Embedded insurance integrates coverage directly within the purchase of products or services, offering seamless protection such as warranty-linked plans in electronics or travel insurance with flight bookings. Surplus lines insurance provides specialized, non-standard risk coverage that traditional insurers typically avoid, including high-risk property or unique liability policies. Explore more to understand how these insurance types cater to diverse risk management needs.

Why it is important

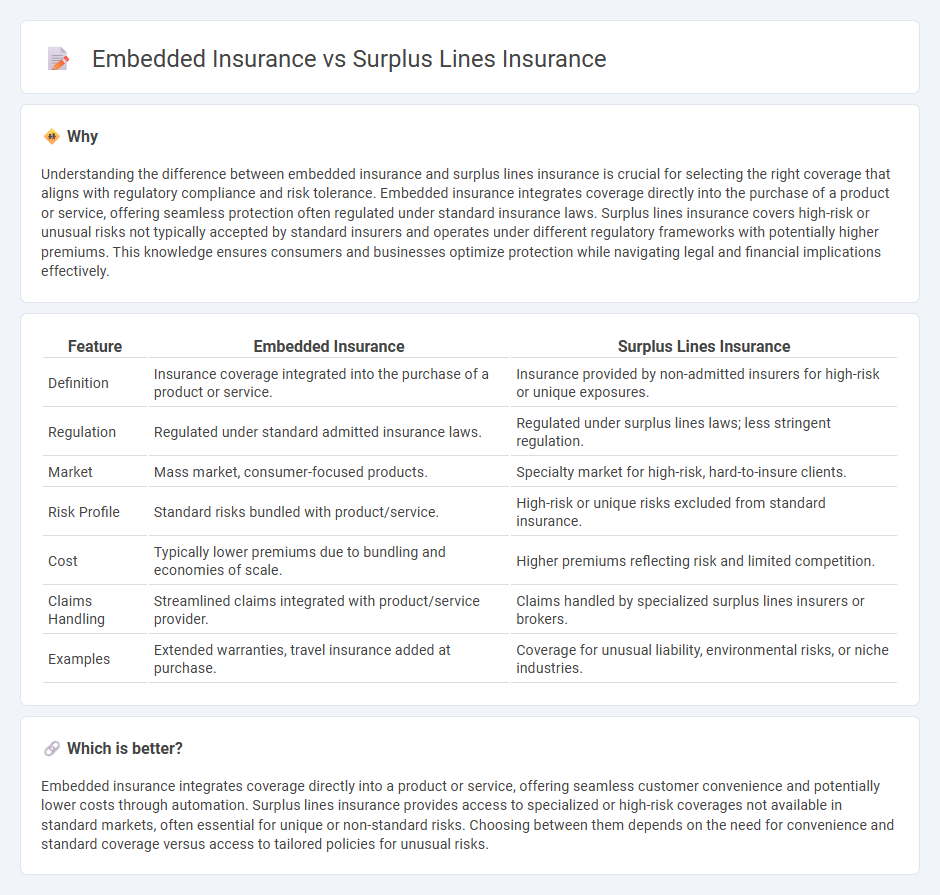

Understanding the difference between embedded insurance and surplus lines insurance is crucial for selecting the right coverage that aligns with regulatory compliance and risk tolerance. Embedded insurance integrates coverage directly into the purchase of a product or service, offering seamless protection often regulated under standard insurance laws. Surplus lines insurance covers high-risk or unusual risks not typically accepted by standard insurers and operates under different regulatory frameworks with potentially higher premiums. This knowledge ensures consumers and businesses optimize protection while navigating legal and financial implications effectively.

Comparison Table

| Feature | Embedded Insurance | Surplus Lines Insurance |

|---|---|---|

| Definition | Insurance coverage integrated into the purchase of a product or service. | Insurance provided by non-admitted insurers for high-risk or unique exposures. |

| Regulation | Regulated under standard admitted insurance laws. | Regulated under surplus lines laws; less stringent regulation. |

| Market | Mass market, consumer-focused products. | Specialty market for high-risk, hard-to-insure clients. |

| Risk Profile | Standard risks bundled with product/service. | High-risk or unique risks excluded from standard insurance. |

| Cost | Typically lower premiums due to bundling and economies of scale. | Higher premiums reflecting risk and limited competition. |

| Claims Handling | Streamlined claims integrated with product/service provider. | Claims handled by specialized surplus lines insurers or brokers. |

| Examples | Extended warranties, travel insurance added at purchase. | Coverage for unusual liability, environmental risks, or niche industries. |

Which is better?

Embedded insurance integrates coverage directly into a product or service, offering seamless customer convenience and potentially lower costs through automation. Surplus lines insurance provides access to specialized or high-risk coverages not available in standard markets, often essential for unique or non-standard risks. Choosing between them depends on the need for convenience and standard coverage versus access to tailored policies for unusual risks.

Connection

Embedded insurance integrates coverage directly into the purchase of goods or services, simplifying access and increasing customer convenience. Surplus lines insurance offers specialized protection for high-risk or unique exposures not typically covered by standard insurers. Both forms expand market reach by addressing niche insurance needs and leveraging alternative distribution channels to enhance consumer options.

Key Terms

**Surplus Lines Insurance:**

Surplus lines insurance provides coverage for unique or high-risk situations that standard insurers typically avoid, offering flexible policy terms and coverage limits tailored to specific client needs. It operates outside the admitted insurance market, allowing access to specialized underwriters with expertise in complex risks. Explore the advantages and regulatory considerations of surplus lines insurance to understand how it can protect unconventional assets effectively.

Non-admitted Carrier

Surplus lines insurance involves coverage provided by non-admitted carriers that are not licensed in the insured's state but are allowed to offer specialized policies for high-risk or unique exposures. Embedded insurance integrates coverage directly within a product or service, often provided by licensed carriers, enhancing customer experience but typically lacking the flexibility of surplus lines. Explore how non-admitted carrier regulations impact surplus lines insurance and embedded insurance models for comprehensive risk management insights.

Regulatory Flexibility

Surplus lines insurance offers greater regulatory flexibility by allowing coverage for high-risk or unique exposures not typically covered by standard insurance markets, operating outside state-mandated policies and rate controls. Embedded insurance integrates coverage directly into non-insurance products, often subject to standard regulations governing the host product and financial services, potentially limiting customization. Explore how these regulatory frameworks impact product innovation and market access in insurance.

Source and External Links

Surplus Lines 101: What Is Excess And Surplus Lines Insurance - This article explains surplus lines insurance as coverage outside a state's admitted market, often used for unique or high-risk policies.

Surplus Line Insurance - This page describes surplus line insurance as coverage for higher risks, such as unique properties or expensive items, and explains its regulatory environment.

Surplus Lines Insurance Guide - This guide provides information on surplus lines insurance in Texas, including its uses and regulatory requirements for companies operating in the state.

dowidth.com

dowidth.com