Earthquake microinsurance provides affordable coverage tailored to seismic risks by offering quick payouts after tremors, often covering structural damage and personal property losses in earthquake-prone regions. Hurricane microinsurance focuses on wind and flood damage protection for vulnerable coastal populations, enabling rapid recovery from storms through specialized policies that address seasonal cyclone threats. Explore the key differences and benefits of each microinsurance type to better safeguard your assets against natural disasters.

Why it is important

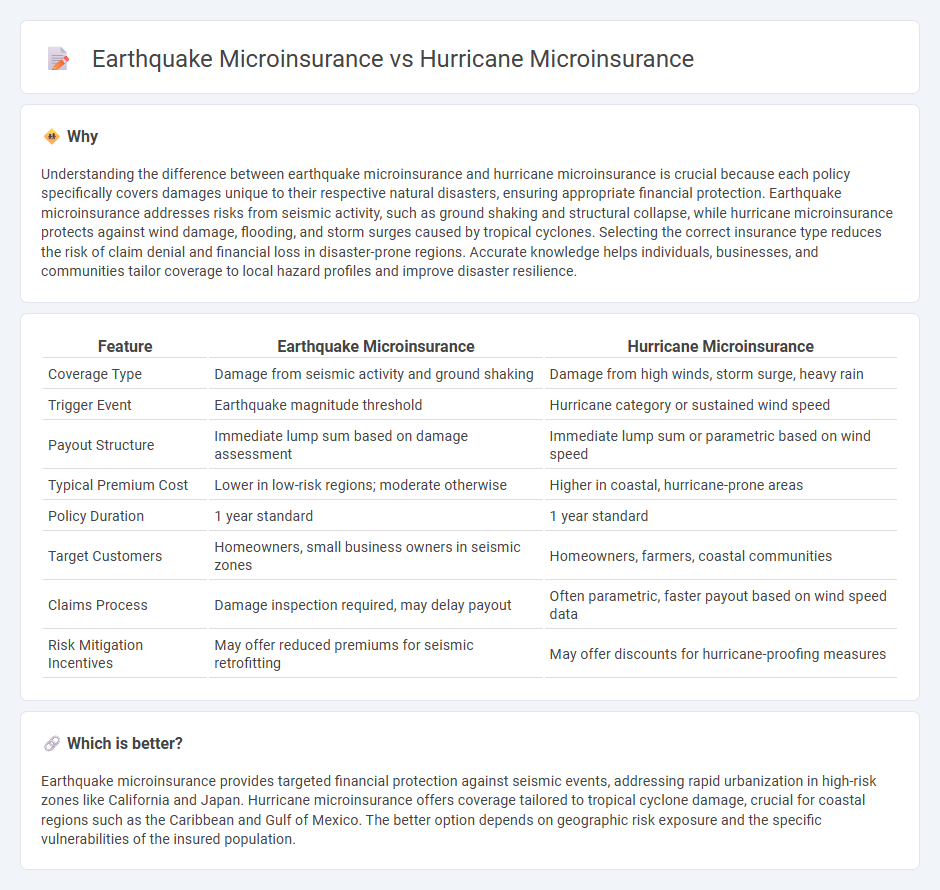

Understanding the difference between earthquake microinsurance and hurricane microinsurance is crucial because each policy specifically covers damages unique to their respective natural disasters, ensuring appropriate financial protection. Earthquake microinsurance addresses risks from seismic activity, such as ground shaking and structural collapse, while hurricane microinsurance protects against wind damage, flooding, and storm surges caused by tropical cyclones. Selecting the correct insurance type reduces the risk of claim denial and financial loss in disaster-prone regions. Accurate knowledge helps individuals, businesses, and communities tailor coverage to local hazard profiles and improve disaster resilience.

Comparison Table

| Feature | Earthquake Microinsurance | Hurricane Microinsurance |

|---|---|---|

| Coverage Type | Damage from seismic activity and ground shaking | Damage from high winds, storm surge, heavy rain |

| Trigger Event | Earthquake magnitude threshold | Hurricane category or sustained wind speed |

| Payout Structure | Immediate lump sum based on damage assessment | Immediate lump sum or parametric based on wind speed |

| Typical Premium Cost | Lower in low-risk regions; moderate otherwise | Higher in coastal, hurricane-prone areas |

| Policy Duration | 1 year standard | 1 year standard |

| Target Customers | Homeowners, small business owners in seismic zones | Homeowners, farmers, coastal communities |

| Claims Process | Damage inspection required, may delay payout | Often parametric, faster payout based on wind speed data |

| Risk Mitigation Incentives | May offer reduced premiums for seismic retrofitting | May offer discounts for hurricane-proofing measures |

Which is better?

Earthquake microinsurance provides targeted financial protection against seismic events, addressing rapid urbanization in high-risk zones like California and Japan. Hurricane microinsurance offers coverage tailored to tropical cyclone damage, crucial for coastal regions such as the Caribbean and Gulf of Mexico. The better option depends on geographic risk exposure and the specific vulnerabilities of the insured population.

Connection

Earthquake microinsurance and hurricane microinsurance are connected through their focus on providing affordable, accessible coverage for natural disaster-related damages in vulnerable communities. Both products use risk pooling and mobile technology to enhance rapid claim processing and financial resilience for low-income households. These microinsurance types address localized hazard risks by offering tailored policies based on geographic and meteorological data to minimize economic impact.

Key Terms

**Hurricane Microinsurance:**

Hurricane microinsurance provides affordable financial protection for low-income communities vulnerable to tropical cyclones, covering damages from high winds, flooding, and storm surges. It leverages parametric triggers such as wind speed thresholds to ensure rapid payouts, aiding swift recovery and resilience. Discover how hurricane microinsurance enhances climate adaptation strategies and supports economic stability in disaster-prone regions.

Parametric Trigger

Hurricane microinsurance and earthquake microinsurance both utilize parametric triggers to expedite claims processing based on predefined event parameters such as wind speed for hurricanes and ground acceleration for earthquakes. These triggers allow for immediate payouts once thresholds are met, reducing assessment delays and providing rapid financial relief to affected communities. Explore the specifics of parametric triggers in disaster microinsurance to understand their impact on risk management and recovery.

Wind Speed Index

Hurricane microinsurance primarily uses the Wind Speed Index to assess risk and determine payouts, as it directly correlates with potential damage from strong winds during storms. Earthquake microinsurance, by contrast, relies on seismic activity measurements and ground shaking intensity rather than wind speed for risk evaluation. Explore the nuances between hurricane and earthquake microinsurance to understand tailored disaster protection solutions.

Source and External Links

Home - EN - Raincoat - Hurricane microinsurance is a parametric insurance that pays out based on hurricane wind speeds recorded by NOAA data in the policyholder's area, providing cash payments without the need for damage claims, with flexible use and policy limits up to $5,000, all available to create quickly online.

What is Microinsurance? - In Puerto Rico, microinsurance is defined as a low-premium, fixed-benefit insurance that includes catastrophic parametric coverage for hurricanes and other natural disasters, paying out a predetermined amount upon occurrence of a federally recognized triggering event, regulated to protect policyholders.

Alive and uninsured: rebuilding businesses after hurricanes - Parametric microinsurance can help small businesses in hurricane-prone regions like the Caribbean and Mexico to recover financially after storms, though high premiums remain a major obstacle to wider adoption.

dowidth.com

dowidth.com