Deepfake insurance protects individuals and businesses against financial losses and reputational damage caused by manipulated video or audio content exploiting synthetic media technology. Identity theft insurance covers expenses related to unauthorized use of personal information, including fraud resolution, credit monitoring, and legal fees. Explore the key differences and benefits of both insurance types to safeguard your digital and personal security.

Why it is important

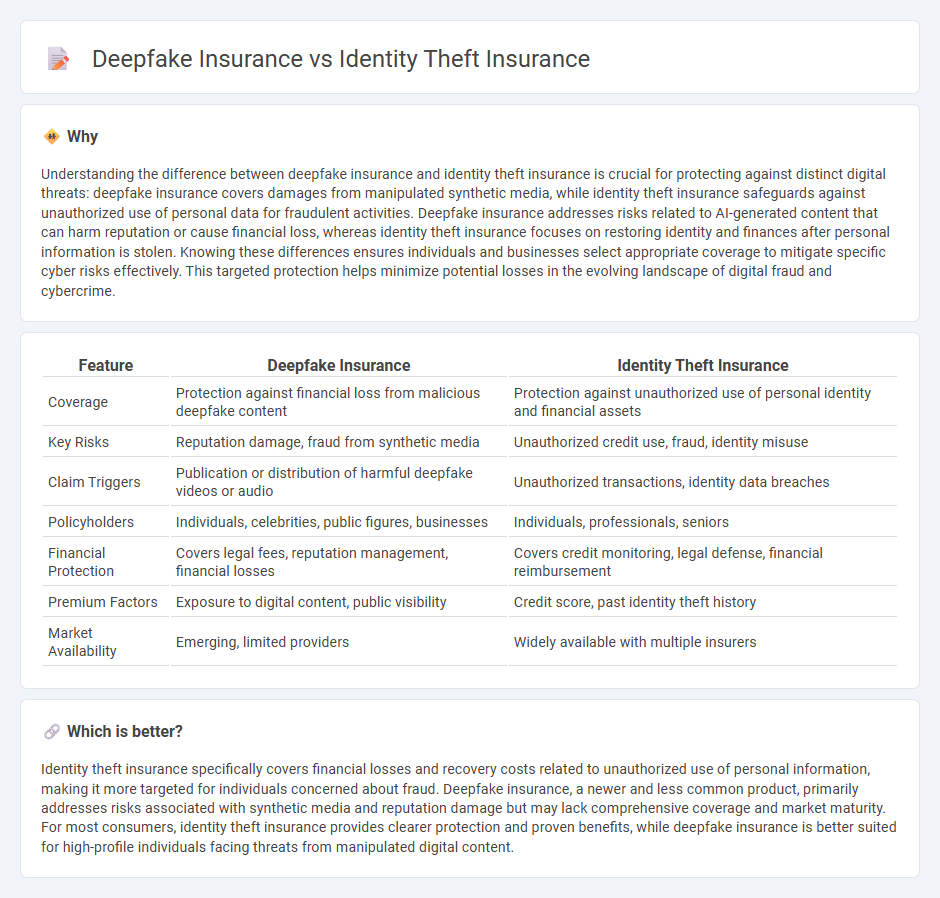

Understanding the difference between deepfake insurance and identity theft insurance is crucial for protecting against distinct digital threats: deepfake insurance covers damages from manipulated synthetic media, while identity theft insurance safeguards against unauthorized use of personal data for fraudulent activities. Deepfake insurance addresses risks related to AI-generated content that can harm reputation or cause financial loss, whereas identity theft insurance focuses on restoring identity and finances after personal information is stolen. Knowing these differences ensures individuals and businesses select appropriate coverage to mitigate specific cyber risks effectively. This targeted protection helps minimize potential losses in the evolving landscape of digital fraud and cybercrime.

Comparison Table

| Feature | Deepfake Insurance | Identity Theft Insurance |

|---|---|---|

| Coverage | Protection against financial loss from malicious deepfake content | Protection against unauthorized use of personal identity and financial assets |

| Key Risks | Reputation damage, fraud from synthetic media | Unauthorized credit use, fraud, identity misuse |

| Claim Triggers | Publication or distribution of harmful deepfake videos or audio | Unauthorized transactions, identity data breaches |

| Policyholders | Individuals, celebrities, public figures, businesses | Individuals, professionals, seniors |

| Financial Protection | Covers legal fees, reputation management, financial losses | Covers credit monitoring, legal defense, financial reimbursement |

| Premium Factors | Exposure to digital content, public visibility | Credit score, past identity theft history |

| Market Availability | Emerging, limited providers | Widely available with multiple insurers |

Which is better?

Identity theft insurance specifically covers financial losses and recovery costs related to unauthorized use of personal information, making it more targeted for individuals concerned about fraud. Deepfake insurance, a newer and less common product, primarily addresses risks associated with synthetic media and reputation damage but may lack comprehensive coverage and market maturity. For most consumers, identity theft insurance provides clearer protection and proven benefits, while deepfake insurance is better suited for high-profile individuals facing threats from manipulated digital content.

Connection

Deepfake insurance and identity theft insurance both address risks associated with digital identity manipulation and fraud. Deepfake insurance protects individuals and businesses from damages caused by synthetic media used to impersonate them, while identity theft insurance covers financial losses stemming from unauthorized use of personal information. Together, these insurances offer comprehensive protection against evolving cyber threats targeting personal and corporate identities.

Key Terms

**Identity Theft Insurance:**

Identity theft insurance protects individuals from financial losses and recovery costs related to unauthorized use of personal information, such as Social Security numbers, credit cards, and bank accounts. Coverage often includes reimbursement for stolen funds, legal fees, and expenses for restoring credit and identity. Explore how identity theft insurance can safeguard your personal information and financial well-being.

Personal Information Recovery

Identity theft insurance primarily covers the financial losses and recovery costs associated with unauthorized use of personal information, such as credit card fraud and social security number misuse. Deepfake insurance, on the other hand, focuses on protecting individuals from reputational damage and emotional distress caused by manipulated digital content implicating them falsely. Explore the distinctions further to understand which coverage best suits your personal information recovery needs.

Fraudulent Account Protection

Identity theft insurance primarily safeguards against unauthorized access to personal financial accounts, offering reimbursement for stolen funds and credit restoration services. Deepfake insurance covers damages related to synthetic media misuse, such as fraudulent account creation or impersonation designed to bypass verification protocols. Explore comprehensive coverage options to understand how to protect your accounts from evolving digital fraud threats.

Source and External Links

Identity Theft Protection - Safeguard Your Credit and ID - Identity theft insurance helps protect your identity with coverage including credit monitoring, device security, and up to $3 million in identity fraud insurance, assisting in reimbursement and resolution when identity theft occurs.

What Is Identity Protection Insurance - Identity theft insurance covers out-of-pocket costs such as legal and administrative fees after your identity is stolen, often combined with monitoring services to detect suspicious activities and help restore your identity.

What Is Identity Theft Insurance? - This insurance provides financial protection for victims of identity theft by covering recovery costs but generally does not cover stolen money or direct financial losses from fraudulent transactions.

dowidth.com

dowidth.com