Pay per mile insurance charges drivers based on the exact number of miles they drive, offering cost savings for low-mileage users by tracking distance through a simple device or app. Telematics insurance uses advanced technology to monitor driving behavior, including speed, acceleration, and braking patterns, providing personalized premiums based on overall driving habits. Explore how each option can tailor your coverage and savings to fit your unique driving style.

Why it is important

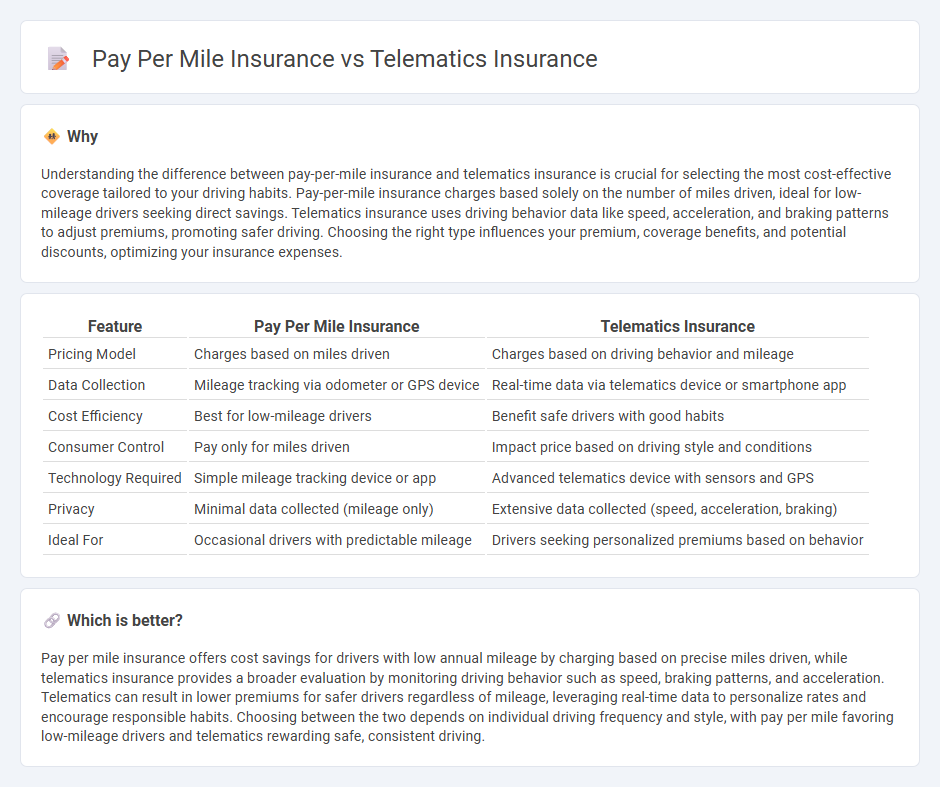

Understanding the difference between pay-per-mile insurance and telematics insurance is crucial for selecting the most cost-effective coverage tailored to your driving habits. Pay-per-mile insurance charges based solely on the number of miles driven, ideal for low-mileage drivers seeking direct savings. Telematics insurance uses driving behavior data like speed, acceleration, and braking patterns to adjust premiums, promoting safer driving. Choosing the right type influences your premium, coverage benefits, and potential discounts, optimizing your insurance expenses.

Comparison Table

| Feature | Pay Per Mile Insurance | Telematics Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Charges based on driving behavior and mileage |

| Data Collection | Mileage tracking via odometer or GPS device | Real-time data via telematics device or smartphone app |

| Cost Efficiency | Best for low-mileage drivers | Benefit safe drivers with good habits |

| Consumer Control | Pay only for miles driven | Impact price based on driving style and conditions |

| Technology Required | Simple mileage tracking device or app | Advanced telematics device with sensors and GPS |

| Privacy | Minimal data collected (mileage only) | Extensive data collected (speed, acceleration, braking) |

| Ideal For | Occasional drivers with predictable mileage | Drivers seeking personalized premiums based on behavior |

Which is better?

Pay per mile insurance offers cost savings for drivers with low annual mileage by charging based on precise miles driven, while telematics insurance provides a broader evaluation by monitoring driving behavior such as speed, braking patterns, and acceleration. Telematics can result in lower premiums for safer drivers regardless of mileage, leveraging real-time data to personalize rates and encourage responsible habits. Choosing between the two depends on individual driving frequency and style, with pay per mile favoring low-mileage drivers and telematics rewarding safe, consistent driving.

Connection

Pay per mile insurance relies on telematics technology to accurately track and record the number of miles driven, enabling precise billing based on actual vehicle usage. Telematics insurance utilizes in-car devices or smartphone apps to collect driving data such as distance, speed, and driving behavior, which informs pay per mile pricing models. The integration of telematics ensures cost-effective, personalized insurance premiums by aligning charges with real-world driving patterns.

Key Terms

Usage-based pricing

Telematics insurance utilizes real-time driving data such as speed, braking patterns, and distance to tailor premiums, encouraging safer driving habits. Pay per mile insurance charges based solely on the number of miles driven, offering a straightforward, distance-based pricing model ideal for low-mileage drivers. Explore how these usage-based pricing models can optimize your insurance costs and coverage options.

Driving behavior monitoring

Telematics insurance relies on comprehensive driving behavior monitoring, analyzing factors such as speed, acceleration, braking patterns, and cornering to calculate premiums tailored to individual risk profiles. Pay per mile insurance primarily tracks the total miles driven, offering cost savings for low-mileage drivers but with limited behavioral insights. Explore how advanced telematics technology can enhance personalized insurance models and safe driving incentives.

Mileage tracking

Telematics insurance leverages GPS technology to monitor driving behavior, including mileage, speed, and braking patterns, providing comprehensive data for personalized premiums. Pay per mile insurance specifically tracks the exact miles driven using odometer readings or GPS, offering cost savings for low-mileage drivers by charging based solely on distance traveled. Explore detailed comparisons to find the best mileage tracking method for your insurance needs.

Source and External Links

Telematics Insurance: How it Works, Benefits + Providers - Geotab - Telematics insurance uses GPS and mobile app data on driving behavior (speed, braking, mileage) to offer personalized, usage-based premiums that reward safe driving and allow insurers to adjust rates according to actual risk.

Telematics Devices for Car Insurance - Progressive - Telematics devices, either apps or plug-in units, monitor driving habits and can lower premiums through usage-based insurance programs by providing insurers with personalized driving data.

Insurance Topics | Telematics - NAIC - Usage-based insurance leveraging telematics is growing in popularity, helping insurers accurately assess risk, reduce fraud, and appeal to consumers seeking cost savings and safer driving incentives.

dowidth.com

dowidth.com