Buy-now-pay-later protection offers flexible payment options for consumers, allowing them to secure insurance coverage immediately while deferring premium payments without upfront financial burden. Parametric insurance provides predefined payouts based on specific triggers or events, such as weather conditions or natural disasters, delivering faster claims processing and reduced administrative costs. Explore the benefits and use cases of both to determine which insurance solution best fits your needs.

Why it is important

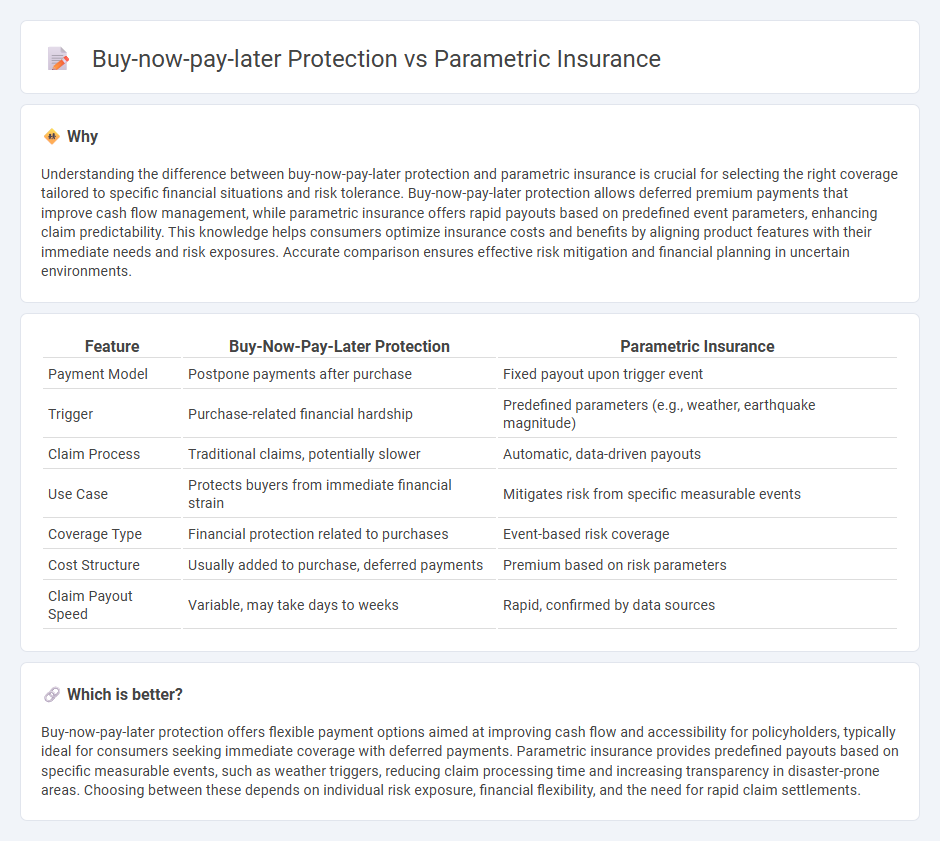

Understanding the difference between buy-now-pay-later protection and parametric insurance is crucial for selecting the right coverage tailored to specific financial situations and risk tolerance. Buy-now-pay-later protection allows deferred premium payments that improve cash flow management, while parametric insurance offers rapid payouts based on predefined event parameters, enhancing claim predictability. This knowledge helps consumers optimize insurance costs and benefits by aligning product features with their immediate needs and risk exposures. Accurate comparison ensures effective risk mitigation and financial planning in uncertain environments.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Parametric Insurance |

|---|---|---|

| Payment Model | Postpone payments after purchase | Fixed payout upon trigger event |

| Trigger | Purchase-related financial hardship | Predefined parameters (e.g., weather, earthquake magnitude) |

| Claim Process | Traditional claims, potentially slower | Automatic, data-driven payouts |

| Use Case | Protects buyers from immediate financial strain | Mitigates risk from specific measurable events |

| Coverage Type | Financial protection related to purchases | Event-based risk coverage |

| Cost Structure | Usually added to purchase, deferred payments | Premium based on risk parameters |

| Claim Payout Speed | Variable, may take days to weeks | Rapid, confirmed by data sources |

Which is better?

Buy-now-pay-later protection offers flexible payment options aimed at improving cash flow and accessibility for policyholders, typically ideal for consumers seeking immediate coverage with deferred payments. Parametric insurance provides predefined payouts based on specific measurable events, such as weather triggers, reducing claim processing time and increasing transparency in disaster-prone areas. Choosing between these depends on individual risk exposure, financial flexibility, and the need for rapid claim settlements.

Connection

Buy-now-pay-later protection integrates with parametric insurance by using predefined triggers, such as delayed payments, to automatically activate coverage without lengthy claims processes. Parametric insurance relies on measurable events like payment defaults to provide swift payouts, aligning perfectly with the buy-now-pay-later model's need for rapid financial protection. This synergy enhances consumer confidence by combining flexible payment options with immediate, data-driven insurance responses.

Key Terms

Trigger Event (Parametric insurance)

Parametric insurance relies on predefined trigger events such as specific weather conditions or natural disasters, enabling swift claims payouts without lengthy assessments. In contrast, buy-now-pay-later protection often depends on traditional claims processes tied to purchase-related disruptions. Discover how understanding trigger events enhances risk management strategies.

Immediate Payout (Parametric insurance)

Parametric insurance offers immediate payout triggered by predefined events such as natural disasters, eliminating lengthy claim assessments and providing swift financial relief. Buy-now-pay-later protection often involves claim validation processes that delay payouts, reducing the effectiveness of timely support. Explore how immediate payout features in parametric insurance can safeguard your finances faster and more efficiently.

Deferred Payment (Buy-Now-Pay-Later protection)

Deferred Payment protection in buy-now-pay-later (BNPL) services offers consumers a safety net by covering missed payments or defaults, reducing financial risk in installment purchases. Unlike parametric insurance, which provides predefined payouts based on specific event triggers like weather or natural disasters, BNPL protection focuses on financial behavior and payment delays. Explore deeper to understand how deferred payment options mitigate credit risk in the evolving BNPL market.

Source and External Links

What is Parametric Insurance? - Parametric insurance covers the probability of loss-causing events like earthquakes by paying based on predefined intensity thresholds rather than actual losses incurred.

Parametric Insurance Solutions - Parametric insurance policies pay out based on pre-defined event thresholds, such as wind speed or earthquake magnitude, and provide quick claims payouts.

Parametric Insurance - Parametric insurance offers pre-specified payouts triggered by specific events, differing from traditional insurance by not requiring proof of actual loss.

dowidth.com

dowidth.com