Insurtech platforms leverage advanced technology to streamline insurance processes, offering real-time data integration, personalized policies, and automated claims management. Third-party administrators (TPAs) specialize in managing insurance claims and administrative tasks for insurers, focusing on efficient service delivery and compliance adherence. Explore the differences and benefits of these solutions to optimize your insurance operations.

Why it is important

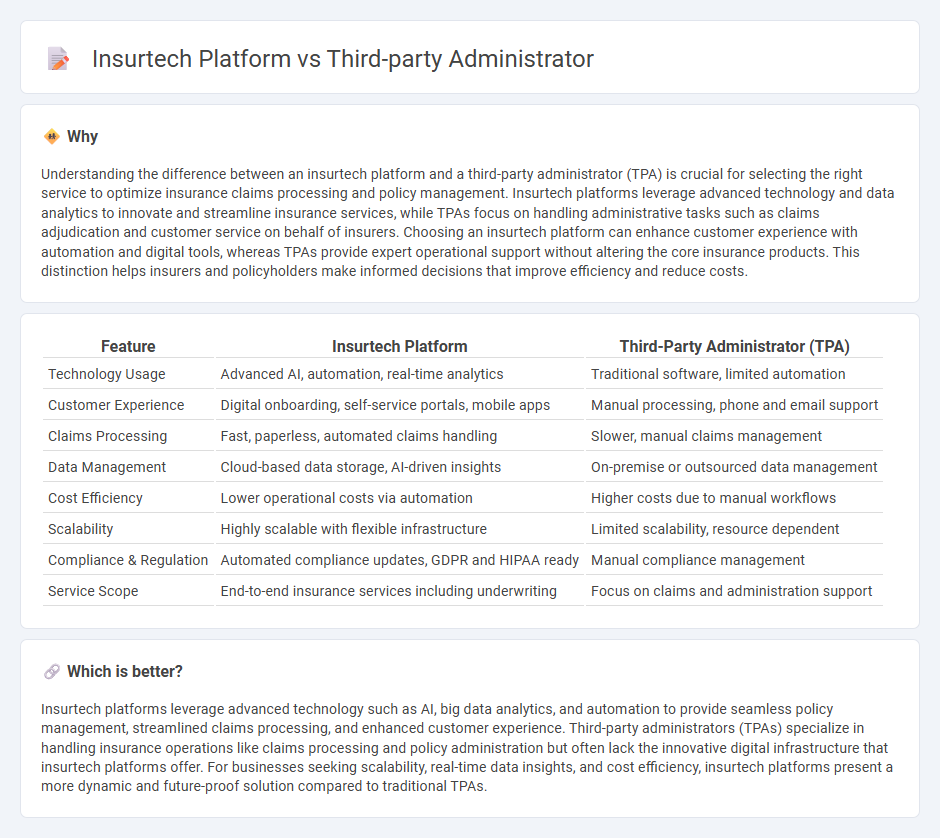

Understanding the difference between an insurtech platform and a third-party administrator (TPA) is crucial for selecting the right service to optimize insurance claims processing and policy management. Insurtech platforms leverage advanced technology and data analytics to innovate and streamline insurance services, while TPAs focus on handling administrative tasks such as claims adjudication and customer service on behalf of insurers. Choosing an insurtech platform can enhance customer experience with automation and digital tools, whereas TPAs provide expert operational support without altering the core insurance products. This distinction helps insurers and policyholders make informed decisions that improve efficiency and reduce costs.

Comparison Table

| Feature | Insurtech Platform | Third-Party Administrator (TPA) |

|---|---|---|

| Technology Usage | Advanced AI, automation, real-time analytics | Traditional software, limited automation |

| Customer Experience | Digital onboarding, self-service portals, mobile apps | Manual processing, phone and email support |

| Claims Processing | Fast, paperless, automated claims handling | Slower, manual claims management |

| Data Management | Cloud-based data storage, AI-driven insights | On-premise or outsourced data management |

| Cost Efficiency | Lower operational costs via automation | Higher costs due to manual workflows |

| Scalability | Highly scalable with flexible infrastructure | Limited scalability, resource dependent |

| Compliance & Regulation | Automated compliance updates, GDPR and HIPAA ready | Manual compliance management |

| Service Scope | End-to-end insurance services including underwriting | Focus on claims and administration support |

Which is better?

Insurtech platforms leverage advanced technology such as AI, big data analytics, and automation to provide seamless policy management, streamlined claims processing, and enhanced customer experience. Third-party administrators (TPAs) specialize in handling insurance operations like claims processing and policy administration but often lack the innovative digital infrastructure that insurtech platforms offer. For businesses seeking scalability, real-time data insights, and cost efficiency, insurtech platforms present a more dynamic and future-proof solution compared to traditional TPAs.

Connection

Insurtech platforms streamline insurance processes by leveraging advanced technologies such as artificial intelligence and data analytics, enhancing policy management and claims processing. Third-party administrators (TPAs) collaborate with insurtech platforms to efficiently handle administrative tasks like claims adjudication and customer service, improving operational efficiency. The integration of insurtech solutions with TPAs results in faster claim settlements, reduced operational costs, and enhanced customer experience in the insurance industry.

Key Terms

Claims Processing

Third-party administrators (TPAs) specialize in managing claims processing through established workflows, manual reviews, and compliance adherence, ensuring accuracy and regulatory alignment. Insurtech platforms leverage artificial intelligence and automation to accelerate claims adjudication, reduce errors, and enhance customer experience with real-time data integration. Explore how these solutions transform claims processing efficiency and accuracy in the insurance industry.

Technology Integration

Third-party administrators (TPAs) primarily streamline insurance claims and policy management through established legacy systems, ensuring regulatory compliance and operational efficiency. Insurtech platforms leverage advanced technologies such as AI, blockchain, and cloud computing to enhance real-time data analytics, automate underwriting, and improve customer engagement. Explore how technology integration transforms insurance services by comparing TPAs with cutting-edge insurtech innovations.

Policy Administration

Third-party administrators (TPAs) specialize in policy administration by managing claims processing, renewals, and customer service for insurers with established manual or semi-automated systems. Insurtech platforms revolutionize policy administration through cloud-based solutions that enable real-time data integration, automated underwriting, and enhanced customer engagement via AI-driven tools. Explore the latest innovations in policy administration by diving deeper into the capabilities of TPAs versus insurtech platforms.

Source and External Links

The Ultimate Guide to Third Party Administrators - A third party administrator (TPA) manages claims and administrative tasks for self-funded employer insurance plans but is not an insurance company itself, acting instead as an intermediary between employers and stop loss insurers, typically used by medium to large employers to handle enrollment, claims processing, and compliance.

Third-party administrator - Wikipedia - A TPA is an organization that processes insurance claims and administers employee benefit plans for employers or insurers, often handling claims for self-insured employers who retain the risk themselves, and also providing services in retirement plan administration and flexible spending accounts.

Third Party Administrator (TPA) Definition - Association Health Plans - TPAs perform administrative duties such as billing, plan design, claims processing, and regulatory compliance for health plans and must usually be licensed by states; they differ from Administrative Services Only (ASO) entities mainly in ownership structure and customer flexibility.

dowidth.com

dowidth.com