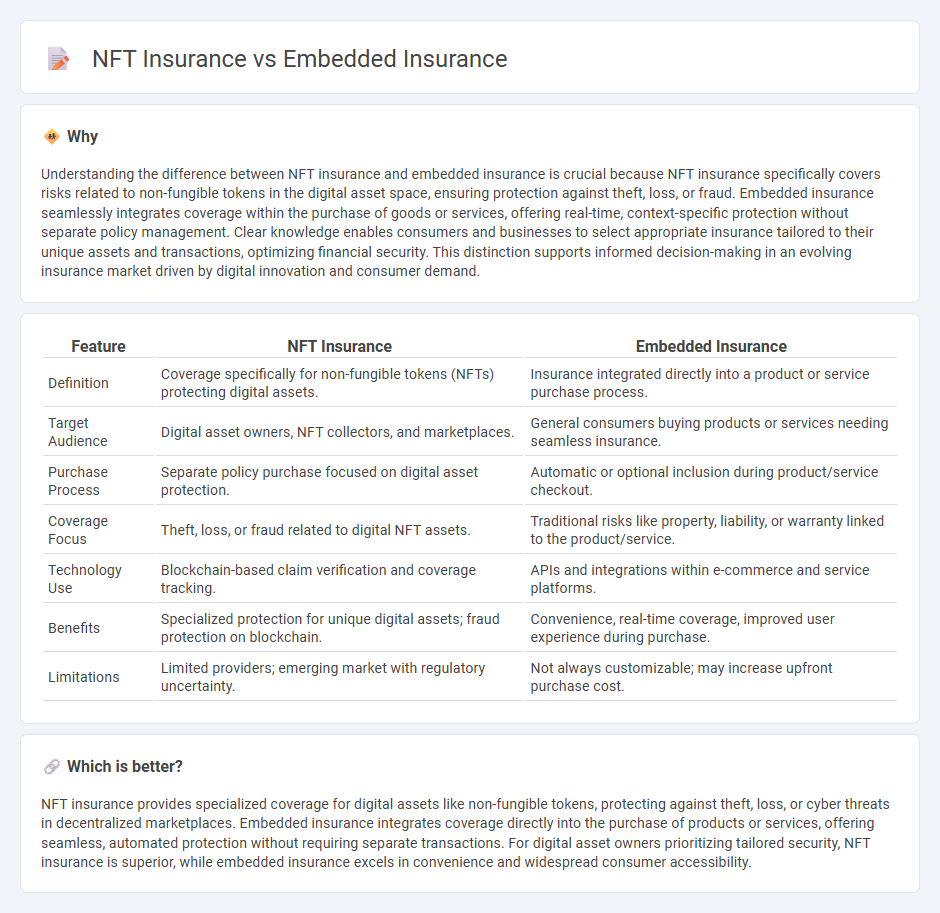

Understanding the difference between NFT insurance and embedded insurance is crucial because NFT insurance specifically covers risks related to non-fungible tokens in the digital asset space, ensuring protection against theft, loss, or fraud. Embedded insurance seamlessly integrates coverage within the purchase of goods or services, offering real-time, context-specific protection without separate policy management. Clear knowledge enables consumers and businesses to select appropriate insurance tailored to their unique assets and transactions, optimizing financial security. This distinction supports informed decision-making in an evolving insurance market driven by digital innovation and consumer demand.

Comparison Table

| Feature | NFT Insurance | Embedded Insurance |

|---|---|---|

| Definition | Coverage specifically for non-fungible tokens (NFTs) protecting digital assets. | Insurance integrated directly into a product or service purchase process. |

| Target Audience | Digital asset owners, NFT collectors, and marketplaces. | General consumers buying products or services needing seamless insurance. |

| Purchase Process | Separate policy purchase focused on digital asset protection. | Automatic or optional inclusion during product/service checkout. |

| Coverage Focus | Theft, loss, or fraud related to digital NFT assets. | Traditional risks like property, liability, or warranty linked to the product/service. |

| Technology Use | Blockchain-based claim verification and coverage tracking. | APIs and integrations within e-commerce and service platforms. |

| Benefits | Specialized protection for unique digital assets; fraud protection on blockchain. | Convenience, real-time coverage, improved user experience during purchase. |

| Limitations | Limited providers; emerging market with regulatory uncertainty. | Not always customizable; may increase upfront purchase cost. |

Which is better?

NFT insurance provides specialized coverage for digital assets like non-fungible tokens, protecting against theft, loss, or cyber threats in decentralized marketplaces. Embedded insurance integrates coverage directly into the purchase of products or services, offering seamless, automated protection without requiring separate transactions. For digital asset owners prioritizing tailored security, NFT insurance is superior, while embedded insurance excels in convenience and widespread consumer accessibility.

Connection

NFT insurance leverages blockchain technology to provide secure and transparent coverage for digital assets, while embedded insurance integrates insurance products directly into the purchase process of NFTs, enhancing user convenience and protection. Both approaches capitalize on the rise of digital ownership and decentralized finance to minimize risks associated with asset fraud, theft, and value volatility. By combining smart contracts with insurance policies, these innovations streamline claims processing and improve trust between buyers, sellers, and insurers in the NFT marketplace.

Key Terms

Embedded insurance:

Embedded insurance integrates coverage options directly into the purchase process of products or services, streamlining customer experience and increasing policy adoption rates. This approach leverages real-time data and digital platforms to offer customized insurance solutions tailored to specific needs, such as travel, electronics, or automotive sectors. Explore how embedded insurance is transforming risk management and enhancing consumer convenience in various industries.

API integration

Embedded insurance leverages API integration to seamlessly connect insurance products within digital platforms, enabling real-time policy issuance and claims processing without disrupting user experience. NFT insurance platforms utilize APIs to validate asset ownership and assess risk dynamically, offering protection against digital asset loss or fraud. Explore how advanced API integrations transform embedded and NFT insurance models for enhanced efficiency and security.

Point-of-sale coverage

Embedded insurance integrates seamlessly within the point-of-sale process, offering real-time coverage options directly aligned with the consumer's purchase, enhancing convenience and uptake rates. NFT insurance, on the other hand, protects unique digital assets on blockchain platforms, often requiring specialized underwriting that occurs post-sale and outside traditional purchase flows. Explore our detailed analysis to understand how these distinct models revolutionize insurance at the point of sale.

Source and External Links

What is Embedded Insurance | Chubb - Embedded insurance integrates risk protection into customers' purchase journeys, offering seamless and competitive coverage options at the point of sale.

Embedded Insurance: Definition, Types, Benefits - Embedded insurance is seamlessly integrated into the purchase process of products or services, providing immediate coverage without requiring separate transactions.

This Is Why The Future of Insurance Distribution Is Embedded - Embedded insurance bundles coverage within the purchase of products or services, delivered in real-time through technology, enhancing customer experience and value proposition.

dowidth.com

dowidth.com