Workers compensation carveout specifically covers medical expenses and lost wages for employees injured on the job, providing statutory benefits based on state regulations. Employers liability insurance protects businesses against lawsuits arising from employee work-related injuries or illnesses not covered by workers compensation, such as third-party claims or negligence. Learn more to understand the key differences and ensure comprehensive workplace protection.

Why it is important

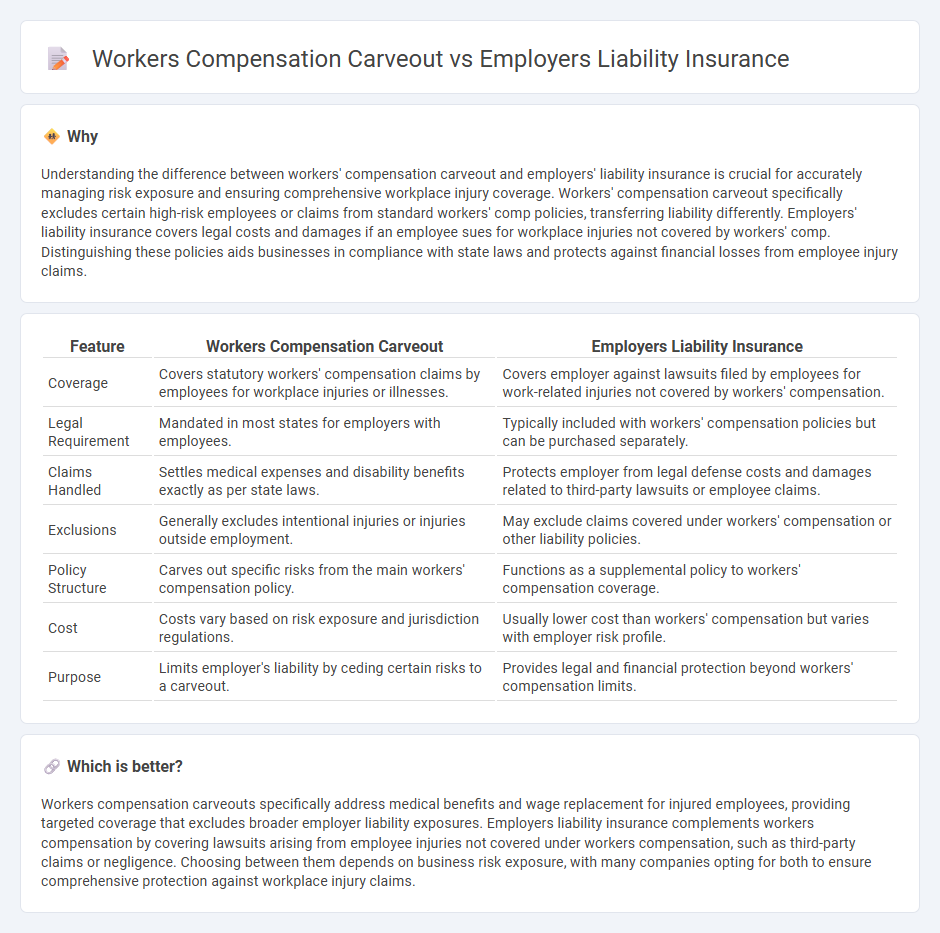

Understanding the difference between workers' compensation carveout and employers' liability insurance is crucial for accurately managing risk exposure and ensuring comprehensive workplace injury coverage. Workers' compensation carveout specifically excludes certain high-risk employees or claims from standard workers' comp policies, transferring liability differently. Employers' liability insurance covers legal costs and damages if an employee sues for workplace injuries not covered by workers' comp. Distinguishing these policies aids businesses in compliance with state laws and protects against financial losses from employee injury claims.

Comparison Table

| Feature | Workers Compensation Carveout | Employers Liability Insurance |

|---|---|---|

| Coverage | Covers statutory workers' compensation claims by employees for workplace injuries or illnesses. | Covers employer against lawsuits filed by employees for work-related injuries not covered by workers' compensation. |

| Legal Requirement | Mandated in most states for employers with employees. | Typically included with workers' compensation policies but can be purchased separately. |

| Claims Handled | Settles medical expenses and disability benefits exactly as per state laws. | Protects employer from legal defense costs and damages related to third-party lawsuits or employee claims. |

| Exclusions | Generally excludes intentional injuries or injuries outside employment. | May exclude claims covered under workers' compensation or other liability policies. |

| Policy Structure | Carves out specific risks from the main workers' compensation policy. | Functions as a supplemental policy to workers' compensation coverage. |

| Cost | Costs vary based on risk exposure and jurisdiction regulations. | Usually lower cost than workers' compensation but varies with employer risk profile. |

| Purpose | Limits employer's liability by ceding certain risks to a carveout. | Provides legal and financial protection beyond workers' compensation limits. |

Which is better?

Workers compensation carveouts specifically address medical benefits and wage replacement for injured employees, providing targeted coverage that excludes broader employer liability exposures. Employers liability insurance complements workers compensation by covering lawsuits arising from employee injuries not covered under workers compensation, such as third-party claims or negligence. Choosing between them depends on business risk exposure, with many companies opting for both to ensure comprehensive protection against workplace injury claims.

Connection

Workers' compensation carveout and employers liability insurance are interconnected components of employer liability coverage designed to manage workplace injury risks. The carveout specifically excludes certain risks or employees from standard workers' compensation policies, while employers liability insurance covers claims that fall outside workers' compensation statutes, such as lawsuits for workplace injuries or illnesses. Together, these coverages provide comprehensive protection for employers against financial losses due to employee injury claims.

Key Terms

Coverage scope

Employers liability insurance covers legal costs and damages when an employee sues for workplace injuries beyond workers' compensation limits, providing protection against third-party claims and occupational diseases. Workers compensation carveout specifically excludes certain high-risk employees or job categories from the workers' compensation policy, shifting their coverage exclusively to employers liability insurance to manage unique liability exposures. Explore further to understand which coverage offers the best protection tailored to your workforce risks.

Legal requirements

Employers liability insurance primarily covers claims related to employee injuries that fall outside workers' compensation statutes, addressing legal liabilities such as third-party lawsuits and coverage gaps. Workers compensation carveouts specifically exclude certain claims from workers' compensation policies, shifting risk to employers liability coverage and ensuring compliance with jurisdiction-specific legal mandates. Explore how these distinctions affect your legal obligations and risk management strategies to safeguard your business effectively.

Benefit delivery

Employers liability insurance covers legal costs and damages when employees sue for work-related injuries, while workers' compensation carveout specifically handles the direct delivery of medical benefits and wage replacements without litigation. The workers' compensation carveout ensures prompt benefit payment to injured employees, minimizing delays inherent in liability claims and streamlining treatment approval processes. Explore more to understand how these insurance components optimize benefit delivery and protect both employers and employees.

Source and External Links

Employers Liability Coverage (EL) - IRMI - Employers liability insurance protects employers against legal claims by employees for work-related injuries or diseases not fully covered by workers compensation, covering legal defense costs, settlements, or judgments.

Employers Liability Insurance vs. Workers' Compensation - Paychex - Employers liability insurance, often part of workers' compensation policies, protects employers from financial losses due to employee lawsuits related to workplace injuries or illnesses.

Employers' liability insurance - GOV.UK - Employers' liability insurance is a legal requirement in the UK to cover at least PS5 million, compensating employees for work-related injury or illness and protecting employers from fines if uninsured.

dowidth.com

dowidth.com