Climate risk insurance provides financial protection against long-term climate impacts such as hurricanes, floods, and droughts, covering losses from extreme weather events. Weather derivatives offer businesses a way to hedge against short-term weather fluctuations by using financial contracts linked to specific weather indices like temperature or rainfall. Explore the differences and benefits of climate risk insurance and weather derivatives to better manage your exposure to climate variability.

Why it is important

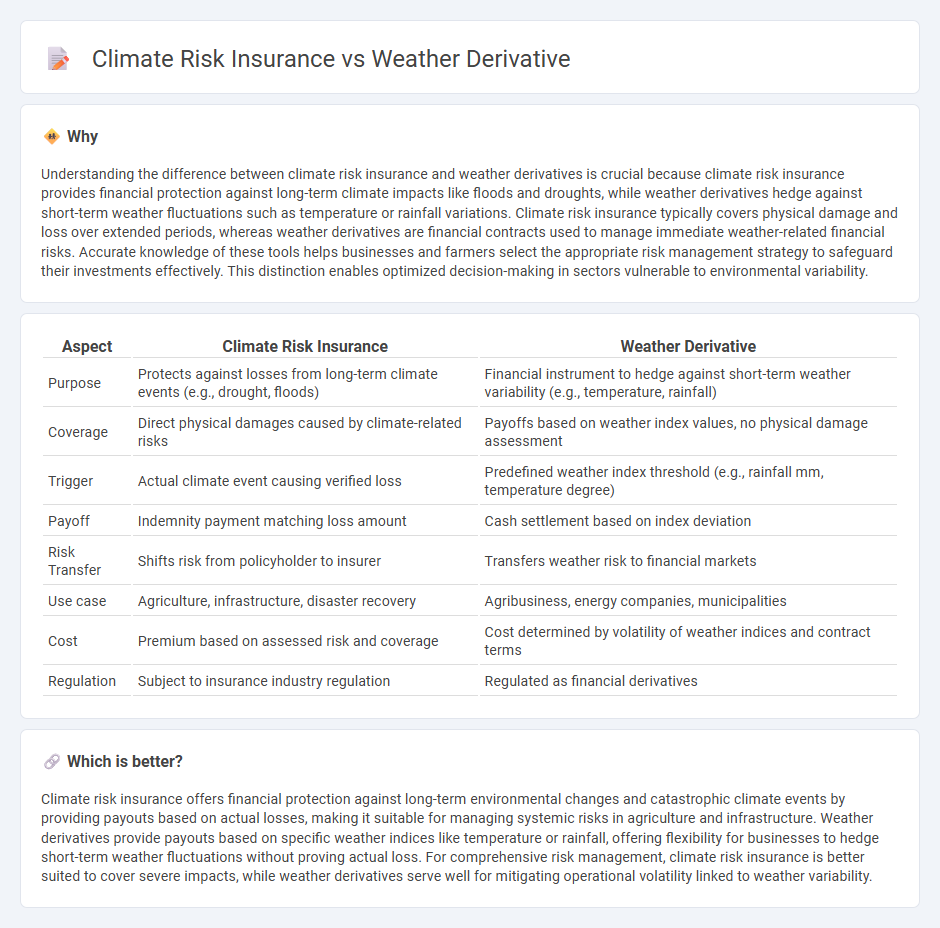

Understanding the difference between climate risk insurance and weather derivatives is crucial because climate risk insurance provides financial protection against long-term climate impacts like floods and droughts, while weather derivatives hedge against short-term weather fluctuations such as temperature or rainfall variations. Climate risk insurance typically covers physical damage and loss over extended periods, whereas weather derivatives are financial contracts used to manage immediate weather-related financial risks. Accurate knowledge of these tools helps businesses and farmers select the appropriate risk management strategy to safeguard their investments effectively. This distinction enables optimized decision-making in sectors vulnerable to environmental variability.

Comparison Table

| Aspect | Climate Risk Insurance | Weather Derivative |

|---|---|---|

| Purpose | Protects against losses from long-term climate events (e.g., drought, floods) | Financial instrument to hedge against short-term weather variability (e.g., temperature, rainfall) |

| Coverage | Direct physical damages caused by climate-related risks | Payoffs based on weather index values, no physical damage assessment |

| Trigger | Actual climate event causing verified loss | Predefined weather index threshold (e.g., rainfall mm, temperature degree) |

| Payoff | Indemnity payment matching loss amount | Cash settlement based on index deviation |

| Risk Transfer | Shifts risk from policyholder to insurer | Transfers weather risk to financial markets |

| Use case | Agriculture, infrastructure, disaster recovery | Agribusiness, energy companies, municipalities |

| Cost | Premium based on assessed risk and coverage | Cost determined by volatility of weather indices and contract terms |

| Regulation | Subject to insurance industry regulation | Regulated as financial derivatives |

Which is better?

Climate risk insurance offers financial protection against long-term environmental changes and catastrophic climate events by providing payouts based on actual losses, making it suitable for managing systemic risks in agriculture and infrastructure. Weather derivatives provide payouts based on specific weather indices like temperature or rainfall, offering flexibility for businesses to hedge short-term weather fluctuations without proving actual loss. For comprehensive risk management, climate risk insurance is better suited to cover severe impacts, while weather derivatives serve well for mitigating operational volatility linked to weather variability.

Connection

Climate risk insurance protects businesses and individuals from financial losses caused by extreme weather events, while weather derivatives offer financial contracts to hedge against weather-related risks like temperature or rainfall fluctuations. Both tools manage the financial impact of climate variability, providing risk transfer mechanisms that stabilize revenues affected by unpredictable weather patterns. Integrating weather derivatives within climate risk insurance products enhances risk management by allowing more precise quantification and mitigation of weather-driven financial exposures.

Key Terms

Weather Derivative:

Weather derivatives are financial instruments designed to hedge against the financial impact of adverse weather conditions by providing payouts based on weather index triggers such as temperature, rainfall, or snowfall. These derivatives enable businesses in agriculture, energy, and tourism sectors to manage revenue volatility linked to weather variability without requiring physical damage proof. Explore the benefits, types, and applications of weather derivatives to better understand how they mitigate climate-related financial risks effectively.

Hedging

Weather derivatives provide financial protection by allowing businesses to hedge against specific weather-related risks such as temperature, rainfall, or wind deviations through customizable contracts traded on exchanges or over-the-counter markets. Climate risk insurance offers broader coverage by transferring risks associated with long-term climate events like hurricanes, droughts, or floods, often involving indemnity-based payouts linked to actual damages. Explore further to understand which hedging instrument suits your risk management strategy best.

Index-based payout

Weather derivatives function as financial instruments offering payouts based on specific weather indices such as temperature or rainfall, enabling businesses to hedge against weather-related financial losses. Climate risk insurance, particularly with index-based payouts, provides coverage triggered by predefined climate metrics, ensuring timely claims without the need for loss adjustments. Explore detailed comparisons to understand which option best suits your risk management strategy.

Source and External Links

Weather Derivatives: How Do They Work? - Weather derivatives are financial tools that protect businesses against financial loss due to changes in weather, paying out based on deviations from predefined weather metrics like temperature or rainfall, rather than actual physical damage, typically using swaps or options contracts.

How Weather Derivatives Hedge Against Nature's ... - Weather derivatives are futures or options contracts settled with indices based on daily weather data such as heating or cooling degree days, utilizing reliable meteorological data providers to quantify payouts linked to weather variations.

Weather derivative - Weather derivatives are index-based instruments that use observed weather data to create payout indices, often modeled using statistical or physical weather models to price and manage risk associated with weather variability.

dowidth.com

dowidth.com