Usage-based insurance (UBI) tailors premiums according to a driver's real-time behavior, leveraging telematics data to assess factors like speed, braking, and mileage. Black box insurance specifically utilizes a physical device installed in the vehicle to continuously monitor driving patterns, providing detailed analytics for risk assessment and premium calculation. Discover how these innovative insurance models transform risk management and customer savings.

Why it is important

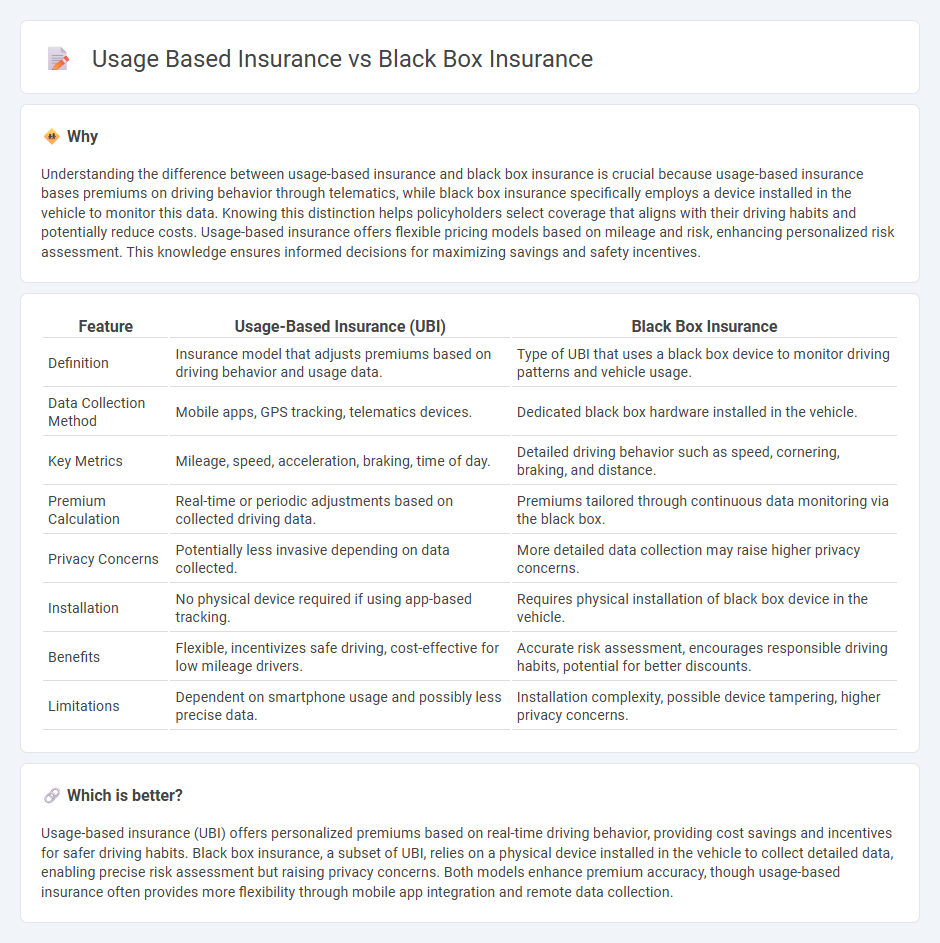

Understanding the difference between usage-based insurance and black box insurance is crucial because usage-based insurance bases premiums on driving behavior through telematics, while black box insurance specifically employs a device installed in the vehicle to monitor this data. Knowing this distinction helps policyholders select coverage that aligns with their driving habits and potentially reduce costs. Usage-based insurance offers flexible pricing models based on mileage and risk, enhancing personalized risk assessment. This knowledge ensures informed decisions for maximizing savings and safety incentives.

Comparison Table

| Feature | Usage-Based Insurance (UBI) | Black Box Insurance |

|---|---|---|

| Definition | Insurance model that adjusts premiums based on driving behavior and usage data. | Type of UBI that uses a black box device to monitor driving patterns and vehicle usage. |

| Data Collection Method | Mobile apps, GPS tracking, telematics devices. | Dedicated black box hardware installed in the vehicle. |

| Key Metrics | Mileage, speed, acceleration, braking, time of day. | Detailed driving behavior such as speed, cornering, braking, and distance. |

| Premium Calculation | Real-time or periodic adjustments based on collected driving data. | Premiums tailored through continuous data monitoring via the black box. |

| Privacy Concerns | Potentially less invasive depending on data collected. | More detailed data collection may raise higher privacy concerns. |

| Installation | No physical device required if using app-based tracking. | Requires physical installation of black box device in the vehicle. |

| Benefits | Flexible, incentivizes safe driving, cost-effective for low mileage drivers. | Accurate risk assessment, encourages responsible driving habits, potential for better discounts. |

| Limitations | Dependent on smartphone usage and possibly less precise data. | Installation complexity, possible device tampering, higher privacy concerns. |

Which is better?

Usage-based insurance (UBI) offers personalized premiums based on real-time driving behavior, providing cost savings and incentives for safer driving habits. Black box insurance, a subset of UBI, relies on a physical device installed in the vehicle to collect detailed data, enabling precise risk assessment but raising privacy concerns. Both models enhance premium accuracy, though usage-based insurance often provides more flexibility through mobile app integration and remote data collection.

Connection

Usage-based insurance (UBI) and Black box insurance are connected through the use of telematics technology that collects real-time driving data via a device installed in the vehicle. Both insurance models leverage metrics such as speed, acceleration, braking patterns, and mileage to assess risk more accurately and personalize premiums. This data-driven approach enhances risk management and incentivizes safer driving behavior by linking insurance costs directly to individual driving habits.

Key Terms

Telematics

Black box insurance leverages telematics devices installed in vehicles to monitor driving behavior, collecting data on speed, acceleration, braking, and mileage to personalize premiums based on actual usage patterns. Usage-based insurance (UBI) extends this concept by using similar telematics technology but often incorporates smartphone apps or OBD-II dongles, providing dynamic, pay-as-you-drive models rewarded with discounts for safe driving. Discover how telematics transforms insurance risk assessment and pricing models by exploring the latest advancements in black box and usage-based insurance solutions.

Premium Adjustment

Black box insurance utilizes telematics devices to collect driving behavior data, directly influencing premium adjustments based on factors like speed, braking, and mileage. Usage-based insurance (UBI) similarly adjusts premiums but incorporates broader metrics such as time of day, location patterns, and trip frequency for a more personalized risk assessment. Discover how these dynamic pricing models can lower your insurance costs and offer tailored coverage options.

Driving Behavior

Black box insurance utilizes telematics devices installed in vehicles to continuously monitor driving behavior, including speed, braking patterns, and acceleration, offering personalized premiums based on risk assessment. Usage-based insurance (UBI) similarly tracks driving habits but often leverages smartphone apps or built-in vehicle systems, emphasizing pay-as-you-drive models that reward safe driving with lower costs. Explore the nuances of both insurance types to determine which aligns best with your driving profile and financial goals.

Source and External Links

Your Complete Guide to Black Boxes in Cars - This guide explains the concept of black boxes in cars, their role in insurance, and how they influence premium rates based on driving behavior.

What is Black Box Car Insurance & How Does it Work? - The webpage details how black box car insurance works by monitoring driving habits and offering lower premiums for safe drivers.

Telematics Car Insurance | Black Box Insurance | AIG Ireland - This page describes AIG's telematics insurance, which uses a black box to track driving behavior, providing rewards for safe driving and additional safety features.

dowidth.com

dowidth.com